Financial Services

Online Identity Verification for Financial Services

Cut down the time and cost to open customer accounts, add up layers of security with proper AML and KYC compliance, streamline the most seamless onboarding experience for your users.

100M+

Users Verified

2x

Fraud Detection

<5s

Response Time

Trusted by industry leaders

Drive high impact growth at low costs

Stay one step ahead of deepfake threats with real-time detection

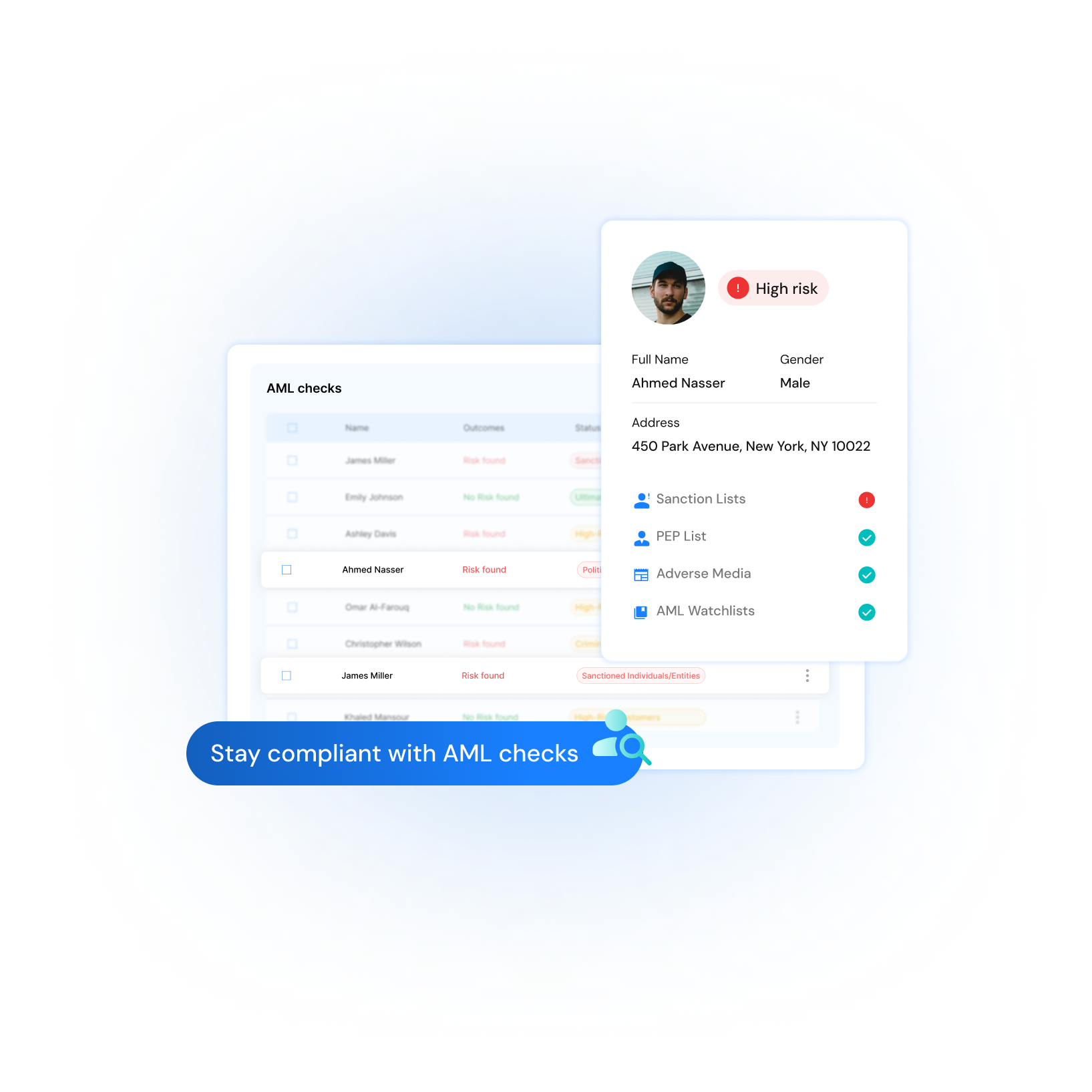

Optimize the AML screening process

Conduct essential AML checks and ongoing monitoring against politically exposed persons (PEPs), sanctions and adverse media watchlists.

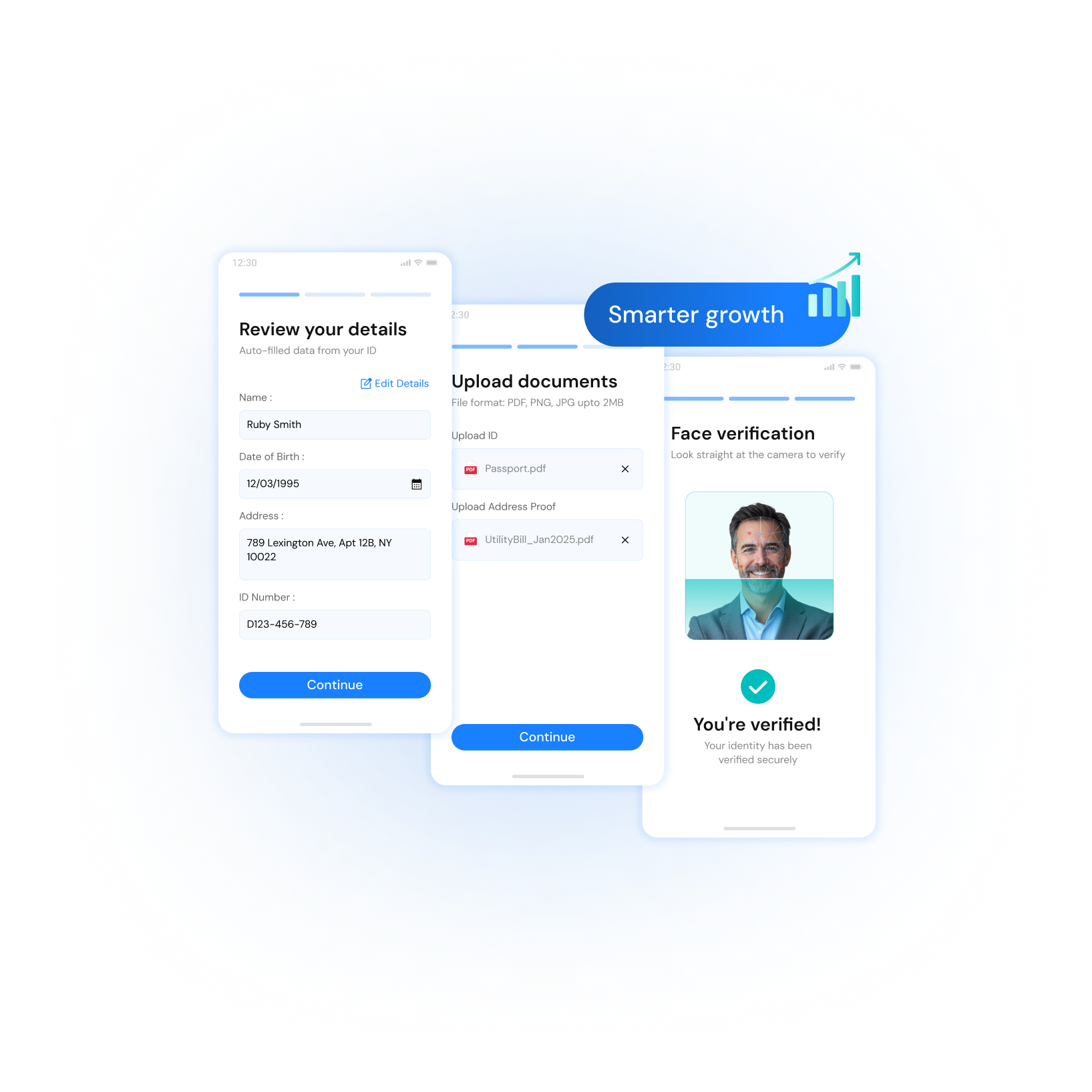

Identify and detect fraudsters promptly

From document verification to liveness check, enforce a complete identity verification process to flag any suspicious activity.

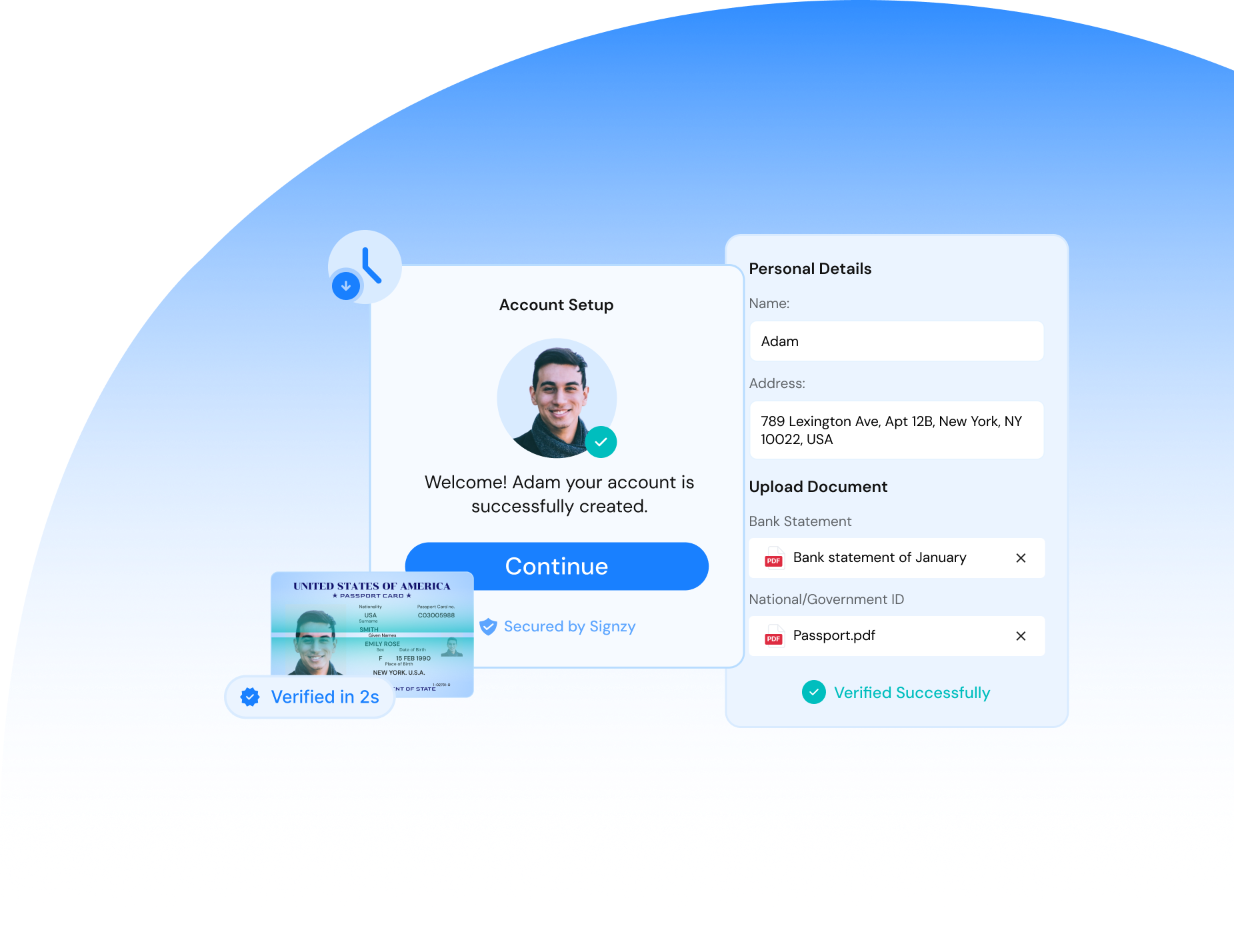

Eliminate manual efforts in onboarding journeys

Expedite your business growth with increased account opening conversions at reduced time and resources.

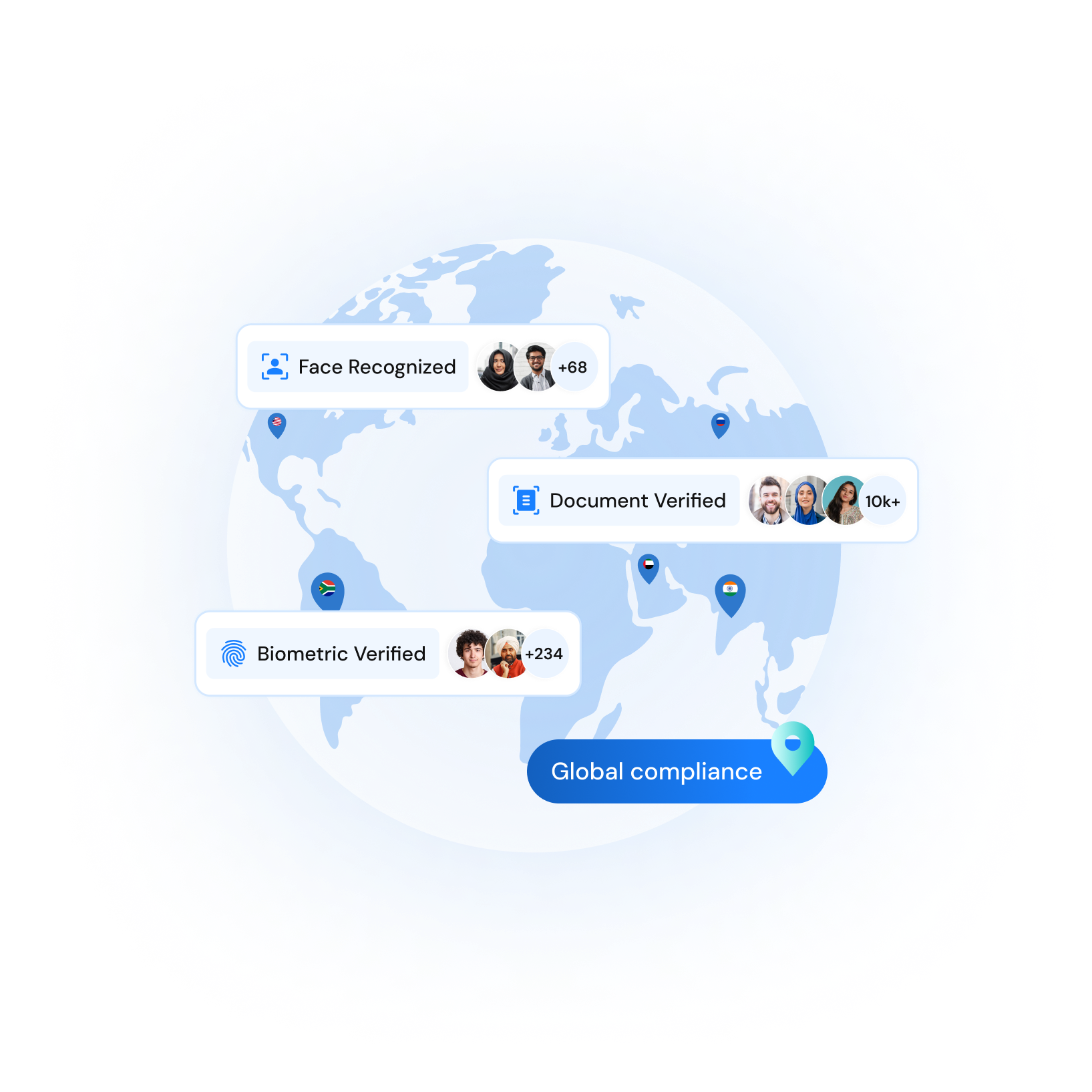

Simplify and secure KYC at scale

Deploy a full-stack KYC solution that adapts to regulatory needs across regions, offering biometric, document, and data-layer verification through 340+ APIs.

Our Innovations

Smarter KYC, AML, and fraud prevention in financial services

One Touch KYC

AI-Powered Digital Identity Verification forGlobal Financial Institutions

Streamline KYC verification across 180+ countries with a single product. One Touch KYC detects deepfakes, validates IDs in real-time, and ensures compliance with global data privacy regulations, making it the fastest and most secure way to verify users in banking and fintech.

Transaction Monitoring

Real-Time AML Compliance and Suspicious Activity Detection

Monitor millions of transactions daily with Signzy’s intelligent rule engine. Our platform flags high-risk behaviors, supports SAR filing, and adapts to changing fraud patterns - empowering banks and NBFCs to stay ahead of financial crime.

MuleShield

Detect and Prevent Money Mule Accounts Before They Do Damage

Stop fraud at the source. MuleShield identifies mule accounts using behavioral biometrics, transaction velocity, and network analysis, helping financial institutions block suspicious activity before it escalates into large-scale fraud.

No Code Platform

Build Custom Onboarding and Compliance Workflows—No Code Required

Launch KYC, KYB, and fraud workflows in days, not months. Signzy’s drag-and-drop platform lets banks and fintechs design, test, and deploy complex compliance journeys without writing a single line of code.

Signzy’s KYC suite

Complete digital KYC infrastructure for regulated financial services.

Biometric Verification

Liveness Detection and Face Matching for Seamless Identity Verification

Authenticate users with advanced face biometrics and passive liveness checks. Prevent deepfake fraud and spoofing while ensuring a frictionless onboarding experience.

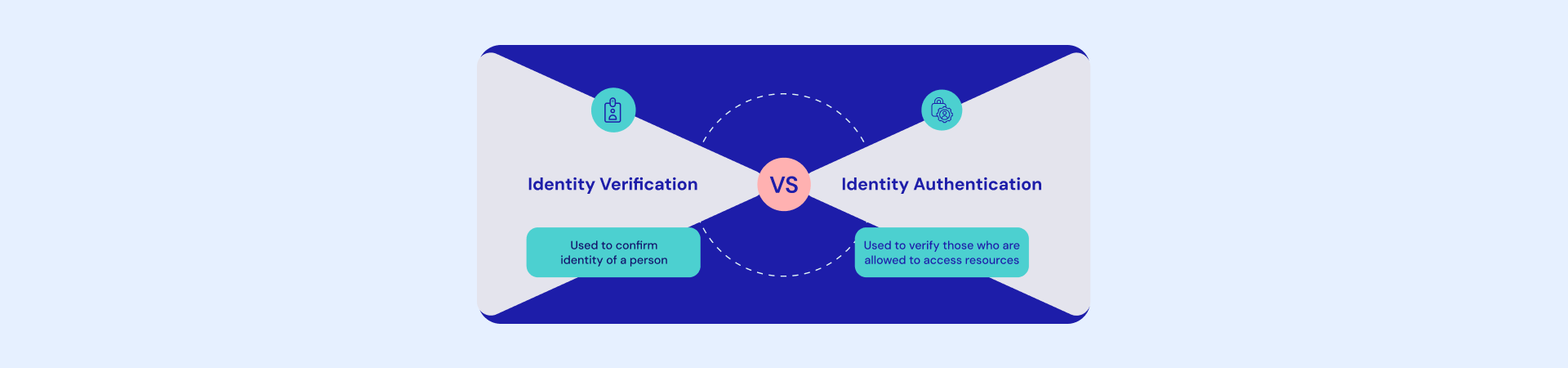

Identity Verification

AI-Powered OCR and Fraud Detection for Global ID Documents

Instantly extract and verify data from 14,000+ documents across 180+ countries. Identify tampered or fake documents with high-accuracy models trained for financial service industry use cases.

Data Validation

Cross-Check User Data Against Government and Credit Databases

Validate government IDs with real-time checks. Ensure data integrity and reduce onboarding friction by catching typos, mismatches, and fraudulent inputs.

Bank Account Verification

Instantly Verify Bank Account Ownership and Activity

Launch KYC, KYB, and fraud workflows in days, not months. Signzy’s drag-and-drop platform lets banks and fintechs design, test, and deploy complex compliance journeys without writing a single line of code.

Built to be quick and keep pace

Integrate the platform during lunch hour, customize based on your needs, and go live within 2-4 weeks :)

Related Blogs

FAQ

How does Signzy help financial institutions streamline digital onboarding?

Signzy automates KYC, KYB, and AML checks across retail, SME, and high-net-worth customer segments. Our AI-powered platform reduces manual work and onboarding time—while ensuring compliance with global standards.

Can Signzy reduce onboarding drop-offs in investment or lending journeys?

Yes. By offering low-friction biometric KYC, smart OCR, and real-time validation, Signzy helps improve conversion in journeys like loan applications, insurance signups, and wealth account creation.

Is Signzy's platform compliant with regulators in India and abroad?

Absolutely. We support compliance with RBI, SEBI, IRDAI, FATF, FinCEN, and regional privacy laws like DPDP, GDPR, and CCPA—making us suitable for financial services with local and global footprints.

Can we tailor KYC/AML workflows for different financial products?

Yes. Our no-code platform lets compliance and product teams design onboarding flows for credit cards, insurance, fixed deposits, mutual funds, and more—without developer support.

What fraud detection tools are available for BFSI clients?

We offer liveness checks, face match, document forgery detection, mule detection, and transaction monitoring to flag high-risk behaviors at onboarding and post-onboarding stages.