Conduct Bank Account verification in UAE: How To + Alternative Methods

- All UAE free zone authorities maintain their own business verification databases, making cross-verification more streamlined than in many other markets.

- The UAE Central Bank allows banks to issue digitally stamped verification letters, eliminating the need for physical branch visits.

- To automate, businesses expanding in the UAE can use Signzy to validate accounts across all local and international banks operating in the country within minutes.

Forget about banks for a second. Imagine you're about to buy a used car from someone. They say it's in perfect shape, low mileage, and has one previous owner. Sounds ideal, right?

But anyone who’s done this before knows you don’t just take their word for it.

You look up the car’s history, you run the VIN, and you get it checked out by a mechanic if you can. Not because you’re expecting anything to be wrong, just because you’re smart about covering your bases.

Verifying a business bank account in the UAE is like doing that background check on the car.

It’s not about doubting someone’s word. You’re just doing the practical steps to make sure what you’re dealing with is exactly what you think it is. And once you’ve ticked those boxes, you can feel confident you’re on solid ground.

This guide covers all the methods you can use to verify bank account ownership with confidence. Before anything, here's a quick definition of bank account verification to ensure we are on the same page.

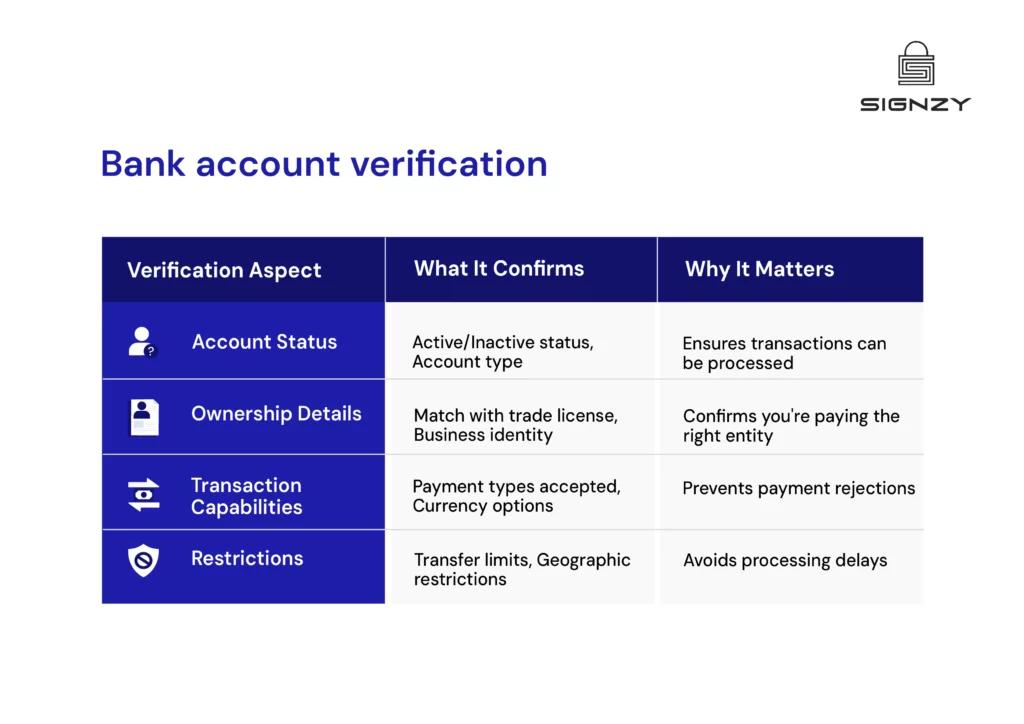

What is bank account verification in the UAE? Quick overview

Bank account verification is a check that validates account ownership and status before processing payments. In the UAE, this involves matching the provided account details, number, IBAN, and holder name with actual banking records. The practice helps businesses avoid costly transfer mistakes and identify fraud issues before they occur.

How to verify bank accounts in the UAE? Methods explored

There are four main methods to verify bank accounts in the UAE as of 2026. Each method has its own way of working, and understanding these mechanics helps choose what works best for specific business needs.

Here’s how each method works in practice:

| Feature | Micro-Deposit Verification | Document-Based Verification | IBAN Format Validation | Instant Account Verification (IAV) |

|---|---|---|---|---|

| Confirms Account Exists | ✅ | ✅ | ❌ | ✅ |

| Confirms Account Ownership | ✅ | ✅ | ❌ | ✅ |

| Automation Capability | ❌ | ❌ | ✅ | ✅ |

| Scalability for High Volume | ❌ | ❌ | ✅ | ✅ |

| Fraud Prevention | ✅ | ❌ | ❌ | ✅ |

| Name Matching Capability | ❌ | ✅ | ❌ | ✅ |

1. Micro-deposit verification

Micro-deposit verification confirms account ownership and operational status by sending small test amounts, typically AED 1 to AED 5, to the account being verified. The account holder must then report back the exact amounts received or provide specific reference codes attached to the transfers, proving they control the account and can access its transaction details.

Here's an example scenario of verifying your supplier's account:

- You send AED 1 to the supplier's account

- The transfer includes a unique reference code: "VER12345"

- Your supplier receives the amount within one to two business days

- They email you the exact amount received (AED 1) and the reference code "VER12345"

- You confirm these details match your records

- Verification complete

The verification provides certainty on two points. First, the account exists and can receive funds through the UAE banking system. Second, the person or business claiming ownership actually controls the account and can monitor its activity.

This dual confirmation makes micro-deposits particularly reliable for establishing new vendor relationships where no prior payment history exists.

Some businesses send two separate micro-deposits of different random amounts rather than one transfer with a reference code. This adds extra verification because the recipient must correctly identify both amounts. The amounts are usually reclaimed or offset against future payments once verification is complete.

2. Document-based verification

Verifying bank-issued documents remains one of the most common verification methods in UAE business practice. Banks provide official letters or statements that confirm account details, account holder identity, and account status. These documents include security features such as watermarks, official bank stamps, and authorized signatures that establish authenticity.

UAE banks have modernized this process significantly. Most major banks now offer digitally stamped verification letters through their online banking portals. Account holders can download these documents instantly while maintaining the same authenticity level as physical documents.

Digital versions typically include unique reference numbers that can be verified through the bank's official channels, providing an additional security against document forgery.

3. IBAN format validation

The International Bank Account Number system, mandatory in the UAE since 2011, provides a structural verification layer. UAE IBANs follow a specific 23-character format beginning with the country code (AE), followed by two check digits, a three-digit bank identifier, and a 16-digit account number. The format uses the MOD 97 algorithm specified in the ISO 13616 standards for mathematical validation.

IBAN validation confirms the account number structure is correct and the check digits match the mathematical formula. This verification catches typographical errors and formatting mistakes before attempting transfers.

Manual verification can be done through online IBAN checker tools or bank websites. However, IBAN validation only confirms structural accuracy, not whether the account actually exists or who owns it. The method works best as a preliminary check combined with other verification approaches.

4. Instant Account Verification (IAV)

Instant Account Verification represents the most advanced verification method available in the UAE market. IAV platforms connect directly with banking systems through secure APIs to validate account information in real time, providing verification results within seconds rather than days.

The verification process follows these steps:

- Business enters account details (account number, IBAN, account holder name) into the IAV platform

- The platform establishes a secure connection with the relevant bank's system through API integration

- System checks multiple data points simultaneously, including account existence, active status, and ownership details

- Platform confirms whether the provided account holder name matches the bank records

- The verification result is returned instantly with a pass or fail status

- A complete audit trail is automatically logged for compliance and record-keeping purposes

IAV solutions like Signzy can verify accounts across multiple UAE banks and international banks with established data-sharing agreements. However, coverage depends on which banks the IAV provider has integrated with, and some smaller regional institutions may fall outside the verification network.

💡 Related Blog:

Is bank account verification mandatory in the UAE?

Bank account verification is not explicitly mandatory under UAE law for most business-to-business transactions. The Central Bank of the UAE and other regulatory authorities do not require companies to verify every bank account before processing payments. However, this absence of direct mandate does not mean verification is optional from a practical standpoint.

The UAE's Anti-Money Laundering and Counter-Terrorism Financing framework, established under Federal Decree-Law No. 20 of 2018, requires businesses to conduct customer due diligence and implement risk-based controls. While these regulations do not specifically mandate bank account verification, they create compliance obligations that verification helps satisfy.

Financial institutions, real estate companies, precious metals dealers, and other designated businesses must verify customer identities and monitor transactions for suspicious activity. Account verification serves as a practical tool for meeting these broader due diligence requirements.

Below's a detailed discussion on why businesses should care about bank account verification in the UAE, even when it's not mandatory

Why is bank account verification important in the UAE?

Bank account verification addresses multiple business needs simultaneously.

↪ Reduces exposure to fraud schemes

The UAE Central Bank imposed a record fine of AED 200 million on an exchange house in 2025 for serious AML and counter-terrorism financing violations. This enforcement action reflects regulators' zero-tolerance approach toward financial crime. Businesses face similar scrutiny when their payment processes enable fraudulent activity, even unknowingly.

Fraud schemes in business payments typically involve invoice manipulation, where criminals intercept legitimate invoice communications and provide altered banking details. More sophisticated operations may involve completely fabricated vendors or services.

↪ Facilitates smoother international operations

UAE businesses regularly engage in cross-border transactions involving different banking systems, currencies, and regulatory frameworks. The International Bank Account Number (IBAN) system, mandatory in the UAE since 2011, standardizes international account identification.

The UAE's implementation of FATF's Crypto Travel Rule adds another verification layer for virtual asset service providers, requiring accurate beneficiary and originator information for transactions exceeding AED 3,500.

↪ Supports AML and Counter-Terrorism Financing compliance

The UAE Financial Intelligence Unit operates the goAML platform for reporting suspicious transactions. Businesses across sectors, including real estate firms, precious metals dealers, and professional services, must report cash transactions above AED 55,000 and submit suspicious transaction reports when appropriate.

Maintaining verified banking relationships creates documentation that supports these reporting requirements and demonstrates that the business conducts proper checks on payment recipients.

The Central Bank's updated guidelines from January 2025 encourage AI-driven transaction monitoring and real-time fraud detection for high-risk entities.

What's the difference between bank account verification and KYC?

| Aspect | Bank Account Verification | Know Your Customer (KYC) |

|---|---|---|

| Primary Purpose | Confirm account details are accurate and operational | Establish customer identity and assess risk profile |

| Scope | Limited to banking information validation | Comprehensive identity and business assessment |

| Information Required | Account number, IBAN, account holder name, bank details | Identity documents, address proof, business licenses, ownership structures, financial statements, source of funds |

| When It Occurs | Before processing payments or setting up payment relationships | During customer onboarding and establishing formal business relationships |

| Regulatory Requirement | Not mandatory for most B2B transactions | Mandatory for financial institutions, real estate firms, precious metals dealers, and designated businesses under Federal Decree-Law No. 20 of 2018 |

| Verification Depth | Confirms account exists and belongs to the claimed holder | Verifies identity, business legitimacy, beneficial owners, and transaction purposes |

| Typical Methods | Micro-deposits, IBAN validation, document requests, digital APIs | Document collection, identity verification, address confirmation, background checks, and ongoing monitoring |

| Documentation Created | Account verification records, transaction confirmations | Customer profiles, risk assessments, compliance files, suspicious activity reports |

| Regulatory Reporting | No direct reporting requirements | Must report suspicious transactions to the Financial Intelligence Unit via the goAML platform |

| Penalties for Non-Compliance | Operational losses from misdirected payments | Regulatory fines ranging from AED 3.5 million to AED 200 million for AML violations |

| Frequency | Before the first payment, when account details change, or periodically | At onboarding, then ongoing monitoring throughout the business relationship |

| Cost Structure | Per-verification fees or minimal transaction costs | Comprehensive assessment costs, ongoing monitoring expenses |

Common mistakes in bank account verification

❌ Verifying only at initial setup and never again: Many businesses verify accounts once during vendor onboarding but never repeat the process. Account details change due to bank mergers, corporate restructuring, or new banking arrangements. Without periodic reverification, payments continue to be made to outdated accounts, particularly when reactivating dormant vendor relationships after extended inactivity periods.

❌ Relying solely on information provided in emails: Accepting bank details from emails without additional verification creates a fraud vulnerability. Compromised email accounts allow criminals to send authentic-looking messages with altered banking information. Proper verification requires confirming changes through secondary channels like phone calls to known contacts or official bank documentation requests.

❌ Not documenting the verification process: Conducting verification without maintaining records creates problems during audits or fraud investigations. Documentation should include the verification method, date, the responsible person, and confirming evidence. This record-keeping proves essential for internal controls, regulatory compliance, and defending liability claims if fraudulent payments occur.

❌ Failing to verify account ownership versus account existence. Some methods confirm accounts exist, but not who controls them. Fraudsters might provide real account numbers belonging to others. The account passes validity checks because it exists, but payments reach unintended recipients. Complete verification must establish both validity and ownership through methods like micro-deposits.

❌ Using automated verification without understanding its limitations: Digital tools provide speed but operate within specific parameters. Some platforms cannot verify certain banks, particularly smaller institutions or international banks, without data-sharing agreements. Businesses may believe accounts are fully verified when gaps remain. Effective verification combines automated tools with manual processes for edge cases.

❌ Ignoring verification results that show mismatches: When verification shows the provided name does not match bank records, some businesses proceed anyway, assuming spelling variations explain discrepancies. Name mismatches frequently indicate fraud attempts or significant errors. Mismatches require investigation and resolution before processing payments, even if this creates operational delays.

How to choose the right verification method for your business?

Selecting an appropriate bank account verification method requires evaluating several factors specific to your business operations.

- Transaction volume: High-volume operations (100+ monthly payments) need automated solutions like IAV platforms, while low-volume businesses can manage with manual methods like document verification or micro-deposits

- Transaction value: Payments above AED 50,000 warrant multiple verification layers (document review plus test transfer), while routine, smaller amounts may only require IBAN validation

- Relationship status: New vendors require thorough initial verification through micro-deposits or IAV, while established partners need only periodic document updates or format checks

- Regulatory requirements: Businesses in AML-regulated sectors (real estate, precious metals, financial services) need verification methods that create comprehensive audit trails

- Budget constraints: Digital platforms charge per verification (AED 5-50), micro-deposits cost only transfer fees, IBAN validation is typically free, and document review costs mainly staff time

- Risk tolerance: Fraud-prone industries or businesses with previous payment fraud should implement multiple verification layers for redundancy

For businesses seeking to implement efficient verification processes without managing multiple methods manually, Signzy offers integrated digital verification solutions.

"We were losing thousands monthly to misdirected payments and invoice fraud schemes. Signzy's bank account verification API catches incorrect details in under 5 seconds, before any money moves. Since implementation, our payment error rate dropped by 89% and we've prevented at least three major fraud attempts." — Head of Finance Operations, Financial Services.

The platform can automatically apply appropriate verification levels based on your business rules, creating a seamless workflow that adapts to different transaction scenarios while maintaining comprehensive compliance documentation. Below’s a detailed look at how Signzy’s solution can help UAE businesses with bank account verification.

⚡ Real-time account validation

Signzy's Bank Account Verification API connects directly to banking networks across 200+ countries. You enter account details, and the system returns verification results in under five seconds. The API checks whether the account exists, confirms the account holder name matches what you were given, verifies the account is active and operational, and validates IBAN format and SWIFT codes for international transfers.

More importantly, automation prevents expensive mistakes. A misdirected payment of AED 50,000 does not just cost the transfer amount.

You spend days coordinating with banks, chasing the recipient, and managing the vendor relationship damage. The verification API catches incorrect account details before money moves.

🏢 Complete business and identity verification in one system

Verifying corporate vendors means checking multiple things separately.

You need to confirm the business is legitimate through trade license validation. You verify their registration with the Department of Economic Development. You identify who actually owns the company.

Then you separately check their bank account details.

Each step uses different systems and takes time. Signzy connects these verification steps into a single workflow:

- Trade license validation through OCR extraction and database checks

- Business registration confirmation across all seven Emirates and 40+ free zones

- AML checks against sanctions lists, PEP databases, and watchlists

- Ultimate Beneficial Owner identification and screening

This integration stops a common fraud pattern where criminals submit real business documents but fake banking details.

"We process AED 2 million in cross-border payments monthly. Before Signzy, verification took 2-3 days per new vendor account through manual document checks. Now it's instant across 200+ countries. We've cut onboarding time by 85% while actually improving our fraud detection capability significantly." — CFO, Logistics & Freight Forwarding Company.

The system confirms the bank account actually belongs to the verified business entity, not just that both pieces of information look legitimate separately.

For individual payments to freelancers or consultants, the platform adds Emirates ID verification. The system validates the Emirates ID, confirms the person's identity details, checks that the ID has not expired, and then links that verified identity to the bank account being used. This prevents someone from using a stolen Emirates ID to collect payments meant for someone else.

🔄 Expand verification across your operations

Bank account verification solves one problem. But as your business grows in the UAE, verification needs to multiply. A new vendor needs account validation. A corporate client requires business legitimacy checks. International transfers demand identity verification. Handling each separately creates gaps.

Signzy's platform connects verification across your complete workflow. When you implement bank account checks, you access integrated capabilities that work together:

- Identity Verification - Validate Emirates IDs, passports, and driver's licenses with OCR extraction, liveness checks, and face matching for individual account holders

- Business Verification - Confirm trade licenses, company registration across 40+ free zones, and identify Ultimate Beneficial Owners for corporate onboarding.

- Transaction Monitoring - Detect suspicious patterns, flag unusual activity, and generate compliance-ready reports for ongoing risk management

- AML Screening - Screen against PEP lists, sanctions databases, watchlists, and adverse media for comprehensive compliance coverage

- Document Verification - Extract and validate data from bank statements, contracts, utility bills, and financial records through OCR technology

- Credit Assessment - Analyze bank statements, evaluate financial history, and assess creditworthiness for lending decisions

- Background Checks - Verify criminal records, employment history, and conduct due diligence screening for high-risk relationships

- Contract Management - Generate, digitally sign, and validate legal agreements with automated consent tracking and storage

The platform scales with your requirements. Start with account validation for vendor payments. Add business verification when onboarding corporate partners. Layer in transaction monitoring as volumes grow. Each component shares data, building comprehensive risk profiles without duplicate work.

Experience digital verification firsthand! Book a no-obligation demo call to see how Signzy’s solutions align with your business verification needs.

FAQ

Is bank account verification mandatory in the UAE?

How long does the verification process usually take?

Can I verify international bank accounts from the UAE?

What documents are typically needed for verification?

Gaurav Gupta

Gaurav Gupta is the Global Product Head at Signzy, leading the strategy and development of the company’s KYC, KYB, AML, and digital onboarding products used by banks, fintechs, and financial institutions across global markets. He specializes in building scalable compliance and verification platforms, transforming complex regulatory and risk workflows into seamless, automated product experiences. Gaurav works at the intersection of product, engineering, and AI.

![UAE GoAML Registration: Step-by-Step Guide [2026]](https://cdn.sanity.io/images/blrzl70g/production/306f8b6909dced815cf7dbcd9398b9a60a5c4537-2821x663.png)