EIN Search For Business Verification: 6 Methods (Free + Paid)

- A business EIN search confirms a company’s legal tax ID and is a foundational part of business verification and KYB compliance before onboarding clients, partners, or vendors.

- There’s no public IRS EIN lookup tool, so reliable methods include asking for Form W-9, checking Secretary of State databases, public documents, credit reports, and SEC EDGAR filings for public companies.

- Automated EIN lookup tools and APIs like Signzy’s offer instant, high-volume EIN verification, saving hours of manual work and reducing errors during company identity checks.

Had to verify about 50 EINs last month for new vendors we were bringing on. Started checking them manually through state websites and public records.

Took way longer than expected. Some numbers checked out right away, others required hunting through multiple databases, and a few just led nowhere.

Realized there are actually tons of different ways to verify EINs. Free methods that take time and manual work. Paid services that do everything automatically. APIs that handle bulk verification.

The approach that works depends on your situation. How many EINs are you checking, how often do you do this, and whether you need answers immediately?

Figured I’d document what actually works since everyone seems to struggle with this same problem. Before discussing methods, here’s why EIN search became such a big deal in the first place.

Related Resources

What is EIN Search?

EIN search is the process of locating a business's nine-digit Employer Identification Number through IRS databases or third-party verification services. It serves as a lookup mechanism to retrieve the unique federal tax identifier assigned to a business entity.

EIN search and EIN verification are often confused. However, they serve different purposes in business authentication. Search is used to retrieve the number itself when you have partial business information, such as name, location, or entity type. Verification, on the other hand, confirms that a known EIN corresponds to a specific business entity. In practical terms, search determines what the EIN is, while verification confirms that a given EIN belongs to the business in question.

Why is an EIN search mandatory for business verification in the U.S.?

The EIN functions as the primary identifier in the U.S. commercial infrastructure. Without it, you cannot definitively establish that a business entity legally exists or cross-reference it against authoritative records. Apart from this, EIN plays a range of roles across compliance operations in the U.S, including but not limited to:

↪ Tax compliance validation: Verifying a business's tax standing, confirming IRS registration, or validating filing history requires the EIN as the primary reference point.

↪ Banking and financial institutions mandates: Opening business accounts, processing merchant services, or establishing credit lines all require EIN verification to comply with BSA/AML regulations and KYC protocols.

↪ B2B transactions: Before extending payment terms or credit, companies need to verify the counterparty is a legitimate registered entity rather than a fraudulent operation.

↪ Government contracts and licensing: Federal procurement, state licensing boards, and regulatory compliance all depend on EIN-linked records to establish entity legitimacy and track obligations.

↪ Legal proceedings and judgments: Enforcing contracts, filing liens, or pursuing collections requires the correct EIN to ensure proper identification of the legal entity, particularly when multiple businesses share similar names.

The EIN search serves as the control mechanism that prevents identity confusion, fraud, and compliance failures in a system where millions of entities operate with overlapping names and structures.

How to look up a business EIN? 6 Best methods explored

There are several ways to find a business EIN, ranging from free manual searches to automated API solutions. Each method has different trade-offs in terms of cost, speed, and reliability.

| Method | Cost | Speed | Accuracy | Best For |

|---|---|---|---|---|

| Ask Business Directly | Free | Fast | High | One-off verifications |

| Public Business Documents | Free | Slow | Medium | Research projects |

| Secretary of State Databases | Free-$10 | Medium | High | State-registered businesses |

| SEC EDGAR Database | Free | Medium | High | Public companies only |

| Business Credit Reports | $20-50 | Fast | High | Credit decisions |

| EIN Lookup APIs | $0.10-2 per lookup | Instant | Very High | High-volume verification |

Now that you know your options, let’s discuss the specifics of each method. Method 6 should be your best bet if you’re doing things at scale.

Method 1: Ask the business directly

The most straightforward approach is simply asking the business for its EIN. Most legitimate companies provide this information readily since it’s not considered sensitive data like SSNs.

You can request EINs through Form W-9 (Request for Taxpayer Identification Number and Certification), which businesses are legally required to complete for tax reporting purposes. Many businesses include their EIN on invoices, contracts, or official letterhead, making it easily accessible during normal business interactions.

The downside is that fraudulent companies might provide fake EINs, and you have no way to verify accuracy without using additional methods.

Method 2: Check public business documents

Many businesses file public documents that contain their EIN, including court filings, trademark applications, and government contract records. These documents are available through various online databases and government websites, though finding them requires some detective work and patience.

Method 3: Business credit reports

Commercial credit reporting agencies like Dun & Bradstreet, Experian Business, and Equifax Business often include EIN information in their reports. You can purchase business credit reports that contain the EIN along with other valuable business information.

Here’s what you typically get:

- Company overview: Basic business information, including EIN, address, and contact details

- Credit history: Payment patterns, credit utilization, and outstanding debts

- Financial information: Revenue estimates, employee count, and industry classification

- Legal filings: Bankruptcies, liens, judgments, and other public records

- Corporate structure: Parent companies, subsidiaries, and ownership details

The report cost depends on the provider and the detail level. This method provides comprehensive business intelligence beyond just the EIN, making it valuable for due diligence and risk assessment.

"Credit reports were costing us $40 per vendor just to get basic business information. Signzy's API costs a fraction of that and returns more data. ROI was obvious after the first month." — Controller, Distribution Company

Method 4: Secretary of State databases

Each state maintains a Secretary of State database containing registration records for businesses operating within its jurisdiction. These databases are publicly accessible and provide corporate filing information, including EINs, when disclosed during the registration process.

To search these databases, you need to access the specific Secretary of State website (e.g., Delaware Secretary of State for Delaware) for the state where the business is registered. Once accessed, look for something in lines of “business entity search”.

The search results typically display the business entity type, registration date, status, registered agent information, and, in many cases, the EIN if it was included in the filing documents.

💡 Note: Not all states require EIN disclosure in their filings, and some businesses may have obtained their EIN after initial registration. Additionally, businesses registered in multiple states may appear in several databases, but the EIN will remain consistent across all entries.

Method 5: SEC EDGAR database

Publicly traded companies must file regular reports with the Securities and Exchange Commission, and these documents often contain EIN information. The EDGAR database provides free access to these filings, making it easy to find EINs for public companies.

Search by company name or ticker symbol to find 10-K annual reports, 10-Q quarterly reports, or 8-K current reports. The EIN typically appears in the company information section of these documents. This method only works for public companies, so it’s limited but highly reliable when applicable.

💡 Related Blog:

Method 6: Signzy’s EIN lookup API

Signzy's EIN Lookup API and similar services provide instant EIN search and verification capabilities that integrate directly into your business systems. These services access multiple databases simultaneously to find and verify EIN information in real time.

Key features include:

🔗 Direct integration with authoritative government databases. The system pulls information exclusively from official state and federal sources, eliminating intermediary data providers and reducing the margin for inaccuracies.

📊 Comprehensive business intelligence retrieval. Each lookup returns extensive entity details such as legal name, operating address, contact information, industry codes, ownership structure, and outstanding legal or financial liabilities.

🗺️ Complete jurisdictional coverage. The platform validates business entities registered in any U.S. state, supporting both federal tax identifier verification and state-specific business registration checks.

⚡ Batch processing functionality. Organizations can process hundreds or thousands of EIN validations in a single operation, useful for periodic compliance reviews, vendor database audits, or partner verification campaigns.

🚨 Proactive risk identification. The system flags businesses with adverse indicators such as bankruptcy filings, regulatory sanctions, or watchlist appearances, enabling preventive action before relationship establishment.

✅ Cross-reference validation. The API confirms that the EIN provided matches the stated business name and legal structure, catching potential identity mismatches or fraudulent credential usage.

🔄 High-frequency data synchronization. Information updates occur multiple times daily to reflect recent business status changes, ensuring verification decisions are based on current rather than outdated records.

"Annual vendor review meant checking 300+ EINs manually, which took our team almost two weeks. Signzy's bulk processing handled the entire list overnight. Now we can actually do quarterly reviews instead of dreading the annual one." — Vendor Compliance Lead, Digital Payments App.

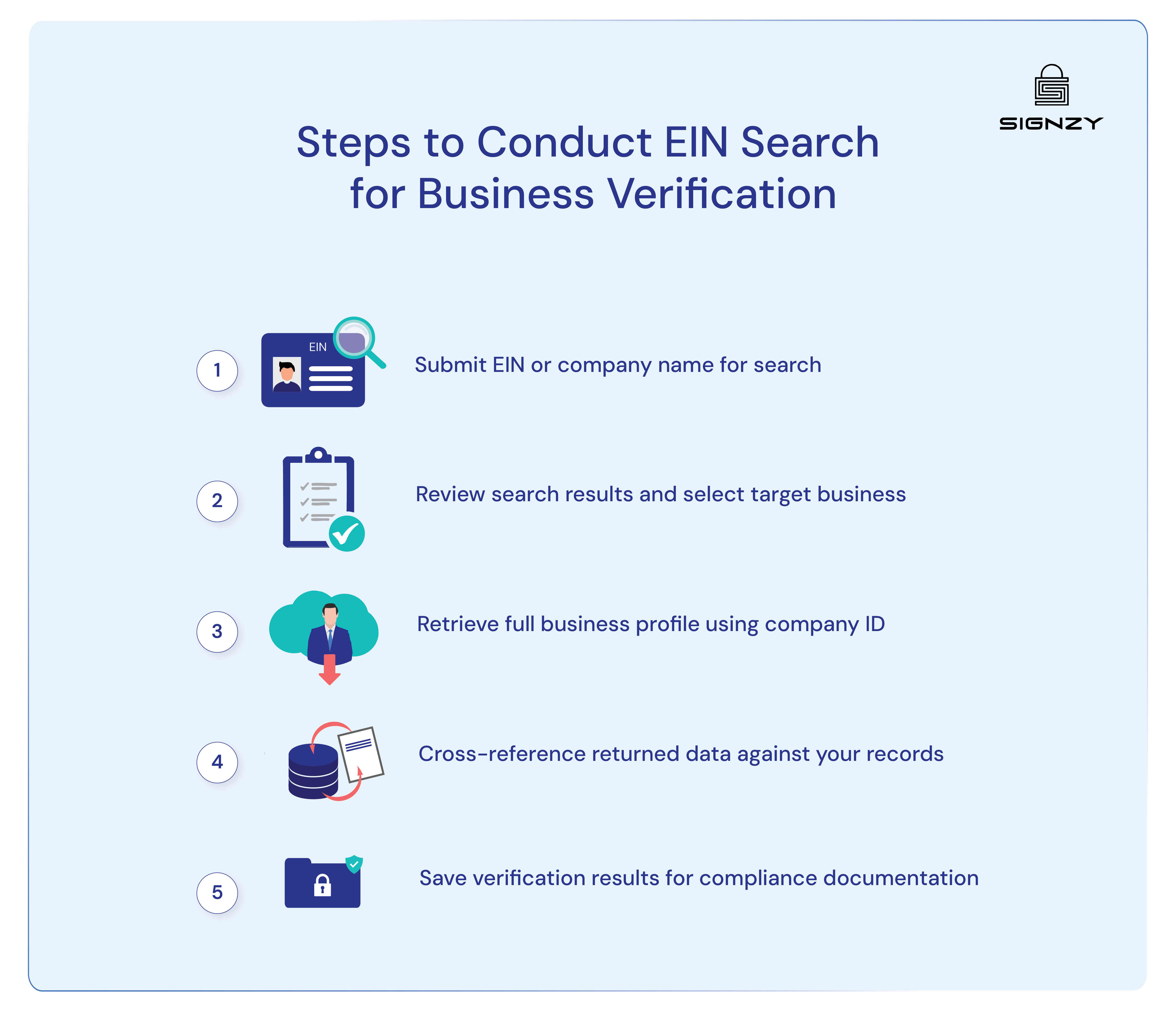

Steps to conduct an EIN search for business verification

The following process applies regardless of which search method you choose, providing a framework for thorough business verification.

Step 1: Gather required business information

Collect all available information about the business entity before initiating your search. Essential documents and details include:

- Legal business name (exact spelling)

- State of incorporation or registration

- Business structure type (LLC, Corporation, Partnership, etc.)

- Primary business address

- Articles of incorporation or organization

- Business license or registration certificate

- DBA filings or trade names

- Previous business names (if applicable)

- Tax identification documentation

Step 2: Determine your verification requirements

The scope of your EIN verification depends on the nature of your business relationship and regulatory obligations. At a minimum, answer these two questions before moving forward:

❓ What level of verification depth do you need: Basic retrieval confirms the EIN exists and matches the business name for routine transactions. Comprehensive validation includes ownership checks, financial assessment, and risk screening for high-value partnerships or regulated industries.

❓ What are your compliance and timing requirements? Industry regulations may dictate verification standards and documentation retention. Real-time verification enables immediate decisions, while batch processing suits periodic reviews of existing relationships.

Aligning your verification approach with actual business needs and regulatory obligations prevents both under-verification that creates risk exposure and over-verification that wastes resources.

Step 3: Select the appropriate search method

Choose your search method based on verification volume, urgency, budget, and internal capabilities. Each approach offers distinct advantages depending on your operational context.

| Method | Free Access | Historical Data | Bulk Processing | Real-time Results | Automation |

|---|---|---|---|---|---|

| IRS EIN Assistant | ✅ | ❌ | ❌ | ❌ | ❌ |

| Secretary of State Databases | ✅ | ✅ | ❌ | ❌ | ❌ |

| Third-party Business Databases | ❌ | ✅ | ✅ | ✅ | ❌ |

| Professional Services | ❌ | ✅ | ✅ | ❌ | ❌ |

| Credit Reporting Agencies | ❌ | ✅ | ✅ | ✅ | ❌ |

| EIN Verification APIs | ❌ | ✅ | ✅ | ✅ | ✅ |

Organizations conducting frequent verifications or requiring immediate results should prioritize automated solutions, while occasional searches with flexible timelines can leverage free government resources.

Step 4: Execute the EIN search

Input the business information into your selected platform with exact formatting and spelling. If the initial search returns no results, try alternative name variations, including common abbreviations, expanded forms, or different arrangements of entity type designators like LLC, Inc., or Corp.

When results appear unclear or conflicting, search across multiple databases to establish consistency and build confidence in the findings. For businesses operating in multiple states, ensure you search the actual jurisdiction of incorporation rather than just the current operating location, as these may differ.

Step 5: Validate the retrieved information

Once you receive search results, cross-reference the retrieved EIN with all known business identifiers to confirm you have the correct entity. The entity type, registration status, and business address in the results should align with your existing records or reasonable expectations based on what the business has disclosed.

If you encounter discrepancies between the EIN data and information provided directly by the business, these require investigation and resolution before moving forward with any relationship.

Step 6: Assess business risk indicators

Beyond confirming basic identity and active status, review the complete business profile for potential risk factors that could affect your relationship. Check for:

- Bankruptcy filings or proceedings

- Tax liens or judgments

- Financial encumbrances or secured debts

- Government watchlist or sanctions database appearances

- Regulatory enforcement actions or violations

- Ownership structure transparency issues

- Connections to high-risk individuals or entities

- Recent changes in business status or legal structure

- Ownership transfers or changes in control

- Pending or recent litigation

Pay particular attention to recent changes, as these often signal operational problems or increased risk that warrant additional scrutiny before proceeding.

Step 7: Document findings and establish re-verification protocol

After completing your verification, create a comprehensive record that includes the EIN, verification date, search methods used, and all retrieved business information.

Beyond initial verification, establish a schedule for periodic re-verification that reflects each business partner's risk profile and transaction volume. High-risk partnerships or significant credit exposure may require quarterly or semi-annual reviews, while stable, low-risk vendor relationships can typically be verified annually.

How can Signzy simplify your EIN search process?

Signzy offers EIN search and business verification solutions for financial institutions and businesses that need to verify U.S. entities. The platform holds ISO 27001 and SOC 2 Type II certifications and maintains PCI-DSS compliance standards for data security. Over 10 Fortune 30 companies use Signzy for their verification needs.

The EIN verification API connects to official government databases and returns business information in real time. Organizations use the platform to automate verification workflows, from initial EIN lookup to ongoing monitoring.

"Real-time verification wasn't possible with our manual process. Vendors would wait days while we researched their information. Signzy is integrated into our vendor portal and validates everything during signup. Application approval happens same-day now." — Operations Director, B2B Marketplace.

With over 340 APIs available, businesses can access everything from basic EIN verification to comprehensive risk screening and compliance checks within a single system. The platform operates on a pay-as-you-go model, allowing organizations to use only the specific APIs they need without paying for unused features.

Schedule a demo to see how Signzy can streamline your EIN search and business verification processes while maintaining compliance with regulatory requirements.

FAQ

Is there a free way to verify if an EIN is real?

Can I verify an EIN directly through the IRS?

What information do I need to verify a business EIN?

Can I verify multiple EINs at once?

Gaurav Gupta

Gaurav Gupta is the Global Product Head at Signzy, leading the strategy and development of the company’s KYC, KYB, AML, and digital onboarding products used by banks, fintechs, and financial institutions across global markets. He specializes in building scalable compliance and verification platforms, transforming complex regulatory and risk workflows into seamless, automated product experiences. Gaurav works at the intersection of product, engineering, and AI.

![5 Best Tools to Verify an EIN Number [Free + Paid] - 2026](https://cdn.sanity.io/images/blrzl70g/production/5acdb26c768fcb06fbd9cfbfb94a408cb3d22bd1-2560x600.webp)

![How to Lookup a Company's EIN Number? [2026 Guide]](https://cdn.sanity.io/images/blrzl70g/production/3ceee4c0b2fac3923bd2303cd5b313631bea7258-2560x600.webp)

![How to Verify TIN Online? Free, Paid, and Bulk Methods [2026]](https://cdn.sanity.io/images/blrzl70g/production/17b953e70e885c58b7a41d0d921c545f3854782c-2821x663.png)

![Role of an EIN in Business Credit Building [2026 Guide]](https://cdn.sanity.io/images/blrzl70g/production/e7696db83ca8a3c86cb79a070ebacc266de58d71-2816x662.png)