Credit Unions

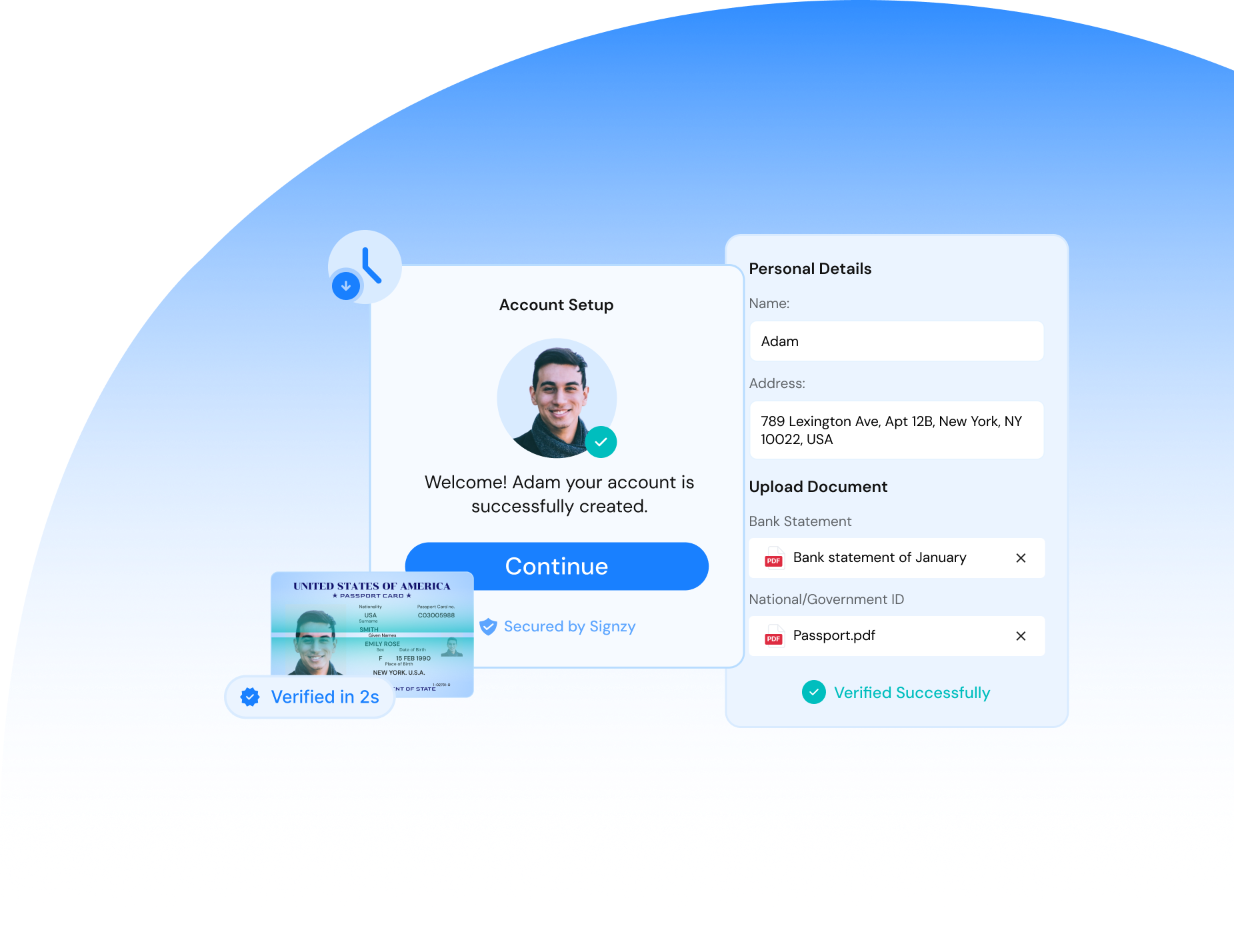

Seamless Digital Onboarding for Members

Give your members the personalized experience they expect, now powered by fast, secure, and fully digital identity verification. Signzy helps credit unions modernize onboarding with real-time KYC, KYB verification, and AML checks – so you can serve your community better, stay compliant, and grow without friction.

100M+

Users Verified

2x

Fraud Detection

<5s

Response Time

Trusted by industry leaders

Bring big bank tech to your local credit union

Compete with big banks, win on experience

Offer a digital onboarding journey that rivals national banks without sacrificing the community-centric values that set your credit union apart. Signzy empowers you to deliver fast, secure, and intuitive user experiences that make members feel right at home.

Onboard more members in less time

Onboard more members in less time-Cut verification times from days to minutes. Signzy’s KYC and AML suite helps you onboard individual and business members faster, boosting approval rates and keeping operational costslow.

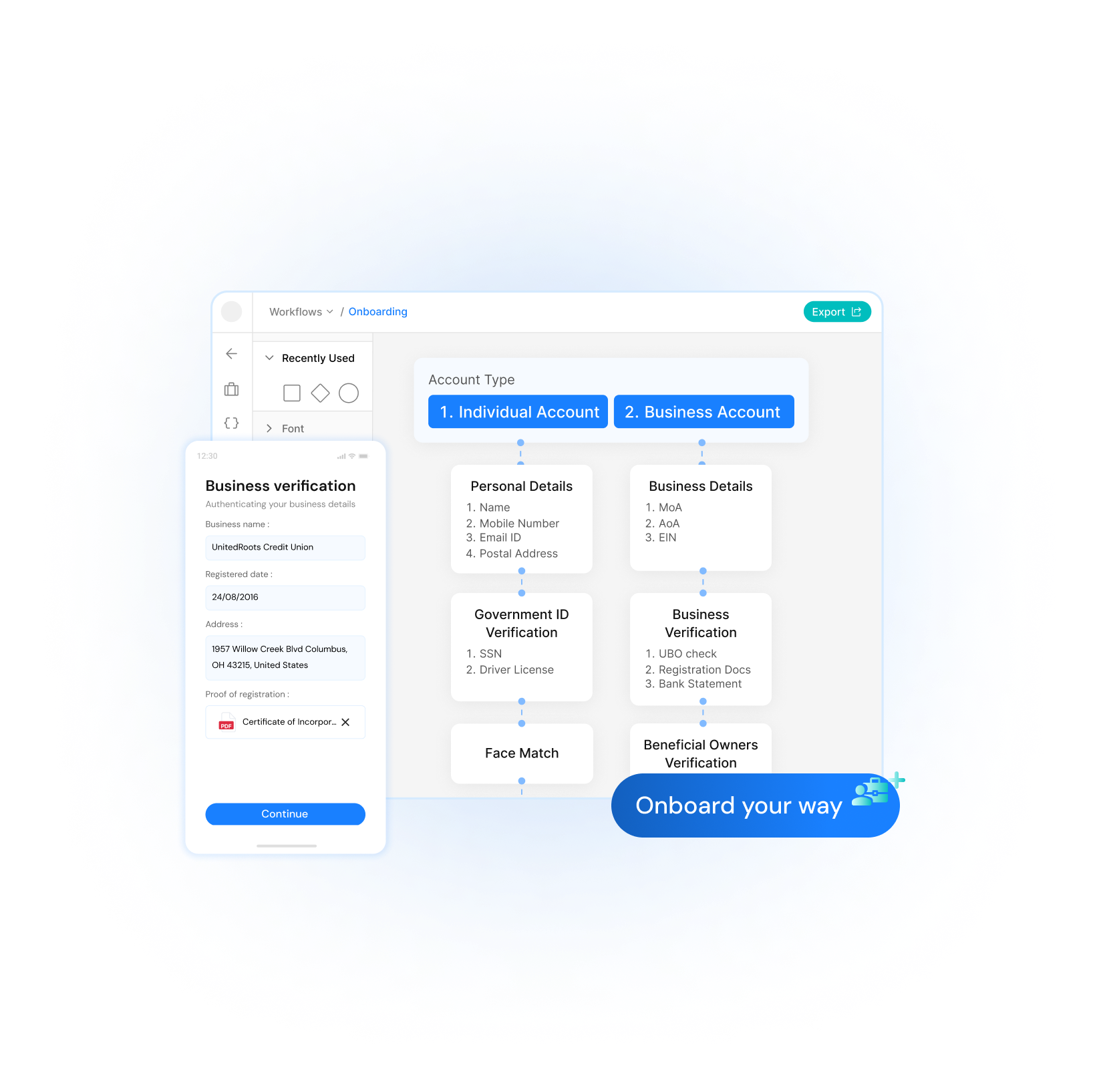

Customize workflows for individuals and businesses

Whether you're onboarding a new personal member or a small business account, Signzy lets you tailor onboarding flows to fit your exact needs, no matter your credit union’s size or tech stack.

Stay compliant without slowing down

Regulations are evolving, your onboarding doesn’t have to fall behind. Signzy helps you stay audit-ready with built-in KYC, AML, and CIP checks that align with U.S. regulatory standards, including: NCUA and FFIEC guidelines, AML compliance, OFAC and watchlist screening.

Our Innovations

Smarter KYC, AML and KYB verification for Credit Unions

Biometric Verification

Liveness detection and face matching for member identity verification

Ensure secure, fraud-proof onboarding with advanced face biometrics and passive liveness checks. Confirm the identity of every member instantly and accurately while delivering a smooth, user-friendly experience.

Document Verification

AI-Driven ID verification for domestic and global members

Automatically extract and verify member information from global documents across 180+ countries. Detect fake or altered documents in real time using high-accuracy OCR verification processes.

Data Validation

Cross-check member data against official records

Validate government-issued IDs, addresses, and personal details using real-time checks with authoritative and reliable databases. Reduce manual errors and onboarding delays while meeting regulatory obligations.

Bank Account Verification

Instant verification of linked bank accounts for deposits and disbursements

Authenticate member bank accounts instantly to ensure accurate fund transfers, recurring payments, and loan disbursements. Prevent fraud and eliminate drop-offs with real-time, API-powered verification.

Signzy’s KYC suite for Credit Unions

Digital identity infrastructure for seamless member onboarding

One Touch KYC

AI-Powered identity verification for fast, compliant member onboarding

Verify new members with a single, secure solution. One Touch KYC instantly detects deepfakes, validates government IDs, and ensures adherence to credit union compliance mandates, delivering a smooth onboarding experience with zero compromises.

Transaction Monitoring

Real-time AML monitoring and suspicious activity reporting

Monitor member transactions at scale using intelligent rules tailored for credit unions. From ACH transfers to cash deposits, detect unusual patterns, flag high-risk activity, and generate automated SARs. Make sure you stay ahead of regulatory requirements without manual overhead.

MuleShield

Stop money mule accounts before they impact your community

Protect your credit union from financial crime. MuleShield uses behavioral biometrics, transaction velocity, and network analysis to identify suspicious accounts early, so you can act before fraud becomes fraud loss.

No-Code Compliance Platform

Design custom KYC and fraud workflows without developers

Launch personalized onboarding flows and risk controls with drag-and-drop simplicity. Whether you’re opening individual deposit accounts or business memberships, Signzy’s no-code platform lets your team build and adapt compliance journeys quickly without any engineering resources.

Built to be quick and keep pace

Integrate the platform during lunch hour, customize based on your needs, and go live within 2-4 weeks :)

Related Blogs

FAQ

How is Signzy different for credit unions compared to big banks?

We understand credit unions prioritize trust, community, and compliance. Signzy helps you verify members faster, prevent fraud, and stay audit-ready without disrupting member experience or requiring large tech teams.

Can Signzy support US-specific ID verification and AML checks?

Yes. We support SSN validation, driver license verification, OFAC/SAM/PEP screening, and CIP compliance tailored for credit unions under FinCEN and NCUA guidance.

Can we use Signzy for both member onboarding and business accounts?

Absolutely. Signzy offers both KYC for individuals and KYB for small businesses—ideal for credit unions expanding into SME lending or community business banking.