Global Expansion

The world is your playground

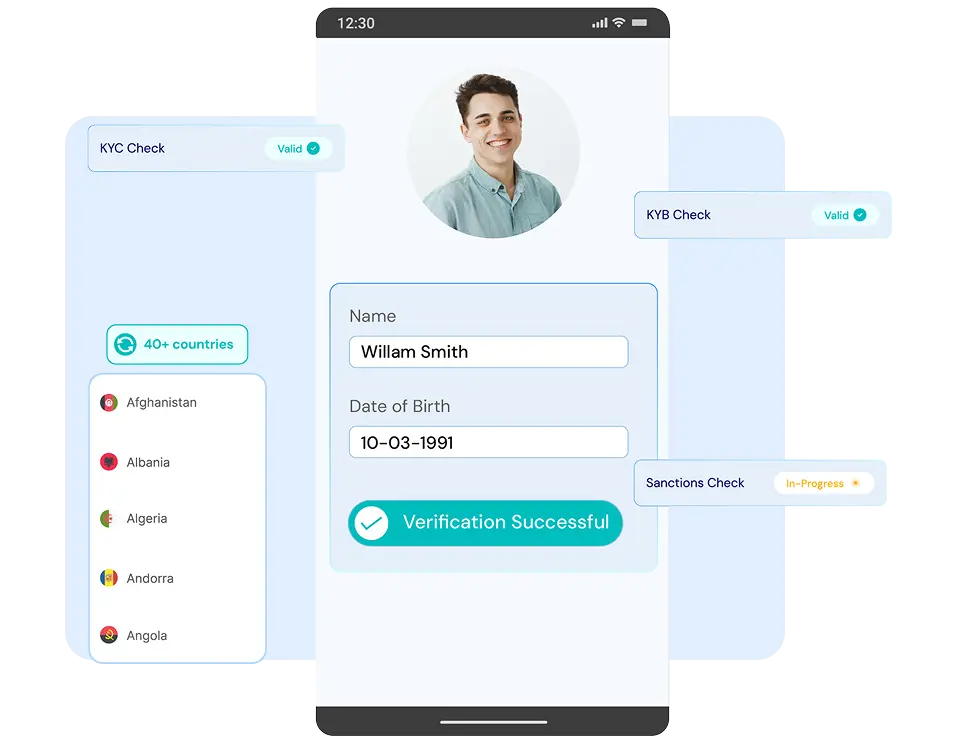

Launching in a new country should feel exciting - not like regulatory roulette. Signzy gives you modular KYC, KYB, and AML workflows that adapt to local laws, detect fraud in real-time, and onboard users with speed. No matter the market, your risk and compliance stack stays future-proof.

100M+

Users Verified

50+

Languages Supported

180+

Countries

Trusted by industry leaders

Compliance that doesn’t kill growth

From EU’s AMLD6 to India’s PMLA, we help you stay ahead of fast-changing compliance regulations.

KYC, KYB, and AML in 5 continents in a single platform

Signzy offers a truly global identity infrastructure. We plug into national registries, telecom databases, passport systems, and document issuers - all through a unified orchestration layer.

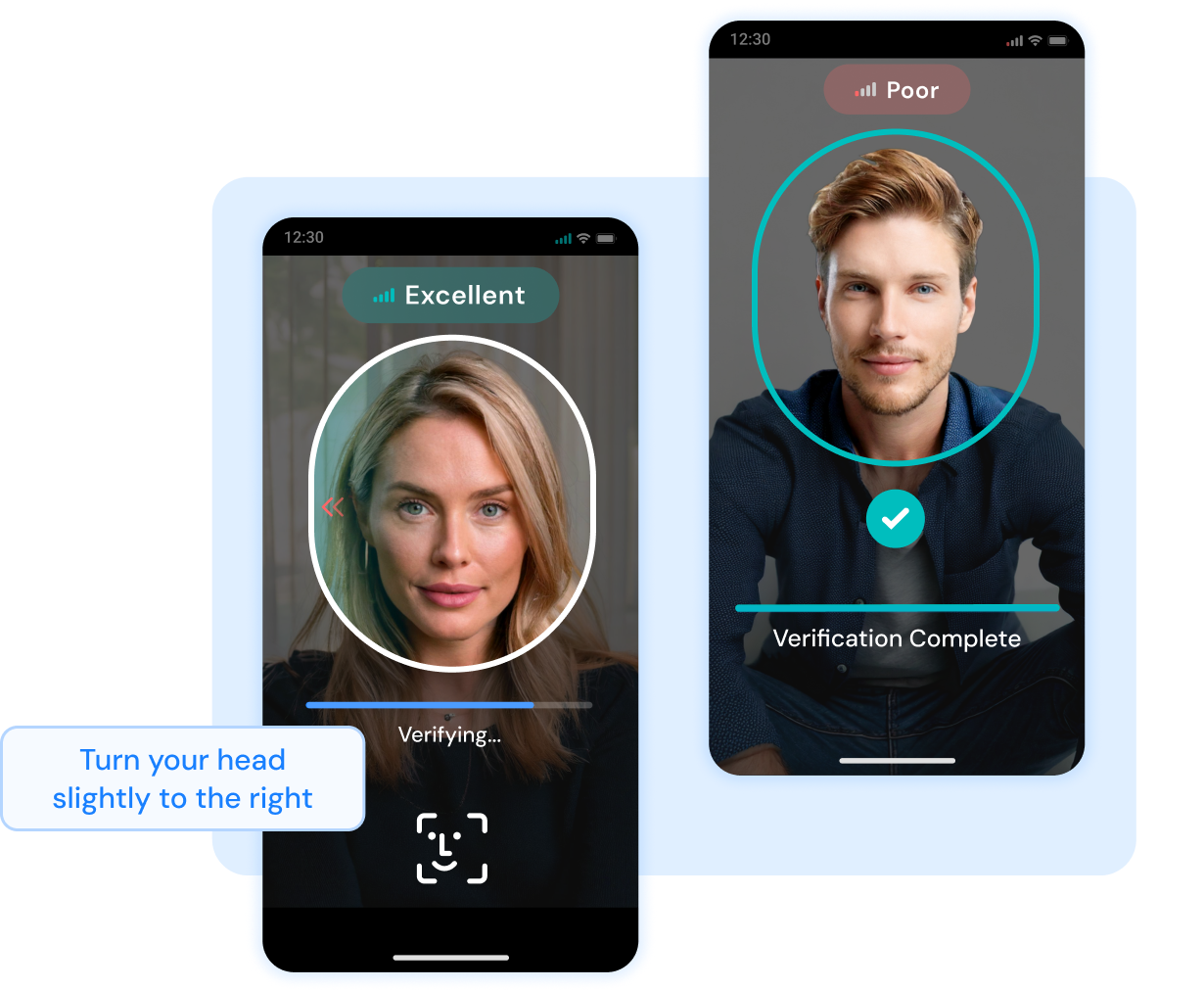

Fraud detection for cross-border onboarding

Global expansion means new risks - fake passports in LatAm, shell companies in UAE, synthetic identities in Southeast Asia. Signzy’s fraud stack isn’t just reactive: it’s built to anticipate.

The truly global compliance stack for all use cases

Our AML screening modules, KYC/KYB workflows, and sanctions checks are continuously updated across 40+ countries - and easily configurable through APIs or dashboard.

Fraud travels. So should your defenses

Screen identities, detect deepfakes, and block bad actors - globally, and in real time.

Real-time PEP + Sanctions monitoring

Verify national IDs, passports, DLs across 100+ formats

Verify national IDs, passports, DLs across 100+ formats

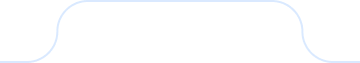

Face match, liveness check, and deepfake detection in 11+ languages

Global by Design

We’re compliant with FATF, FINTRAC, SEBI, RBI, MAS, GDPR, PDPA, and more.

Get the complete Identity Stack

Scale fearlessly with fraud detection that adapts to new geographies, documents, and risk.

Global KYC

Simplify the Know Your Customer (KYC) process with AI-driven fraud detection, biometric checks, database screening, and more.

Global KYB

Validate government issued IDs and documents through Optical Character Recognition (OCR) software, and reduce risk of human errors during the verification process.

AML and Ongoing Monitoring

Screen users against global watchlists while onboarding, or monitor behaviour to never let a suspicious transaction or user slip by.

Deepfake Detection

Leverage AI and machine learning-driven systems to keep deepfake fraud at bay. Get real-time data on impersonators while providing a friction-less onboarding process to your real users.

Developers love us for a reason!

Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks!

![10 Best KYC Software Providers of 2026 [US Guide]](https://cdn.sanity.io/images/blrzl70g/production/008b1ea8636a5a1febcd10331269d51c5c29090e-3985x933.jpg)