GRC Suite

The only governance, risk, and compliance suite you need

Mitigate fraud confidently and make your compliance team breathe easy. Signzy’s GRC Suite empowers your security and compliance processes with real-time AML screening, transaction monitoring, smart risk assessment, and more.

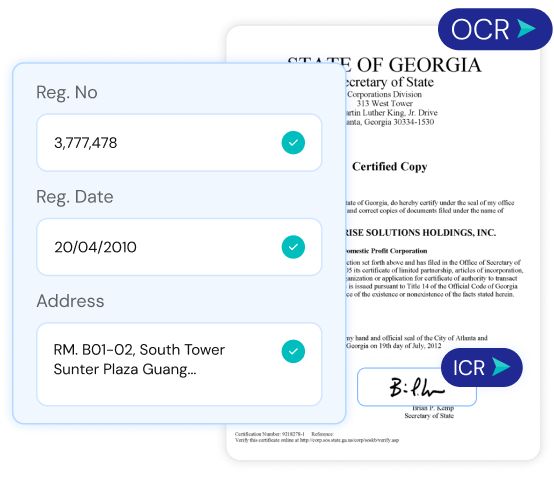

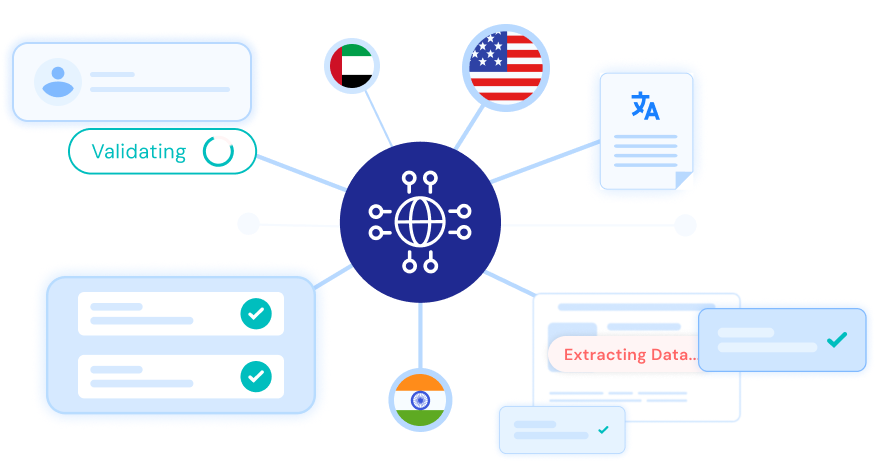

Verify every business confidently

50+

Countries

Get coverage across high-risk jurisdictions for the most comprehensive protection.

99%

Accuracy

Focus on real risks with reduced false positives and unmatched precision.

25%

Reduced Operational Costs

Make faster decisions and save on resources by automating manual processes.

Purpose-built for complex security management

The single source of truth for your compliance teams

Stay compliant and confident without the manual reporting and busywork.

Build a unified compliance and monitoring framework

Juggling fragmented tools and processes is not just exhausting—it creates blind spots and risks. With Signzy, you get AML screening, transaction monitoring, and fraud prevention, all in one platform. Real-time visibility means you stay in control, so compliance is one less thing keeping you up at night.

Protect your business without drowning in false positives

Endless alarms shouldn’t be the cost of staying compliant. Our AI-powered risk scoring cuts through the noise—filtering out false positives while flagging real threats that need your attention. Save time, reduce costs, and protect your business for real.

Simplify your regulatory reporting & audit challenges

Manual compliance tasks drain your time, and your team. With Signzy, you automate everything from STR filings to complex regulatory reports, keeping you audit-ready without the scramble. Built to align with FIU, RBI, and global regulations, so you’re always a step ahead

Expand fearlessly while we minimize risk in the background

Seamlessly manage compliance, risk, and audit in a single GRC platform

Comprehensive Transaction Monitoring

Keep a constant watch on transactions with real-time monitoring that adapts to new fraud patterns, keeping your financial ecosystem secure.

AML Screening, Periodic Monitoring, and NDD checks

Screen users before and after onboarding using Sanctions lists, PEP databases, and NDD APIs to verify IPs, emails, and locations—so you always know who you’re dealing with.

Chargeback inimization

Take control of chargebacks with smart analytics that uncover fraud patterns and help you stop disputes before they happen.

Compliance Management System

Streamline policy tracking, procedure management, and certification oversight—giving you a clear, real-time view of your compliance status

Third-Party & Vendor Risk Management Platform

Assess, monitor, and reduce vendor risks in real time. Ensure third-party compliance with automated due diligence and continuous risk tracking.

Digital Internal Audit & VAPT Compliance Management

Simplify security audits with automated vulnerability assessments and penetration testing compliance—keeping your systems safe and audit-ready.

Automated FIU-IND Reporting & Data Privacy Compliance

Streamline FIU-IND reporting and stay on top of evolving data privacy regulations with automated compliance tools.

Cybersecurity Compliance & Incident Management Portal

Detect, manage, and respond to security incidents before they escalate. Keep your business resilient with centralized cybersecurity compliance tracking.

ESG & Climate Risk Compliance Tool

Navigate ESG regulations effortlessly. Track climate risks, sustainability metrics, and regulatory requirements with a single, easy-to-use platform.

A foolproof security stack that fits in your workflow

Discover end-to-end risk management functionalities that turn chaos into clarity

Batch Mode

Accelerate compliance workflows with Batch Mode, designed to process large transaction volumes efficiently and accurately. Perfect for growing organizations, it ensures faster processing and seamless scalability to handle increasing demands.

Case Manager

Screen users before and after onboarding using Sanctions lists, PEP databases, and NDD APIs to verify IPs, emails, and locations—so you always know who you’re dealing with.

AI-Based Reviewer

Take control of chargebacks with smart analytics that uncover fraud patterns and help you stop disputes before they happen.

Reporting

Streamline policy tracking, procedure management, and certification oversight—giving you a clear, real-time view of your compliance status

Compliance should fuel your growth at every step of the way

Strengthen your business with tailor-made transaction monitoring for regulatory compliance and risk assessment

Payments & Remittances

Credit & Debit Card Transactions

Crypto Exchanges & Virtual Assets

Banking & NBFC Lending

Insurance Claims Processing

Stock & Securities Trading

E-commerce & Marketplace Transactions

Corporate & Treasury Transactions

Buy Now, Pay Later (BNPL) & Fintech Lending

Gaming & Gambling Platforms

Solving real problems in every sector

We power compliance for leaders in every sector. Wherever you operate, we’ve got you covered!

Fintech

Ecom

Banks

Payment Gateways

Cards

ATM

Net Banking

BNPL

UPI

DMT

AEPS

POS

Get audit-ready in a few quick steps

01

Initial Consultation

Assess specific need and tailor solution

02

System Integration

Seamless incorporation into existing infrastructure

03

Staff Training

Comprehensive onboarding for team members.

04

Go-Live and Support

Launch with ongoing onboarding assistance.

Go Live!

Regulations keep changing, but keeping up shouldn’t feel like a losing game. Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks

Related Blogs

FAQ

What is an Employer Identification Number (EIN)?

GST (Goods and Services Tax): A 5% federal tax applied across all provinces and territories in Canada.

HST (Harmonized Sales Tax): A combined federal and provincial tax used in provinces like Ontario (13%), Nova Scotia (15%), and New Brunswick (15%). It replaces separate GST and provincial sales tax.

PST (Provincial Sales Tax): A separate provincial tax collected alongside GST in provinces like British Columbia, Saskatchewan, and Manitoba that don't use HST.

How is GST verification different from general business verification in Canada?

An Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses, non-profits, and other entities for tax identification purposes in the United States. It functions similarly to a social security number but is used for organizations and businesses.

- Opening a business bank account

- Hiring employees

- Filing tax returns

- Conducting certain financial transactions

How can I obtain an EIN?

You can apply for an EIN through the IRS using one of the following methods:

- Online: Instant issuance of the EIN.

- By Mail: Application forms can be mailed to the IRS.

- By Fax: Fax your application to the IRS.

What is the EIN Verification API?

The EIN Verification API is a tool designed to verify the validity and accuracy of Employer Identification Numbers (EINs). It checks EINs against official records to ensure that businesses and organizations are properly identified for tax-related purposes.

How can the EIN Verification API be useful?

The EIN Verification API enhances data accuracy and compliance across various applications:

- Tax Filing and Reporting: Validates EINs on tax documents to prevent errors.

- Business Verification: Helps banks and financial institutions verify the legitimacy of businesses.

- Vendor Onboarding: Ensures the authenticity of vendors before onboarding.

- Employee Background Checks: Confirms the accuracy of EINs provided by potential employees.

- E-commerce and Payment Processing: Verifies business legitimacy for online transactions.

- Contract Management: Validates EINs in legal agreements to reduce disputes.

- Government Services: Supports business registrations, permits, and grants.

- Insurance: Verifies policyholders and beneficiaries for coverage.

- Real Estate Transactions: Confirms ownership and legal status of commercial property owners.

- Compliance and Reporting: Ensures adherence to industry regulations.

- Data Enrichment: Enhances customer and vendor databases with accurate information.

- Fraud Prevention: Helps detect and prevent identity theft and fraud.

How does the EIN Verification API ensure accuracy and reliability?

The API verifies EINs against official records maintained by the IRS and other relevant databases, ensuring that the information is accurate and up-to-date.

![FINRA Rule 2090: Know Your Customer Requirements [2026 Guide]](https://cdn.sanity.io/images/blrzl70g/production/ed4b5a8ceb78cf2f2d98312cecca21829dd5a6f5-1354x318.webp)