Database Validation API

Build a quick and safe user onboarding with instant database validation

Validate data and confidently onboard individuals. With Signzy’s trusted Database Check API, you can instantly extract information from documents, screen against central and private lists, and keep fraudsters away.

Trusted by industry leaders

Autofilled data you can trust

100%

Data accuracy

All user data is sourced directly from official sources, ensuring 100% coverage and zero room for error.

100M+

users verified

Grow fearlessly with APIs that scale with your business. Millions trust Signzy for secure and seamless verification.

50

States coverage

Screen against criminal prosecutions, arrest records, warrant lists, most wanted, and much more across states.

Validate customer data for better decision making

Onboard new users and monitor existing users with reliable KYC data at your fingertips

Verify against Global and local databases

Our ML and AI-powered systems are trained on both global and local IDs to extract, validate, and authenticate with precision. We support multi-language and multi-format data so you never have to hold back from expanding into new regions.

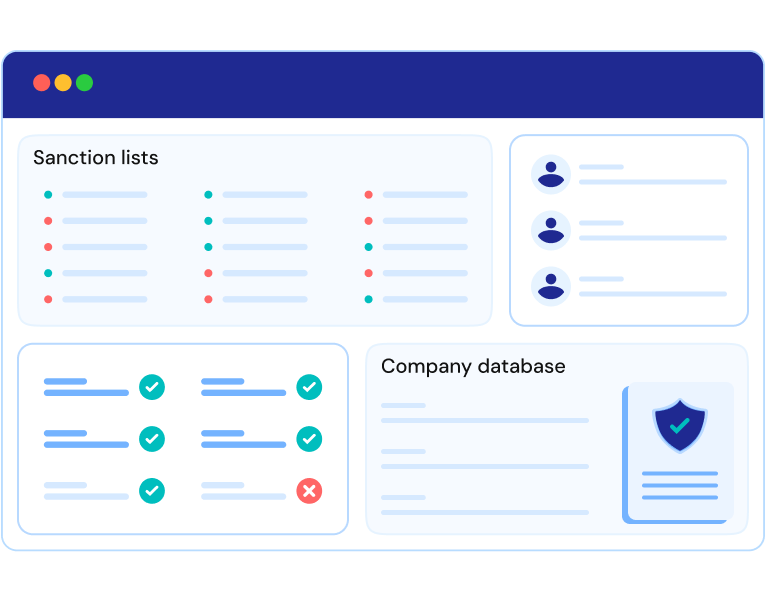

Get the most extensive data coverage

Match details across multiple databases for 100% data accuracy. With Signzy’s extensive partnerships and reliable data sources, you can screen against PEPs, sanctions, watchlists, and compliance databases with a single tool.

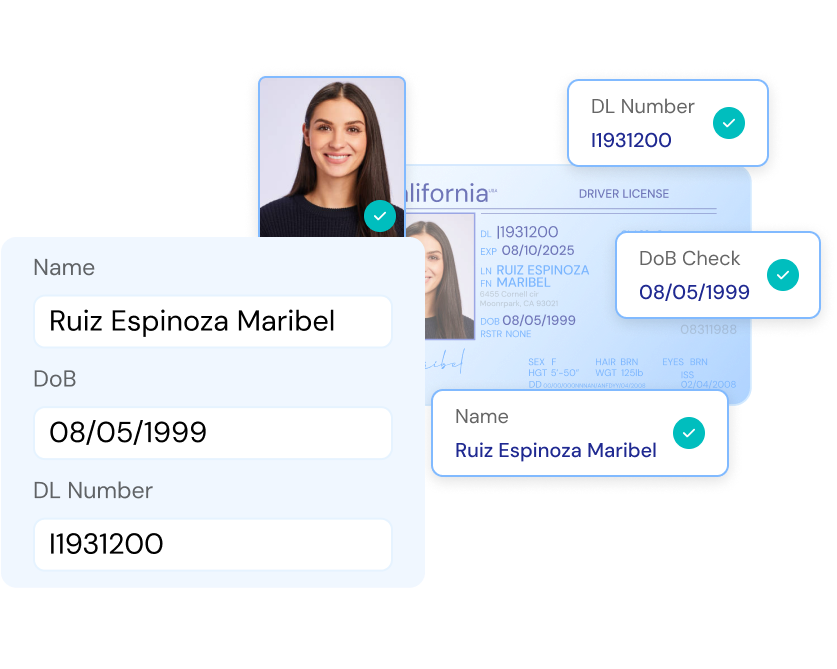

Eliminate fraud with OCR and ICR extraction

Signzy’s OCR and ICR extracts valuable text + visual data, validates it against official data records, and auto-fills input fields. We’re a tech-led, privacy-first company which means all data is always encrypted and safe.

Get consistent and reliable data from multiple sources

We validate and cross-check data from official and private databases to ensure no fraud goes by unnoticed

Government records

Tax Authorities

Sanctions and Watchlists

PEP and Adverse Media

Criminal Screening

Credit Bureaus

Business Registries

Industry Databases

State-level Databases

Simplify your enhanced due diligence and KYC efforts

One tool for all possible user and business functionalities

Financial Stability Analysis

Evaluating an individual’s financial health through credit reports and financial records.

Ownership Verification

Identifying and authenticating the identities of ultimate beneficial owners (UBOs).

Vendor or Supplier Validation

Verifying the legitimacy and reliability of vendors or suppliers before initiating partnerships or contracts.

Regulatory Compliance Screening

Ensuring that users adhere to regulatory requirements and are not flagged in sanctions lists or watchlists.

KYC and Customer Due Diligence

Enabling comprehensive verification of business clients and their key stakeholders to meet KYC obligations.

Real-Time Business Assessment

Continuously monitoring businesses for changes in status, such as financial distress, lawsuits, or compliance violations.

Customer Risk Profiling

Categorizing business clients based on their risk levels to tailor due diligence efforts and compliance measures.

Access the complete KYC stack

Build your foolproof user verification system through government IDs, reliable data sources, and advanced biometric checks.

Document Verification

Validate government issued IDs and documents through Optical Character Recognition (OCR) software, and reduce risk of human errors during the verification process.

Biometric Authentication

Ensure every user in your onboarding process is authentic and live. Leverage advanced pixel analysis and pattern recognition to combat deepfake and synthetic fraud by identifying anomalies in real time.

Built to be quick and keep pace.

Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks!

Related Blogs

FAQ

What is Signzy's Database Validation API?

Signzy's Database Validation API enables businesses to verify and validate user information against authoritative databases, ensuring the accuracy and authenticity of data provided during onboarding or transactions.

Which types of data can be validated using this API?

The API can validate various data types, including business and personal identification numbers, addresses, and other critical KYC and KYB data, by cross-referencing them with official databases.

How does the Database Validation API enhance security?

By verifying user-provided data against trusted sources, the API helps detect and prevent fraudulent activities, ensuring that only legitimate users are granted access or services.

Is the API compliant with global data protection regulations?

Yes, Signzy's API is designed to adhere to international data protection standards, ensuring that user data is handled securely and in compliance with relevant regulations.

What industries can benefit from the Database Validation API?

Industries such as financial services, banking, insurance, and e-commerce can leverage the API to enhance security, ensure compliance, and improve user experience during the onboarding process.

How does the API handle data privacy?

Signzy utilizes end-to-end encryption, secure APIs, and data anonymization to safeguard information. All processes comply with data protection laws like GDPR and CCPA to prevent breaches.

How can I get support if I encounter issues with the API?

You can troubleshoot through our documentationor get in touch with us through connect@teamsignzy.com

![AML Watchlist Screening Guide: Regulations, Tools, and More [2026]](https://cdn.sanity.io/images/blrzl70g/production/d6f119be39abfc6cd718c86eb5a401ddc6d44e66-1920x450.png)