Money Mule Detection

Fight money mules with AI-powered detection

Actively fight money laundering and fraud with Signzy's MuleShield. The API helps you detect, monitor, and safeguard your business against mule accounts in real-time.

72%

Increase in Mule Detection

400,000+

Money Mules Detected

2x

More Fraud Detection

Trusted by industry leaders

Make your business mule-proof

Mules attack your money, as well as your reputation. Signzy helps you protect both!

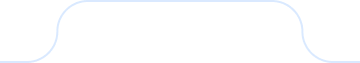

Make confident decisions based on trust scores

Get the complete picture of a user account and make decisions based on reliable databases and trust scores.

Verify risky accounts over 200+ parameters

Implement KYC and AML checks on pincode, IP address, digital presence, KYC details, UPI information, and much more within seconds.

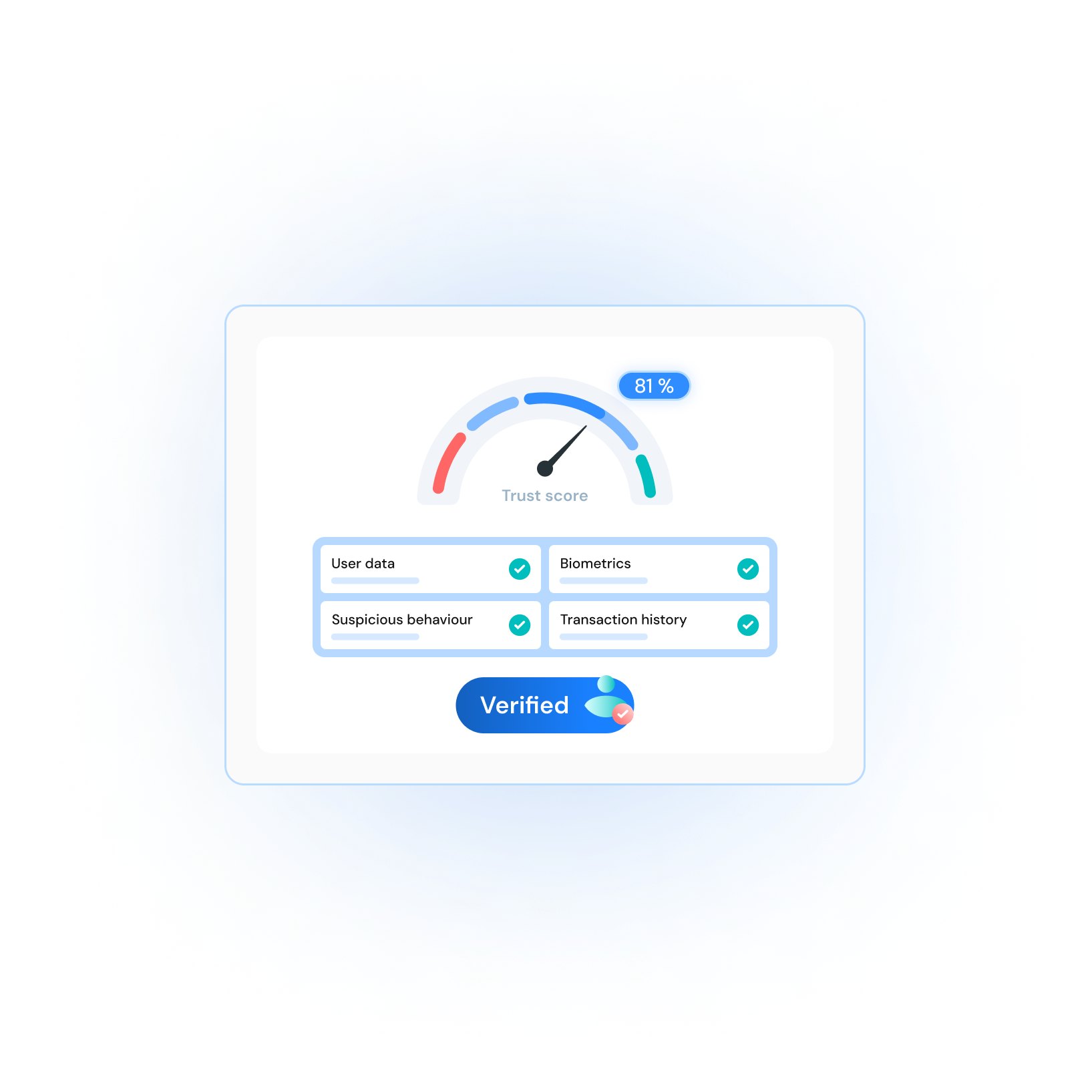

Detect mules with advanced pattern recognition

Identify hidden patterns and red flags to spot fraudsters, all while maintaining a quick and delightful onboarding for your genuine users.

Identify and block mules during onboarding

Screen users at the first touchpoint for 100% safe business operations

Phone intelligence

Email intelligence

Behavior intelligence

Asset and financial records

Employment information

Negative database check

Digital footprint

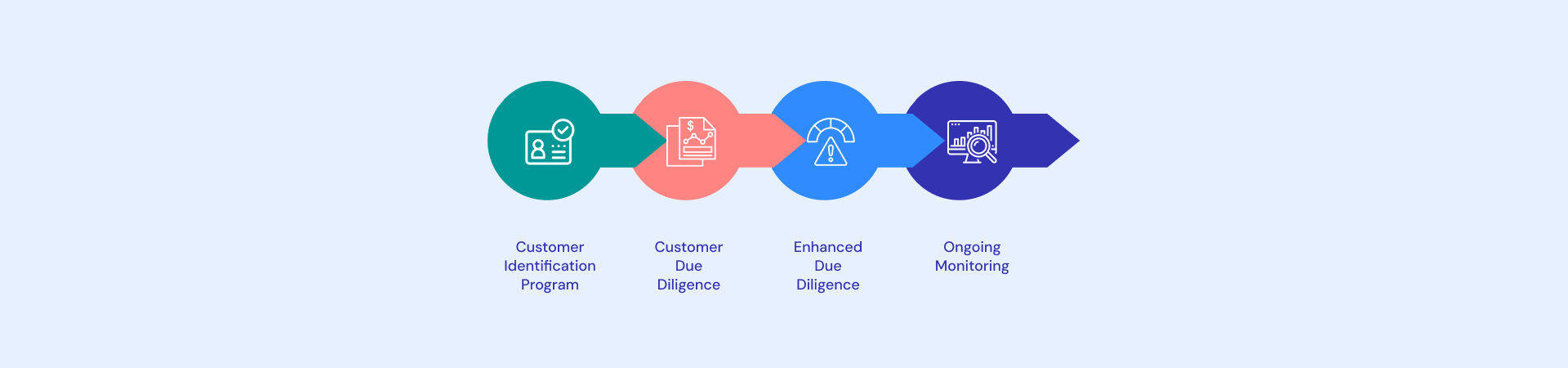

3 ways to foolproof mule detection

Protect better with MuleShield

We fight mules ruthlessly while ensuring you never lose a business or user connection

Fight fraud, not genuine users

We help you reduce drop offs and strike the delicate balance between speed and security.

Tech first, not trend-first

We were using AI and ML for mule detection before they were buzzwords in the industry.

Never non-compliant

Our teams work dedicatedly on regulations, so you never have to worry about compliance.

Don’t just stop at mule detection

Get 360° security and compliance at one place with KYC, KYB, and AML checks

Transaction Monitoring

Analyse financial transactions to detect suspicious activities while also ensuring compliance with increasingly stringent AML regulations.

AML Screening

Stay one step ahead of fraud and money laundering — mitigate risk and screen users against Politically Exposed Persons (PEP), sanctions lists, adverse media, etc.

Risk Assessment

Build comprehensive risk profiles based on customizable risk levels. Analyze cashflow data, credit reports, risk patterns, and much more.

Criminal Screening

Screen users against comprehensive government watchlists and databases. Also auto-monitor through the entire user journey to prevent fraud.

Integrate once and secure your data forever

Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks!

Related Blogs

FAQ

What is Signzy's Money Mule Detection?

MuleShield is Signzy's advanced AI product that helps financial institutions detect, flag, and prevent mule accounts — which are often used to launder money, route fraud funds, or act as conduits for scams.

What exactly is a mule account?

A mule account is a legitimate bank account (real or stolen) used to move illicit money — often unknowingly. These accounts are central to modern fraud rings and financial crimes like phishing, romance scams, and refund fraud.

How does Signzy detect mule accounts?

- Unusual transaction patterns

- Multiple accounts accessed from the same device

- Accounts acting as pass-through nodes

- Synthetic or dormant profiles suddenly showing high activity

Our system uses AI-based behavioral analytics, network intelligence, and device fingerprinting to flag suspicious activity.

Does MuleShield work in real time?

Yes. Our APIs and decisioning engine are built for real-time or near-real-time detection, so suspicious transactions can be stopped before they complete.

Can MuleShield integrate with our existing fraud detection or transaction monitoring tools?

Absolutely. Signzy's solution is modular and API-first, meaning you can plug it into your existing risk engines, AML platforms, or onboarding workflows.

What's the impact of mule detection for banks and fintechs?

- Reduces fraud losses significantly

- Improves compliance posture with regulators

- Protects brand reputation by proactively identifying risky accounts

- Supports investigations with audit trails and network visualizations