One Touch KYC Verification

Global KYC – Complete Verification in One Platform

Customize KYC flows with document OCR, AML screening, database checks, and liveness detection — all through a single, scalable API.

2x

More Fraud Detection

14,000+

Global Document Types

100M+

Users Verified

10x more powerful and secure than individual verification APIs

Let's verify your identity

It takes less than 2 minutes

Verify your ID document

Verify your liveness

Trusted by industry leaders

Effortless. Secure. Global. KYC

Experience faster, safer, and smarter identity verification for your business.

Verify within seconds with no manual effort

Say goodbye to manual processes with AI-powered document verification, face matching, and liveness detection. Signzy’s seamless KYC ensures real-time verification with zero human intervention, making onboarding faster and more reliable.

Minimize fraud while staying user-friendly

Protect your business from identity fraud with advanced passive and active liveness checks that detect deepfakes, masks, photos, and 3D spoofing. Integrated AML screening flags high-risk individuals using global watchlists and databases to keep your platform compliant and secure.

Get global coverage with a single dashboard

Verify identities from over 120 countries and 14,000+ document types using one plug-and-play API. With instant government database checks, auto ID classification, and support for all languages, you can deliver a seamless onboarding experience—anytime, anywhere.

One dashboard for infinite control

Streamline all your admin and back office tasks with the end-to-end KYC dashboard.

Image Quality Analysis

- Ensures that the uploaded documents meet the required standards for clarity and readability.

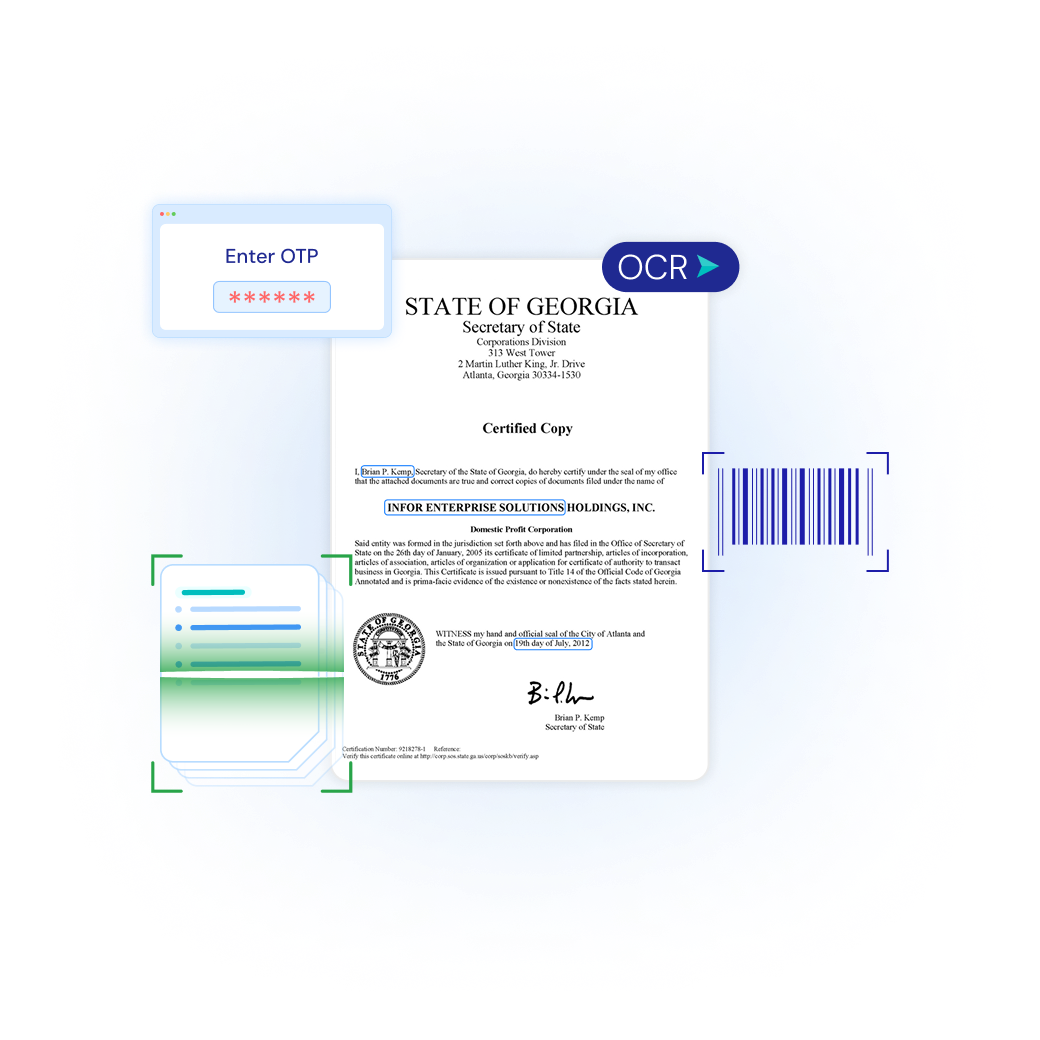

Optical Character Recognition (OCR) Checks

- Extracts and verifies information from the uploaded documents.

Forgery and Tampering Checks

- Detects any signs of document forgery or tampering to ensure authenticity.

Liveness Checks

- Confirms that the person performing the KYC is physically present and alive, reducing the risk of impersonation.

Face Match Check

- This check compares the face on the ID card with the selfie taken to ensure similarity.

ID Classification

- Reduces human error and friction, making the KYC journey seamless.

Create, manage, and monitor with zero manual effort

Make confident choices with our risk/decision engine and countless built-in capabilities.

Phone and OTP Verification

Multi-document Validation

Details and Database Checks

MRZ and Bar Code Scanning

Face Match

Deepfake and Spoof Detection

Auto-ID Classification

Cross-device Support

In-built OCR Checks

Who can benefit from Signzy’s One Touch KYC?

KYC verification is a common compliance pain point across industries—and we’re here to solve it.

Banking and Financial Services

Crypto

Travel & Hospitality

Credit Unions

Healthcare

Online Gaming and Gambling

Real Estate

Discover the power of no-code for your business

Deliver a global onboarding experience that truly engages and delights your users.

Create your perfect user experience

Offer a unique onboarding experience for your products—don't just optimize, delight!

Expand fearlessly with zero risk

The no-code platform is globally compliant and can be used in over 240+ countries.

Stay one step ahead of compliance

We were using AI and ML for verification before they were buzzwords in the industry.

Discover the end-to-end Identity Verification Stack

This is as secure and straightforward as KYC gets—in a single click setup!

Document OCR

Validate government issued IDs and documents through Optical Character Recognition (OCR) software, and reduce risk of human errors during the verification process.

Biometric Authentication

Ensure every user in your onboarding process is authentic and live. Leverage advanced liveness checks and face matching to combat deepfake and synthetic fraud.

Database Check

Analyse financial transactions to detect suspicious activities while also ensuring compliance with increasingly stringent AML regulations.

AML Screening

Stay one step ahead of fraud and money laundering — mitigate risk and screen users against Politically Exposed Persons (PEP), sanctions lists, adverse media, etc.

Risk Assessment

Build comprehensive risk profiles based on customizable risk levels. Analyze cashflow data, credit reports, risk patterns, and much more.

Transaction Monitoring

Analyse financial transactions to detect suspicious activities while also ensuring compliance with increasingly stringent AML regulations.

Built to be quick and keep pace

Integrate the platform during lunch hour, customize based on your needs, and go live within 2-4 weeks :)

Related Blogs

FAQ

What is One Touch KYC?

One Touch KYC is Signzy's unified, end-to-end digital identity verification solution that enables instant customer onboarding with a single API suite. It bundles document verification, biometric checks, liveness detection, and consent capture into one seamless flow — whether you're onboarding individuals or businesses globally.

How is One Touch KYC different from traditional KYC solutions?

- Offers a single, orchestrated, and customizable workflow for KYC

- Covers both personal and business verifications

- Is regulatory-compliant across multiple jurisdictions

- Ensures fraud detection, data extraction, and audit trails in one step

This means fewer drop-offs, faster onboarding, and lower operational costs.

What types of verifications does it include?

- ID document capture and OCR

- Face match and liveness checks

- Address proof extraction

- Consent management

- Deepfake verification

All in a single touchpoint!

Is it customizable for different industries or geographies?

Yes! Whether you're a U.S.-based neobank, a Middle Eastern crypto exchange, or a regulated Indian NBFC, One Touch KYC can be configured to match your regulatory requirements, risk thresholds, and UI preferences.

How long does the entire onboarding process take with One Touch KYC?

It's built for real-time onboarding. Identity checks and fraud scans complete within seconds — dramatically reducing drop-offs and operational delays.

How is user data protected during the process?

Signzy ensures end-to-end encryption, GDPR/DPDP compliance, and audit-friendly logs, so you stay compliant while offering a frictionless customer experience.

![FINRA Rule 2090: Know Your Customer Requirements [2026 Guide]](https://cdn.sanity.io/images/blrzl70g/production/ed4b5a8ceb78cf2f2d98312cecca21829dd5a6f5-1354x318.webp)

![10 Best KYC Software Providers of 2026 [US Guide]](https://cdn.sanity.io/images/blrzl70g/production/008b1ea8636a5a1febcd10331269d51c5c29090e-3985x933.jpg)