Payments

Power Cross-Border Payments with Secure, Compliant Onboarding.

Cross-border payments come with complex rules but we make them simple. Signzy helps you verify users, detect fraud, and stay KYC/AML compliant across 180+ countries.

100M+

Users Verified

2x

Fraud Detection

<5s

Response Time

Trusted by industry leaders

Expand your global payment footprint without increasing your risk.

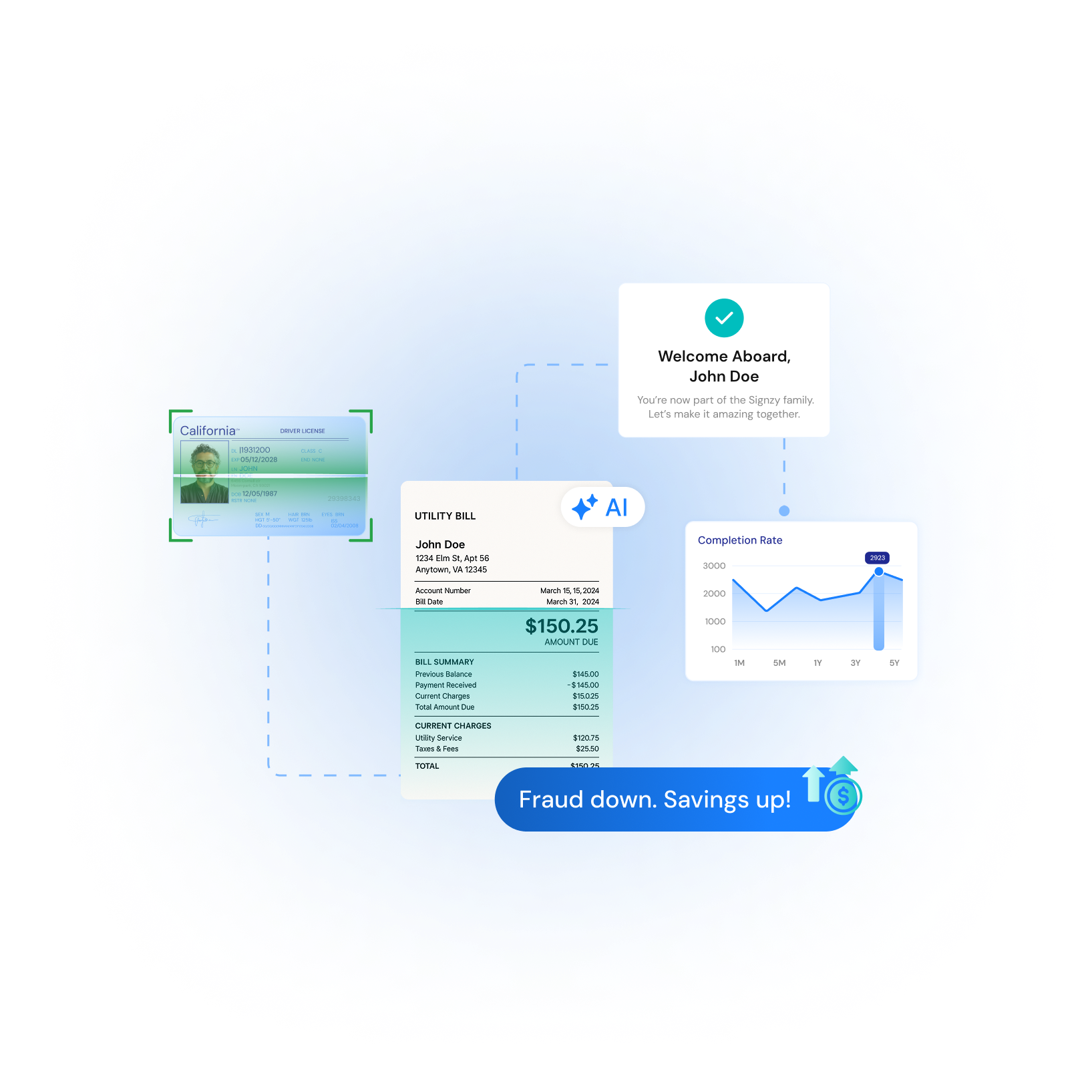

Stop payment fraud before it starts

Protect your platform from money mules, fake identities, and fraudulent payment activity. Signzy’s AI-powered fraud detection solutions include liveness checks, face match, and behavioral signals that ensures only verified users can send or receive international payments..

Comply with cross-border payment laws in 180+ countries

Stay ahead of evolving payment regulations - from FinCEN and OFAC in the US to GDPR, FIU-IND, and SAMA. Signzy’s dynamic 340+ API solutions adapt automatically to local KYC/AML rules, keeping you compliant across your remittance corridors.

Lower onboarding costs for payment users

Lower onboarding costs for payment users-Achieve reduced CAC by combining fast, digital identity checks with high completion rates and smooth UX. Onboard remittance senders and receivers globally without spending on manual reviews or extra dev effort.

Verify individuals and businesses across borders

Whether it’s a migrant worker sending money home or an SME receiving international transfers, Signzy enables instant KYC & KYB using global databases, sanctions lists, and real-time risk scoring.

Our Innovations

End-to-End Digital KYC Infrastructure for Payments & Remittance Platforms

Biometric Verification

Liveness Detection & Face Match for Fast, Secure KYC

Authenticate users in real time with passive liveness detection and face biometrics. Block spoofing and deepfake-based fraud, while keeping the onboarding journey smooth for high-speed payment onboarding.

Document Verification

AI-Powered OCR for Global ID Verification

Extract and validate data from 14,000+ global documents with intelligent OCR and document forgery checks. Detect tampering and fake IDs instantly without any manual review.

Data Validation

Real-Time Checks Against Official Databases

Verify driver license, passport, SSN, and other government IDs using live APIs. Cross-check user information with credit bureaus, watchlists, or national registries to reduce onboarding drop-offs and detect mismatches early.

Bank Account Verification

Validate Payout Accounts Instantly

Confirm bank account ownership and status in seconds. Prevent failed payouts, refund delays, and fraud in international transfers, merchant settlements, and recurring mandates.

Built for payment platforms, processors, and remittance providers.

Signzy's KYC Suite will be the heading and then the line will be subheading

One Touch KYC

Instant Identity Verification for Cross-Border Payments

Verify individuals and merchants across 180+ countries in seconds. One Touch KYC detects deepfakes, authenticates global IDs, and ensures compliance with local data privacy laws making it ideal for high-volume payment and remittance platforms. It combines AI-powered liveness detection, face match, and smart OCR to verify and validate identities.

Transaction Monitoring

Real-Time AML for Payment Processors and Gatewaysg

Track millions of transactions across geographies with our intelligent rules engine. Detect suspicious activity, auto-flag high-risk patterns, and stay compliant with AML directives like FinCEN, FATF, and FIU-IND - all without slowing down your payment flows.

MuleShield

Stop Money Mule Accounts Before They Move a Rupee

Protect your platform from fraudulent remittance activity. MuleShield uses behavioral biometrics, transaction velocity, and network patterns to detect and prevent money mule accounts before they enable financial crime.

No Code Platform

Custom Onboarding & Risk Workflows—No Developers Needed

Launch a new KYC flow for a region or tweak AML logic in a few hours. Our drag-and-drop platform helps PSPs and cross-border payment providers build, test, and deploy custom onboarding and fraud rules in days not months.

Built to be quick and keep pace

Integrate the platform during lunch hour, customize based on your needs, and go live within 2-4 weeks :)

FAQ

How does Signzy help prevent fraud in cross-border payments?

Payment platforms and remittance providers operate in high-risk, high-volume environments with strict KYC/AML regulations. Signzy's KYC Suite helps you verify users instantly, detect payment fraud in real time, and stay compliant across 180+ countries, all while delivering a seamless onboarding experience. Our platform combines passive liveness detection, face match, deepfake prevention, and transaction behavior analysis to stop fraudulent users before they transact.

Is this solution compliant with AML regulations for remittance and payment firms?

Yes. Signzy's tools are aligned with AML regulations like FATF, FinCEN, FIU-IND, SAMA, and more. Our transaction monitoring and KYC/KYB checks ensure you're covered for both onboarding and ongoing AML obligations globally.

Do you support KYC for both senders and merchant partners?

Absolutely. Signzy enables KYC for individual remittance users and KYB for payment merchants, allowing full-stack compliance whether you're onboarding freelancers, migrant workers, or global business partners.

Can Signzy verify ID documents for international remittance users?

Yes. Signzy supports verification of over 14,000+ global documents across 180+ countries, including passports, national IDs, and driver's licenses. This makes Signzy ideal for cross-border payment platforms looking to scale globally while maintaining compliance and trust.