Database Check

Verify businesses with up-to-date global KYB data

Simplify and strengthen your KYB process with real-time, reliable, and comprehensive database verification. Get access to reliable databases that you can use to verify any business within seconds.

Trusted by industry leaders

Verify every business confidently

100%

Data Accuracy

Get business data sourced directly from official sources, ensuring 100% coverage and zero room for error.

160M+

Businesses Verified

Grow fearlessly with APIs that scale with your business. Millions trust Signzy for secure and seamless partner verification.

180+

Countries Coverage

Screen businesses in 180+ countries and 50 U.S. states against company databases and registries to verify business names, TINs, and more.

Make better business decisions with data you can trust

Onboard new businesses and monitor existing ones with reliable KYB data at your fingertips

Get the most extensive business data coverage

Match details across multiple databases for 100% data accuracy. With Signzy’s extensive partnerships and reliable data sources, you can screen company names, numbers, and vital information with a single tool.

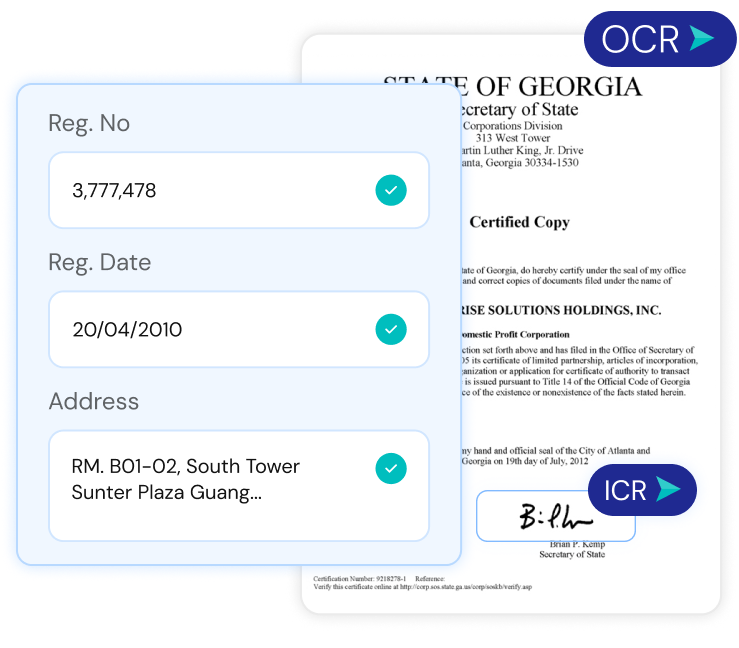

Eliminate fraud with OCR and ICR extraction

Signzy’s OCR and ICR extracts valuable text + visual data, validates it against official business directories, and auto-fills input fields. We’re a tech-led, privacy-first company which means all business data is always encrypted and safe.

Validate company information and stay compliant

Our ML and AI-powered systems are trained on both global and local documents to extract, validate, and authenticate with precision. We support multi-language and multi-format business data so you never have to hold back from expanding into new regions.

Get consistent and reliable data from multiple sources

Uncover the entire business identity with both public and private databases

Government records

Tax Authorities

Company Databases

Business Registries

Sanctions and Watchlists

PEP and Adverse Media

Criminal Screening

Credit Bureaus

Secretary of State (SOS) Database

Industry Databases

State-level Databases

Private Directories

What business details can you validate with Signzy?

Business Name

TIN Verification

Secretary of State Filing

Address Analysis

OFAC details

Business Names

Listed Officers

Web Presence

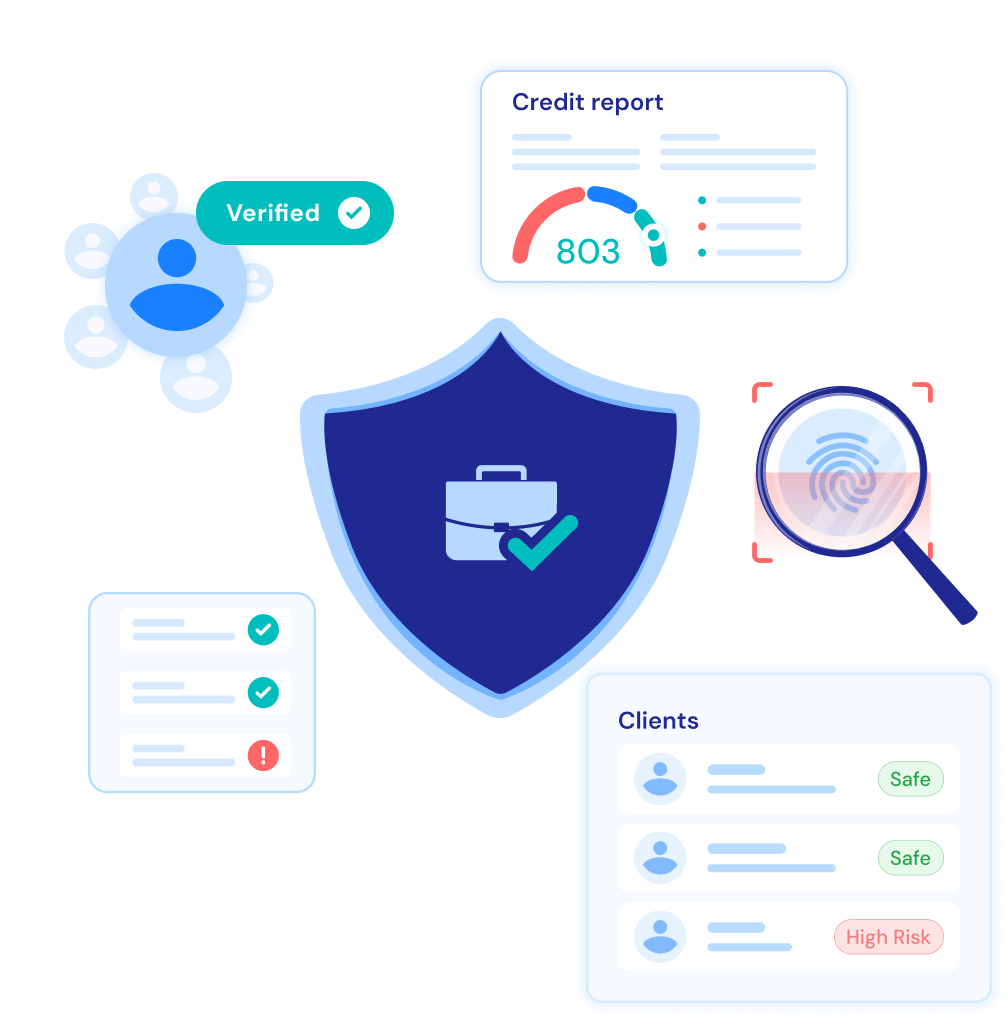

Fight business fraud of any shape or size

We make business search easy for all use-cases and industries

Ownership Verification

Regulatory Compliance Screening

Financial Stability Analysis

KYC and Customer Due Diligence

Vendor or Supplier Validation

Real-Time Business Assessment

Customer Risk Profiling

Automate your entire KYB process with Signzy

We’ve got business verification tools for all your needs - from EIN, TIN, UBO checks to bank account verification and underwriting reports - we cover it all!

EIN Verification

Get accurate validation of EINs against official records to support KYB with details such as business name, license, industry, address, and more.

UBO Check

Learn the beneficial ownership, control, and shareholder structures of a business you’re working with and dodge any risks of money laundering.

Document Verification

Verify bank statements, articles of incorporation, UCC filings, and many more documents to build a comprehensive company profile.

Identity Verification (KYC)

Onboard users with confidence with Signzy’s foolproof KYC system. ID checks, biometric verification, criminal screening, all work together to build dynamic user risk profiles.

Built to be quick and keep pace.

Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks!

Related Blogs

FAQ

What is a business database check?

A business database check is the process of verifying a company's legitimacy, ownership details, financial health, and compliance status against authoritative databases. It helps organizations mitigate risk, prevent fraud, and streamline business onboarding.

What types of business data can be verified?

Signzy's business database check supports verification of:

- Company Registration Details: Business name, incorporation date, entity type

- Ownership & Leadership Information: UBO (Ultimate Beneficial Ownership), shareholders, directors

- Financial & Credit Data: Revenue, credit score, tax filings

- Regulatory Compliance Checks: AML (Anti-Money Laundering), sanctions lists, PEP screening

Why is a business database check important?

A business database check helps organizations:

- Ensure compliance with AML, KYC, and KYB regulations

- Reduce fraud by identifying shell companies or high-risk entities

- Streamline onboarding for vendors, suppliers, and partners

- Conduct due diligence before engaging in financial transactions

How accurate is Signzy's business database check?

Signzy leverages AI-powered data extraction, fraud detection, and cross-referencing with trusted sources to ensure high accuracy and minimize errors.

How long does the verification process take?

Business database checks are conducted in real-time or within minutes, depending on the complexity of the verification and the availability of database sources.

Can Signzy verify international businesses?

Yes, Signzy supports multi-jurisdictional verification, covering company records from global corporate registries, financial institutions, and compliance databases.

How does Signzy detect fraudulent businesses?

Signzy uses AI-powered fraud detection techniques such as:

- Cross-referencing data with official registries to detect inconsistencies

- Analyzing metadata for document authenticity

- Screening against fraud watchlists, sanctions lists, and PEP databases

Which industries benefit from a business database check?

Industries that rely on business database checks include:

- Banking & Financial Services: Corporate KYC (KYB), risk assessment

- FinTech & Payment Providers: Merchant verification and fraud prevention

- Investment & Wealth Management: Due diligence for business clients

- E-commerce & Marketplaces: Seller onboarding and risk mitigation

How does Signzy ensure data security during business verification?

Signzy follows industry-best security practices, including end-to-end encryption, secure API integrations, and compliance with global data protection laws to safeguard business information.