Customer Stories

How ASAPP Banking optimized Onboarding for Credit Unions with Smart, Scalable Compliance

While many fintech companies chase headlines with flashy features, ASAPP has quietly spent years perfecting the art of making credit unions genuinely competitive in the digital age.

ASAPP's goal

Simplifying digital onboarding while upgrading to enterprise-grade security

<2%

False positive rate for fraud detection

>70%

Straight-through onboardings

<60s

Average verification time

33%

Decrease in drop-offs

The ASAPP story

ASAPP is the digital banking platform that helps credit unions act with fintech-level speed. It brings onboarding, lending, and member engagement into one smooth workflow so teams can focus on people, not processes.

Serving hundreds of financial institutions across North America, ASAPP understands that behind every technological advancement is a real credit union trying to serve real people better. Their platform doesn’t just offer digital tools – it protects the personal, member-first approach that defines credit unions, while enabling experiences that rival those of the largest financial institutions.

When it came to member onboarding, ASAPP saw an opportunity to raise the bar once again.

Today’s credit union members want speed, without losing trust or security

Users today live in a world of instant everything. They expect to order dinner, book travel, and manage investments with the same effortless simplicity. ASAPP's clients recognized this shift and wanted to meet their members where they were.

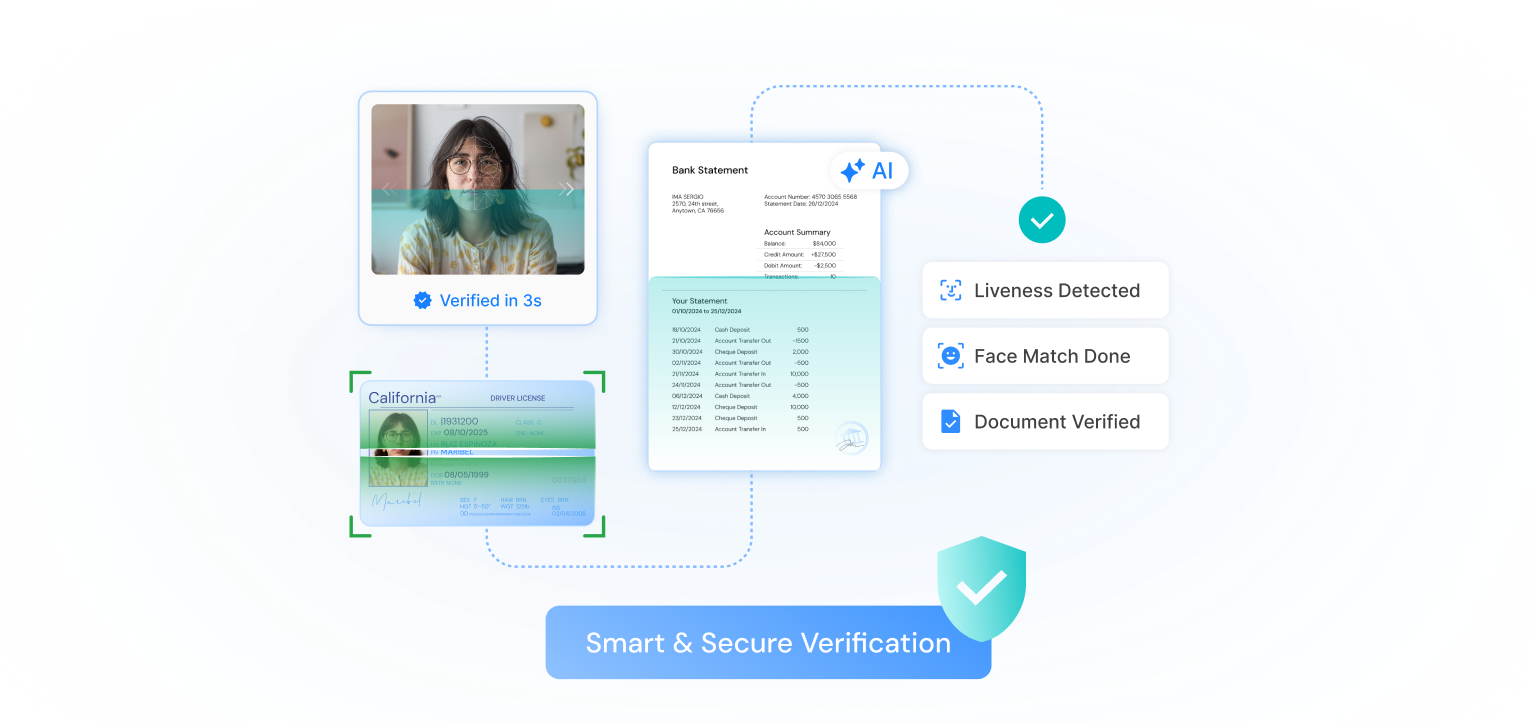

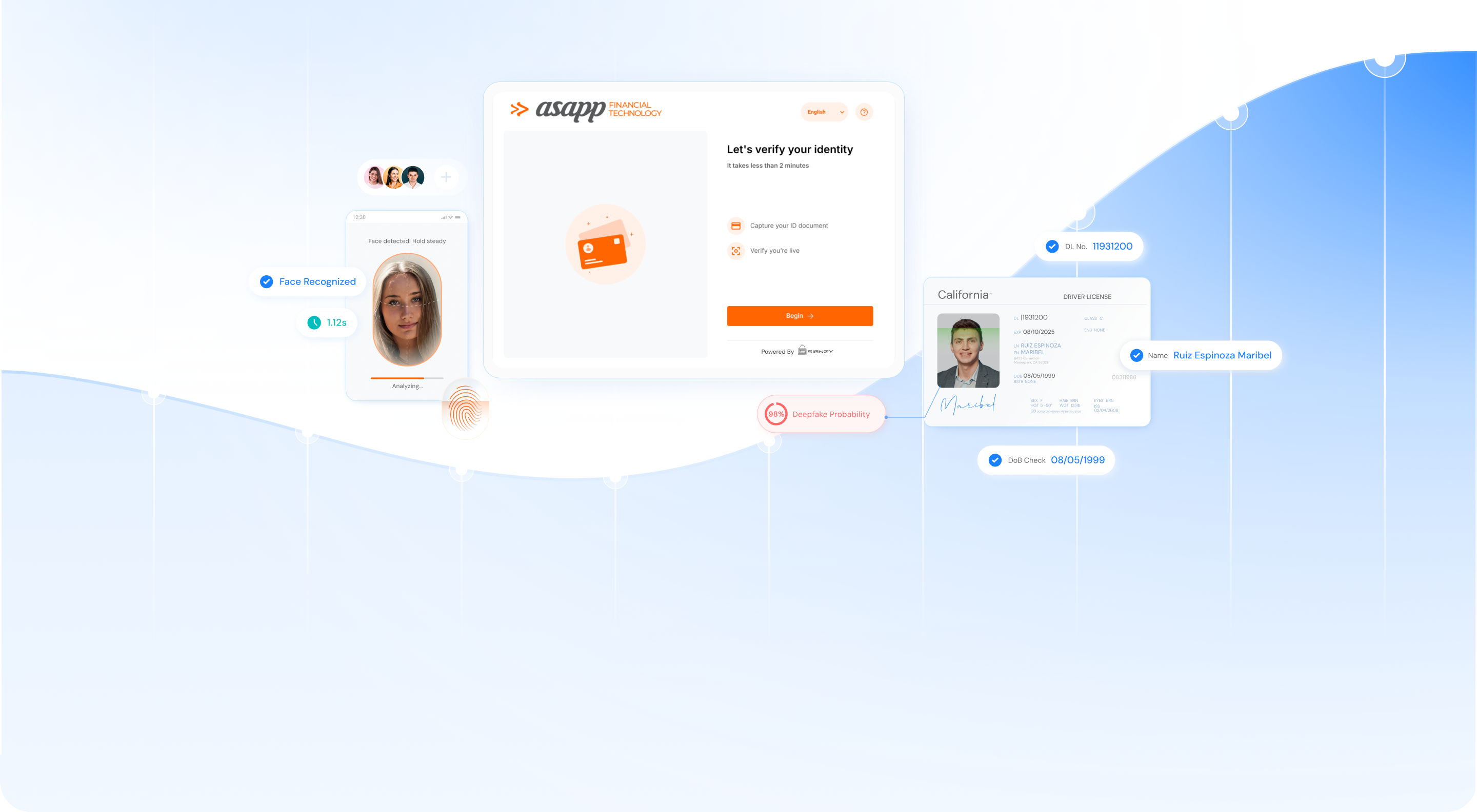

The challenge wasn't just technical. These institutions needed to balance member convenience with the rigorous security and compliance standards that protect their communities. Add in the complexity of Canadian data residency requirements and emerging fraud threats like deepfakes, and the path forward required both innovation and expertise.

Why ASAPP chose Signzy for smarter, faster KYC

ASAPP's decision to integrate Signzy's One Touch KYC into their Version 20 platform reflected their commitment to thoughtful innovation. They decided to move from a legacy provider to a faster, smarter solution built for modern banking needs.

The integration brought together ASAPP's deep understanding of member-first experiences with Signzy's specialized expertise in identity verification:

The transformation was immediate and measurable. Members who previously faced frustrating verification processes now sailed through onboarding in minutes. Credit unions could offer the instant verification that members expected without compromising on security or compliance.

For ASAPP's clients, this meant more than operational efficiency – it meant keeping pace with member expectations while staying true to their community-focused values.

Working with Signzy has been a game-changer. Their team isn’t just responsive, they’re deeply invested in helping us solve real onboarding and compliance challenges. The flexibility of their product, the speed of execution, and their commitment to partnership have set a new bar for us.

-Steve Sauve, CPO, ASAPP Financial Technology

Giving credit unions the flexibility they’ve always needed

One of ASAPP's greatest strengths is understanding that credit unions need control over their own destiny. The Signzy integration reflected this philosophy perfectly, giving institutions the power to customize onboarding flows in real-time without technical bottlenecks.

A credit union launching a new youth savings program could have custom verification workflows live within hours, not weeks. Risk teams could adjust parameters based on emerging threats without waiting for software releases. This agility transformed how financial institutions could respond to opportunities and serve their members better.

With Signzy, institutions can now:

This agility is transforming how credit unions could react to new opportunities and build better services for their communities.

Where ASAPP’s mission truly came to life

What sets ASAPP apart is their unwavering focus on financial inclusion and accessibility. They're not just building software – they're democratizing sophisticated banking technology for institutions that might otherwise be left behind in the digital transformation.

Their global vision extends far beyond North America, working toensure that community-focused financial institutions worldwide can offer experiences that rival the largest banks while maintaining the personal relationships that define community banking.

With Signzy's verification technology seamlessly woven into their platform, ASAPP continues advancing this mission, proving that cutting-edge technology and community values aren't just compatible – they're powerful together.

Raising the bar for seamless member onboarding

In an industry often dominated by impersonal mega-banks, ASAPP proves that technology can amplify rather than replace the human elements that make member-first banking special. Their partnership with Signzy demonstrates that when thoughtful companies work together, the result is innovation that serves people, not just profits.

That's the kind of fintech partnership that builds trust, one successful onboarding at a time.

The global API marketplace for KYC, KYB, & AML

Explore the end-to-end verification stack trust by 1,000 businesses.

Get in touch

![11 Best KYB verification solutions in Canada, Ranked [2026 Guide]](https://cdn.sanity.io/images/blrzl70g/production/dc490f248b28a2ab2773faa7b712a01640036226-5641x1325.webp)