Bank Account Verification

Instant, secure, and scalable bank account verification

Reduce fraud, prevent payment failures, and accelerate customer onboarding with real-time bank account authentication. Get instant verification for seamless transactions and consent-based verification for enhanced security and compliance.

Trusted by industry leaders

Reduce business risk and fraud

2x

More Fraud Detection

Have a secure and seamless onboarding journey. Fight fraudsters and low pass rates with 1 tool.

100M+

Users Verified

Grow fearlessly with APIs that scale with your business. Millions trust Signzy for secure and seamless verification.

<5s

Response Time

Users never settle for slow, and neither should you. Signzy’s quick response time means 60% less dropoffs for businesses.

Secure and efficient bank account verification for 200+ countries

Signzy helps you paint a picture of any bank account and the user behaviour associated with it

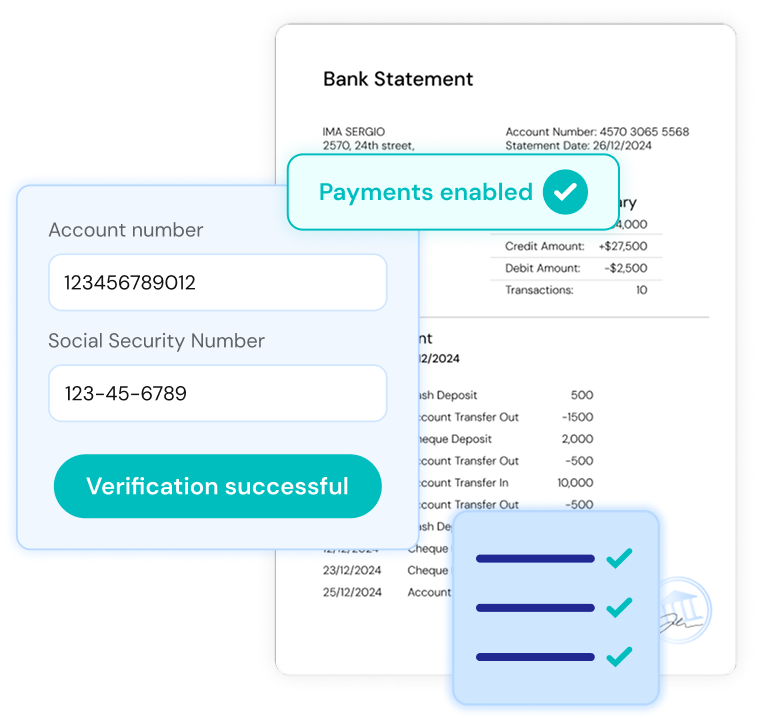

Verify accounts instantly with Instant BAV

Verify bank accounts in real time, reducing fraud and accelerating customer onboarding. Instantly confirm account details for seamless payments and AML compliance.

Build user trust with Consent-based BAV

Ensure compliance and build trust with consent-driven bank account verification. Authenticate accounts securely while giving users full control over their financial data.

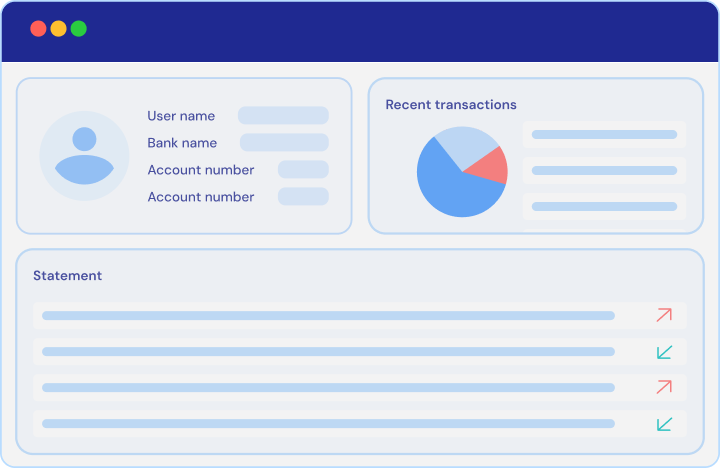

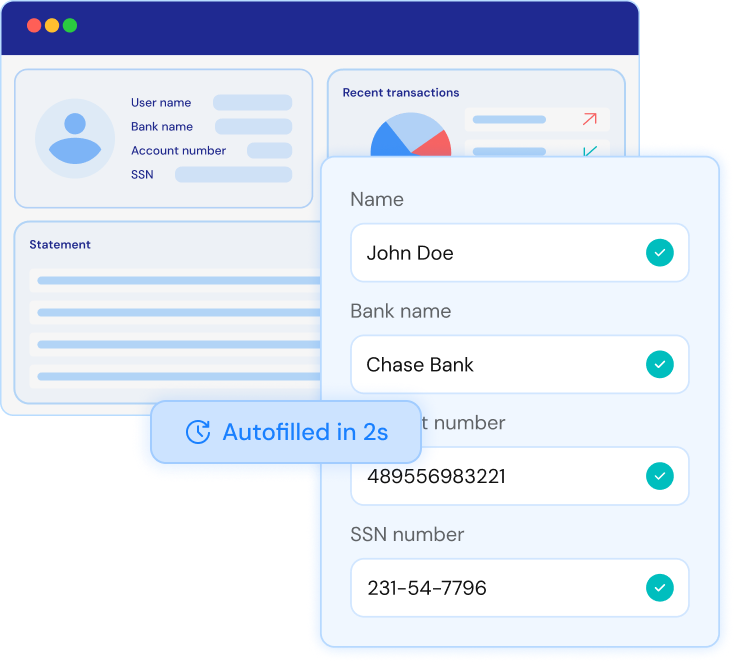

Get every data point you need to verify a bank account

Verify account ownership, bank details, transaction info, currency, account status, IBAN, SWIFT code, and other vital bank details autofilled within seconds.

Signzy’s bank account validation flow

Implement country-specific workflows tailored to the needs of your users

Automate your entire due diligence process

Verifying a bank account is essential for KYB, KYB, AML, and many more use cases

Credit Risk Evaluation for Lenders

- Industry: Banks, Fintech, Credit Unions

- Use Case: Lenders can assess an applicant’s creditworthiness by analyzing financial history, outstanding debts, and repayment behavior. This helps in approving loans with minimized default risks.

Fraud Detection & Prevention

- Industry: E-commerce, Payment Processors, Financial Services

- Use Case: Businesses can detect suspicious transactions, identify high-risk users, and prevent fraudulent activities by analyzing behavioral and transactional patterns in real time.

KYC & AML Compliance

- Industry: Banking, Cryptocurrency Exchanges, Regulatory Compliance

- Use Case: Companies can verify customer identities, assess transaction risks, and detect money laundering attempts to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

Insurance Underwriting & Risk Pricing

- Industry: Insurtech, Health & Auto Insurance Providers

- Use Case: Insurers can evaluate the financial stability and claim history of applicants to determine premiums, prevent fraud, and optimize risk-based pricing models.

Vendor & Supplier Risk Assessment

- Industry: Supply Chain, Procurement, Logistics

- Use Case: Businesses can assess the financial stability and credibility of vendors before onboarding them, reducing supply chain disruptions and mitigating financial risks.

Insurance Industry

- Industry: Insurance companies can validate the EINs of policyholders and beneficiaries to ensure that policies are correctly issued and claims are processed accurately.

Cybersecurity Risk Analysis

- Industry: IT Security, SaaS, Enterprise Solutions

- Use Case: Organizations can use risk assessment APIs to evaluate cybersecurity threats, detect data breaches, and monitor vulnerabilities in digital transactions.

Customer Risk Scoring for Financial Services

- Industry: Wealth Management, Investment Platforms, BNPL (Buy Now, Pay Later) Services

- Use Case: Financial service providers can assign risk scores to customers based on spending behavior, investment patterns, and credit exposure to tailor financial offerings accordingly.

Gambling & Gaming Compliance

- Industry: Online Gambling, Betting Platforms, Gaming Companies

- Use Case: Platforms can assess user financial behavior to prevent problem gambling, enforce responsible gaming policies, and comply with financial regulations.

Integrate the complete data verification suite

Identity fraudsters and money mules while staying compliant with global and local AML regulations

Credit Underwriting

Make smarter lending decisions with AI-powered credit underwriting. Analyze financial data, assess risk, and approve loans faster while minimizing defaults.

Bank Statement Analysis

Gain deep financial insights with automated bank statement analysis. Verify income, detect fraud, and make data-driven decisions in real time.

Business Verification

Get everything from government-approved watchlists and bankruptcy filings to org details like state registrations to streamline your KYB process.

Identity Verification

Onboard users with confidence with Signzy’s foolproof KYC system. ID checks, biometric verification, criminal screening, all work together to build dynamic user risk profiles.

Developers love us for a reason!

Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks :)

Related Blogs

FAQ

What is the Bank Account Verification API?

Signzy's Bank Account Verification API enables businesses to instantly verify the ownership and validity of bank accounts globally, ensuring that the account details provided belong to the intended individual or business.

Why is bank account verification important?

The API helps businesses:

- Prevent fraud and misdirected payments

- Validate account ownership before payouts or disbursements

- Ensure compliance with AML and KYC regulations

- Improve onboarding experiences for individuals and businesses

How does the Bank Account Verification API work?

The API connects with global banking networks, financial institutions, and verification partners to:

- Confirm the account holder's name

- Validate the account number, IBAN, or routing information

- Check account status (active/inactive/closed)

- Support real-time verification in many regions

What account types can be verified?

- Personal bank accounts

- Business or corporate accounts

- International bank accounts (IBANs / SWIFT codes supported)

Which industries benefit from this API?

Industries that benefit from this API include:

- Banks, FinTechs, and Payment Providers: for onboarding, payouts, and compliance

- Lending Platforms: to verify borrower bank accounts before disbursement

- E-commerce & Marketplaces: to validate seller or vendor bank details

- Gig Economy Platforms: for contractor and freelancer payouts

Can the API perform real-time verification?

Yes, the API supports real-time or near real-time verification, enabling instant validation of bank details globally.

Does the API support international verification?

Yes, Signzy's solution supports cross-border account verification, including IBAN, SWIFT/BIC codes, and country-specific formats.

Can the API be integrated into existing systems?

Yes, the API is designed for easy integration with core banking platforms, CRMs, payment systems, and digital onboarding workflows.

How does Signzy ensure data security during verification?

All data is processed through secure, encrypted APIs compliant with global data privacy and security standards, including GDPR and PCI-DSS where applicable.