AML Transaction Monitoring

Secure your business against financial fraud and money laundering

Verify, onboard, and monitor against suspicious financial activity to keep fraudulent users and businesses away. Access the most secure anti-money laundering suite for foolproof transaction analysis and monitoring.

100M+

Users Verified

2x

More Fraud Detection

360°

Risk Profiling

Trusted by industry leaders

Detect. Prevent. Protect.

Verify boldly with complete transaction analysis, risk recognition, and behavioral monitoring

Stay compliant and secure against financial fraud

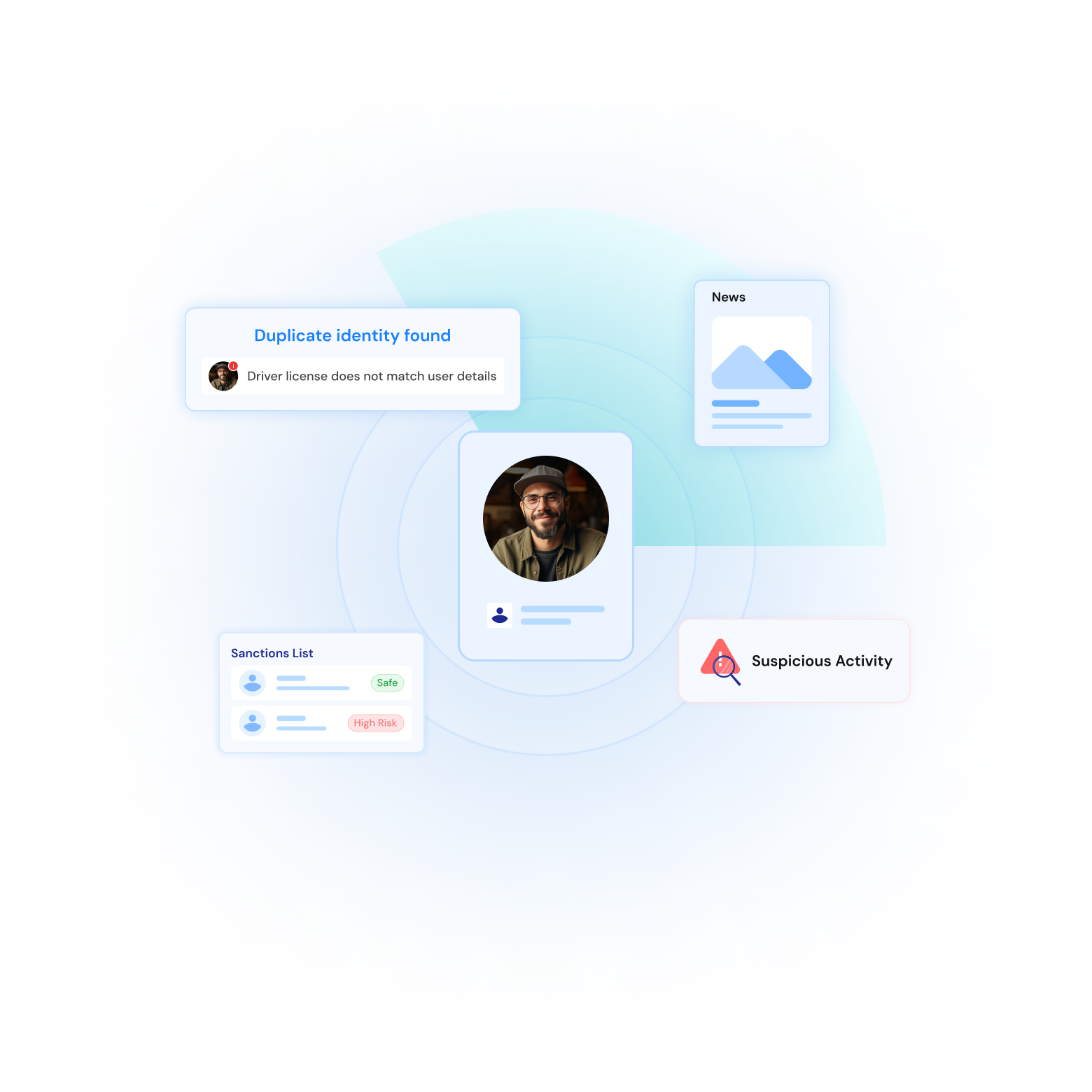

Signzy automates AML checks in the background, ensuring every transaction is secure—without frustrating your users with unnecessary delays. Signzy’s monitoring goes beyond red flags, offering you deep risk analytics and actionable insights.

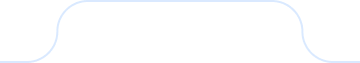

Monitor and reduce risk with global databases

Uncover hidden patterns, pinpoint anomalies, and make data-driven decisions that protect your institution and users from financial crime. Our machine learning system continuously learns from evolving fraud patterns, ensuring financial institutions stay one step ahead of criminals.

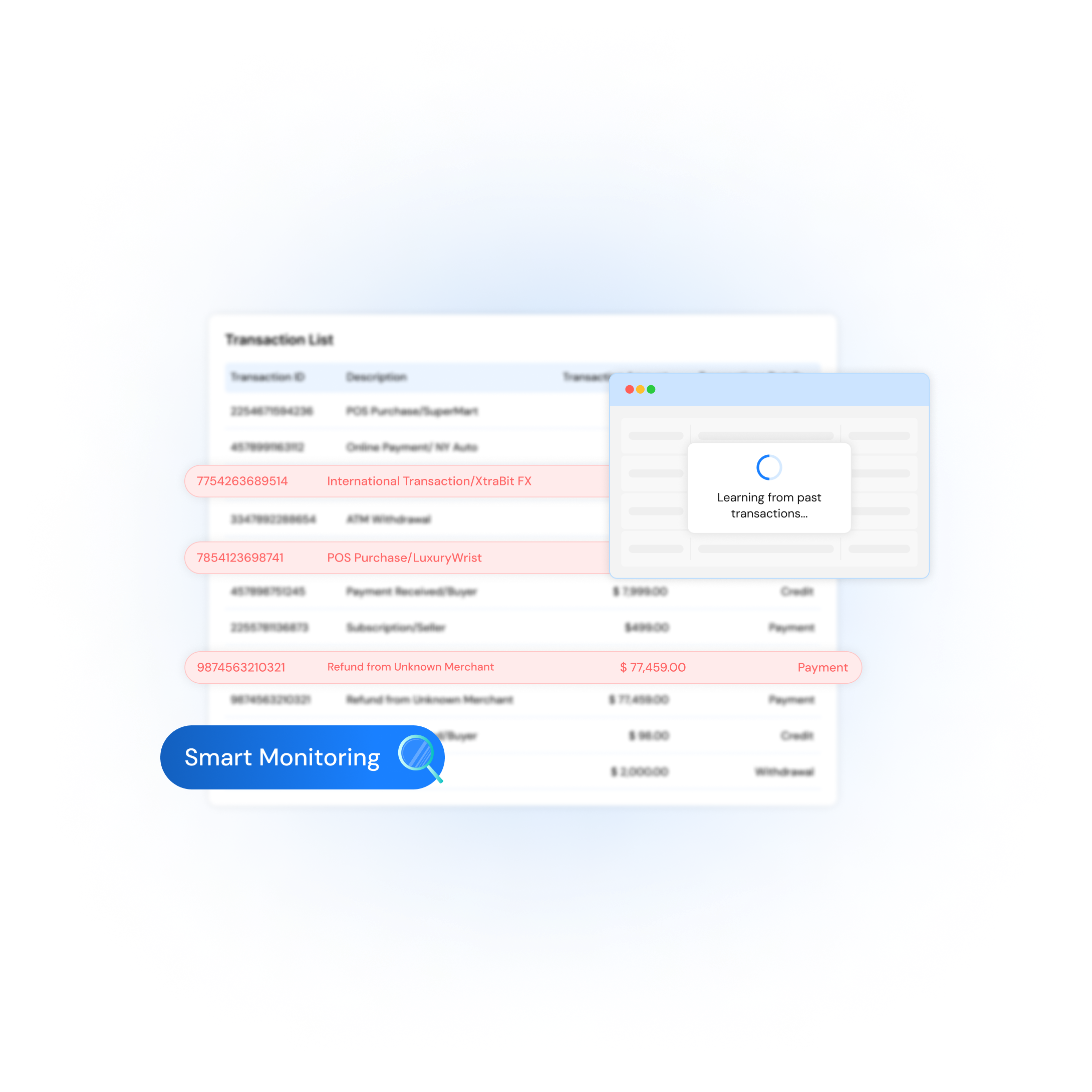

Detect risk throughout the user journey

Monitoring doesn’t stop after onboarding a user onto your platform. You can automate your AML efforts, customize stringency based on your needs, and auto-populate your fields with fresh data throughout every step of the user journey.

Get the comprehensive risk profile of a user

Build trust, onboard with confidence, and never let a fraud transaction slip by

Behavioral Monitoring

Negative News

Adverse Media Screening

Fight fraud, not your users

Deliver a global onboarding experience that truly engages and delights your users!

Create your perfect user experience

Offer a unique onboarding experience for your products—don't just optimize, delight!

Expand fearlessly with zero risk

The no-code platform is globally compliant and can be used in over 240+ countries.

Stay one step ahead of compliance

We were using AI and ML for verification before they were buzzwords in the industry.

Discover the end-to-end Identity Verification Stack

This is as secure and straightforward as KYC gets—in a single click setup!

One Touch KYC

Simplify the Know Your Customer (KYC) process with AI and sophisticated fraud detection algorithms to provide a seamless, efficient, and highly secure user verification.

AML Screening

Stay one step ahead of fraud and money laundering — mitigate risk and screen users against Politically Exposed Persons (PEP), sanctions lists, adverse media, etc.

Risk Assessment

Build comprehensive risk profiles based on customizable risk levels. Analyze cashflow data, credit reports, risk patterns, and much more.

Bank Account Verification

Reduce fraud, prevent payment failures, and accelerate customer onboarding with instant or verification for seamless transactions and consent-based verification for enhanced security and compliance.

Built to be quick and keep pace

Integrate the platform during lunch hour, customize based on your needs, and go live within 2-4 weeks :)

Related Blogs

FAQ

What is AML Transaction Monitoring by Signzy?

It's a real-time and rule-based system designed to detect suspicious transactions, flag anomalies, and help you comply with global AML regulations such as FATF, FinCEN, and India's PMLA.

How does Signzy's AML Monitoring work?

- Pre-configured or custom rules

- Customer risk profiles

- Behavioral and volume thresholds

The system ingests transaction data (from core banking, wallets, payment rails, etc.) and applies these elements to automatically detect patterns that may indicate money laundering, smurfing, or structuring.

What types of alerts can it generate?

- Sudden high-value transactions

- Round-figure splits

- Cross-border transfers

- Activity inconsistent with user profile

- Multiple small deposits and rapid withdrawals

- High-risk counterparties flagged by sanction lists

Can I customize thresholds or logic?

Yes! You can create custom risk rules, set customer-based thresholds, and even combine AML data with transaction metadata or CRM inputs to build advanced detection logic.

Does Signzy support continuous learning or AI-based risk scoring?

Yes. The platform is built to learn from past false positives/negatives and improve over time. It can also assign dynamic risk scores to users and transactions based on behavior.

What reporting capabilities are included?

- Regulatory-ready reports (e.g., STR, CTR formats)

- Audit trails for every alert and action taken

- Dashboard views of high-risk entities

- Integration with FIU or SAR filing systems (custom)

What geographies are supported?

- OFAC, UN, EU, FinCEN, SEBI, RBI watchlists

- Real-time PEP and sanctions screening

- Multi-currency, cross-border workflows

Signzy's AML and transaction monitoring system is built for multi-jurisdictional compliance.