Credit Risk Assessment API

Assess and monitor risk throughout the user journey

Build a holistic risk profile for your users with customizable risk levels based on your business needs. Simplify your credit and risk assessment process by analyzing cashflow data, credit reports, risk patterns, and more.

Trusted by industry leaders

Build trust in every transaction

Discover powerful risk workflows and risk insights customized to your business needs

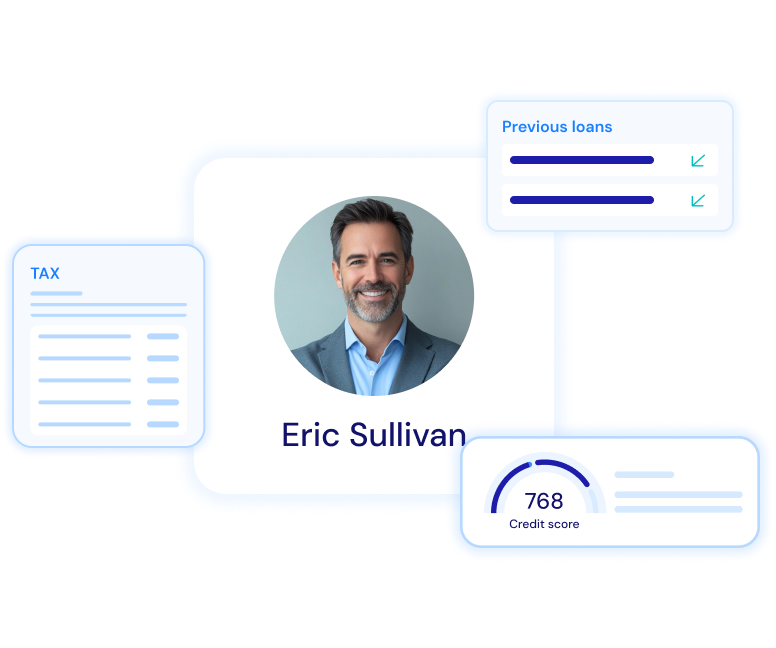

Make confident decisions with credit reports

This is your one place to build the complete risk picture of the user. Get access to comprehensive credit reports containing vital data obtained from credit grantors, public records, employers, collection agencies, etc.

Simplify your merchant underwriting process

With business principal reports you get a holistic idea of the key stakeholders of a business, the ownership structure, payment history, collection record history, and overall risk profile of the business.

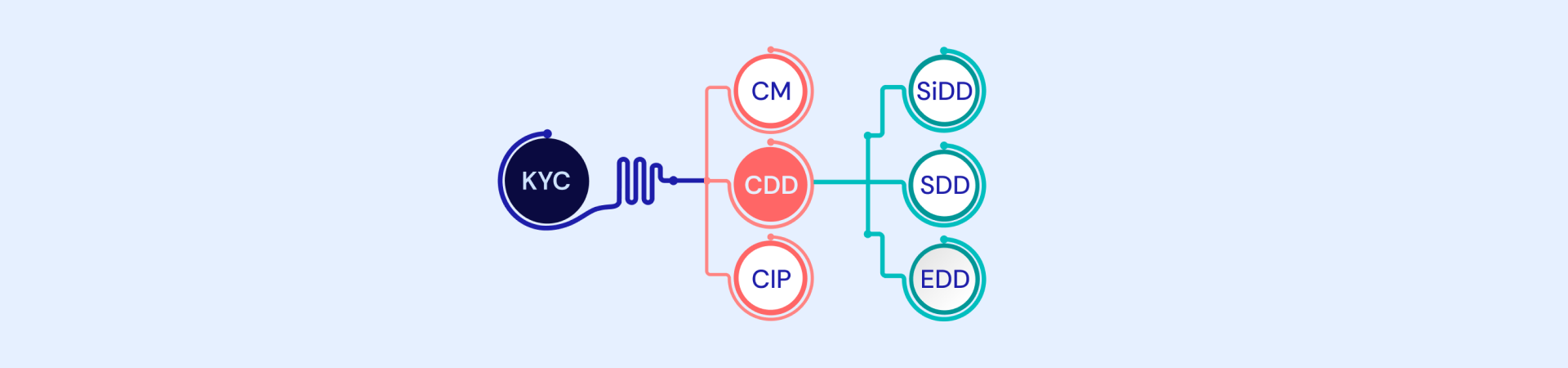

Fight fraud before, during, and after you onboard

Stay secure and AML-compliant at all times with verification, validation, and transaction monitoring APIs. Strengthen your routine KYC and KYB processes while we ensure you associate with a fraudster.

Build a complete consumer risk story

Credit reports or bank statements don’t give the entire picture. Signzy helps you build comprehensive risk profiles for foolproof assessment and monitoring

Database Checks

Personal Details Verification

Credit Report

FICO Score

Bank Statement Analysis

Where can you use Signzy’s Risk Assessment API?

We help you ensure businesses or individuals are not linked to money laundering or high-risk jurisdictions

Minimize risk and stay one step ahead of fraud

Explore plug-and-play solutions for 360° credit and risk mitigation for your business

Identity Verification

Onboard users with confidence with Signzy’s foolproof KYC system. ID checks, biometric verification, criminal screening, all work together to build dynamic user risk profiles.

Business Verification (KYB)

Automate your approach to verify UBOs, documents, and bank accounts effectively, preventing fraud while being compliant with global KYB requirements.

Bank Statement Analysis

Get in-depth financial insights by extracting and analyzing over 500 data points from bank statements including income sources, expenditure patterns, EMI obligations, investments, and more.

Bank Account Verification

Access instant bank account verification for seamless transactions and consent-based verification for enhanced security and compliance.

Developers love us for a reason!

Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks :)

Related Blogs

FAQ

What is the Risk Assessment API?

Signzy's Risk Assessment API enables businesses to evaluate the financial health, creditworthiness, and risk profile of companies in real time using reliable data sources, AI models, and scoring frameworks.

Why is risk assessment important?

The API helps businesses:

- Identify high-risk customers, vendors, or partners

- Prevent defaults, fraud, and credit losses

- Strengthen underwriting, lending, and investment decisions

- Comply with regulatory risk management requirements

What industries benefit from this API?

Industries that benefit from this API include:

- Banks & NBFCs: Credit underwriting and risk monitoring

- FinTechs & Lending platforms: SME risk scoring and automated loan approvals

- Supply Chain & Procurement: Vendor risk assessment and contract vetting

- Investment Platforms & Funds: Portfolio monitoring and risk mitigation

How is the risk score calculated?

Signzy combines financial data, behavioral patterns, public records, and proprietary models to generate risk scores, PD metrics, and risk flags—tailored to each business's profile.

Can the API assess international businesses?

Yes, the API covers global companies across multiple jurisdictions, using international financial data sources and credit bureau integrations.

How often is the data updated?

Risk assessments are based on real-time data pulls and updated regularly to reflect the latest financial performance, legal filings, and market signals.

Can the Risk Assessment API integrate with our systems?

Yes, the API is designed for seamless integration into core banking systems, lending engines, CRMs, and decision-making workflows.

Does Signzy support ongoing risk monitoring?

Yes, Signzy enables continuous monitoring and auto-alerts if a business's risk profile changes, helping clients stay proactive.

How does Signzy ensure data security?

The API uses end-to-end encryption, secure APIs, and complies with global data protection laws to ensure the confidentiality and integrity of sensitive data.