What is Liveness Check? Types, Benefits & Use Cases (2026)

- Liveness check verifies real, live users during authentication by analyzing biometric patterns and natural movements, blocking spoofing attacks from photos, videos, masks, and deepfakes.

- The technology includes active detection requiring user actions, passive detection working silently, and hybrid approaches, each balancing security strength, user convenience, and processing speed differently.

- Businesses use liveness checks to prevent identity theft, meet compliance requirements, and improve onboarding experience, with solutions like Signzy offering detection and deepfake prevention in under 5 seconds.

Digitization has brought ease of business and operations for both businesses and customers. However, the reduced physicality due to this development has also compromised the security of identity verification.

Bad actors circumvent the identity verification processes to commit fraud and other illegal activities. This usually involves stealing the customer’s identity to misuse their personal information. According to an AARP report, adults in the US lost around $43 billion to identity theft in 2023.

Thankfully, identity fraud is not a problem without a solution. The identity verification industry has kept up with this growing problem and created measures to resist it. Liveness checks are one of the many ways businesses can counter the identity theft issue.

Let’s find out how liveness checks can help improve your business.

Related Solutions

What is a liveness check?

A liveness check is a security technology that verifies whether the person being authenticated is physically present and alive at the moment of verification. It distinguishes real users from photos, videos, masks, deepfakes, or other spoofing attempts by analyzing biometric data and behavioral patterns in real time. Liveness checks are commonly used in identity verification systems to prevent fraud and ensure that authentication requests come from genuine individuals rather than synthetic or reproduced representations.

How does the liveness check work?

Liveness check operates by analyzing real-time biometric and behavioral indicators to confirm physical presence. The verification process involves five steps:

- The system initiates the verification process and activates the device camera.

- The user is prompted to position their face within the designated frame.

- The system captures initial biometric data, including facial structure and features.

- The user receives instructions to perform specific actions like blinking, nodding, or smiling.

- Algorithms analyze the response for natural movement patterns, skin texture, and depth.

- The system checks for signs of spoofing, such as flat surfaces, screen reflections, or unnatural motion.

- The technology processes all data points and delivers an instant decision on authenticity.

The entire process typically completes within seconds, balancing security requirements with user convenience.

What are the different types of liveness checks?

Before we dive into the specifics of different types of liveness checks, here's a quick comparison table for quick review.

| Type | User action required | Speed | Security level | Hardware needs | Best for |

|---|---|---|---|---|---|

| Active | Yes | Medium | High | Standard camera | High-security applications |

| Passive | No | Fast | Medium-High | Standard camera | Seamless user experience |

| Hybrid | Sometimes | Fast | Very High | Standard camera | Balanced security and UX |

| 3D Depth | Minimal | Medium | Very High | Specialized sensors | Premium security systems |

| Motion-Based | Minimal | Fast | Medium | Standard camera | Continuous authentication |

| Challenge-Response | Yes | Slow | Very High | Standard camera | Maximum fraud prevention |

Type #1. Active liveness checks

Active liveness checks require users to perform specific actions during verification. The system prompts users to blink, smile, turn their head, or follow an object on screen. These challenges are often randomized to prevent pre-recorded videos from passing verification. Active detection provides strong security but requires user participation and a few extra seconds to complete.

Type #2. Passive liveness checks

Passive liveness checks work in the background without requiring any action from the user. It analyzes biometric indicators like skin texture, blood flow, light reflection, and micro-expressions captured from a single image or brief video. This method offers a seamless user experience since verification happens automatically, though it may be slightly less robust against sophisticated attacks compared to active methods.

Type #3. Hybrid liveness checks

Hybrid liveness checks combine both active and passive techniques for maximum security. The system first runs passive checks in the background, then triggers active challenges only when additional verification is needed. This approach balances strong fraud prevention with user convenience, adapting the level of interaction based on risk assessment.

Type #4. 3D depth detection

3D depth detection uses specialized cameras or sensors to map facial contours and measure distance. It creates a three-dimensional profile of the face to distinguish real depth from flat surfaces like photos or screens. This technology is highly effective against print attacks and 2D spoofing, but requires compatible hardware.

Type #5. Motion-based detection

Motion-based detection analyzes natural human movements and behavioral patterns. It tracks head position, eye movement, facial expressions, and subtle involuntary motions that are difficult to replicate artificially. The system looks for fluid, realistic movement rather than jerky or looped patterns typical of spoofing attempts.

Type #6. Challenge-response detection

Challenge-response detection presents users with unpredictable tasks that must be completed in real time. Examples include reading random numbers aloud, performing gestures in a specific sequence, or responding to visual cues. The unpredictability makes it nearly impossible for attackers to use pre-recorded content.

How is a liveness check different from other verification methods?

Liveness check is one of several approaches to identity verification, each with distinct characteristics and use cases.

| Method | What it verifies | Spoofing resistance | User experience | Implementation cost | Best use case |

|---|---|---|---|---|---|

| Liveness checks | Physical presence | Very high | Good | Medium-High | Real-time authentication |

| Facial recognition | Face matches database | Medium | Excellent | Medium | Access control, identification |

| Document verification | ID authenticity | Medium | Good | Low-Medium | Onboarding, KYC compliance |

| Fingerprint Scanning | Fingerprint matches the record | High | Excellent | Low-Medium | Device unlock, secure access |

| Voice recognition | Voice matches profile | Low-medium | Excellent | Low | Phone authentication |

| Knowledge-based authentication | User knows information | Low | Poor | Low | Password recovery |

| Two-factor authentication | User has device/token | Medium | Fair | Low | Account security |

| Behavioral biometrics | Typing/usage patterns | Medium | Excellent | Medium | Continuous monitoring |

Liveness checks stand out by specifically addressing the challenge of presentation attacks, making it an important layer when physical presence verification is essential for security.

How does a liveness check help with fraud prevention?

Liveness check prevents fraud by checking that a real person is present during verification. It blocks common tricks that fraudsters use with fake or stolen photos and videos, protecting accounts and personal information from unauthorized access.

↪ Stops photo and video attacks: Fraudsters often hold up stolen photos or play recorded videos to pretend they are someone else. Liveness check catches these fakes by looking for depth and natural movement. A printed photo is flat, and a video cannot answer random questions or follow new instructions. The system rejects these attempts because they lack the signs of a real, live person.

↪ Prevents fake identity fraud: Some fraudsters create completely new fake identities by mixing real and made-up information. These fake identities look legitimate on paper and can be used to open accounts. Liveness check stops this by requiring a real person to verify, making it impossible to complete sign-up with an identity that only exists as documents or data.

↪ Detects mask and model attacks: Advanced attackers use silicone masks, 3D-printed heads, or mannequins to fool face recognition systems. Liveness check catches these tricks by checking for things masks cannot fake. Real skin changes color slightly as blood moves, stretches naturally when you smile, and has a texture that rigid materials lack.

↪ Reduces account takeover: Account takeover happens when fraudsters break into someone else's account using stolen passwords. Liveness check adds protection beyond passwords by requiring the real person to be there. Even if an attacker knows your password, they cannot get in without physically being present at the device during verification.

↪ Stops replay attacks: Replay attacks happen when fraudsters record a real verification session and play it back later to gain access. Liveness check prevents this by asking for different actions each time or checking markers that change moment to moment.

Key benefits of liveness checks

Liveness checks help organizations stay secure while making verification easy for users. It fills important gaps in traditional security methods and helps companies meet legal requirements efficiently.

🔒 Enhanced security against spoofing

Liveness checks stop fraud by catching common tricks that get past regular verification systems. It protects against:

- Photo and video attacks where fraudsters use stolen images

- Deepfakes and AI-generated fake faces

- Physical masks and 3D-printed heads

- Replay attacks using recorded verification videos

This protection makes it very hard for attackers to pretend they are someone else, even if they have stolen photos or personal data. Organizations see fewer fraud cases and lose less money to account takeovers and identity theft.

⚡ Improved user experience

Liveness checks make verification quick and simple, taking only seconds to finish. Users just look at their camera and follow easy prompts like blinking or turning their head. There are no passwords to remember, no extra devices to carry, and no long security questions to answer.

The process works on regular smartphones and computers without special equipment. This ease of use means more people complete sign-ups and fewer abandon their transactions, which matters most for mobile apps and online services where users expect speed.

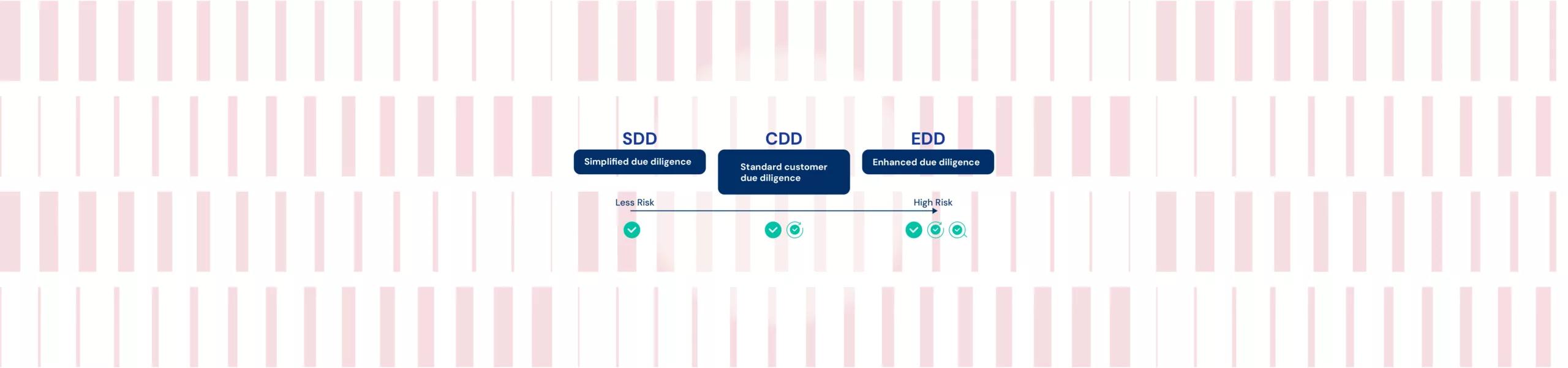

✅ Regulatory compliance and trust

Many industries must follow strict rules that require strong identity checks to stop money laundering, fraud, and unauthorized access.

Liveness checks help organizations meet requirements like:

- Know Your Customer rules: Require banks and financial companies to verify customer identities before opening accounts or allowing transactions to protect against fraud and financial crimes

- Anti-money laundering regulations: Require banks to confirm who their customers are and watch for suspicious activity to prevent criminals from hiding illegal money through the financial system

- Healthcare privacy standards: Require strong identity checks before allowing access to medical records to protect patient information and ensure only authorized people view sensitive health data

- Age verification laws: Require websites and apps selling alcohol, tobacco, gambling services, or adult content to confirm users are old enough before letting them access restricted products or services

By using liveness checks, companies show they take security seriously and earn trust from customers who care about protecting their personal information. This also reduces legal risks and helps avoid fines for breaking regulations.

"Deepfake attacks during account recovery were becoming a serious problem. The videos looked completely legitimate to our team, but Signzy's AI caught synthetic patterns we couldn't see. It's prevented 23 account takeovers this quarter that would have succeeded with our old system." — Security Director, Cryptocurrency Exchange

💰 Cost-effective fraud prevention

Liveness checks cut the costs of dealing with fraud in multiple ways. It reduces expenses from investigating fake accounts, handling chargebacks, and paying back victims of identity theft. Automated verification means fewer staff are needed to manually check identity documents and flag suspicious activity. The technology handles growth easily as more users join without needing to hire more security personnel.

While there is a setup cost, the money saved from preventing fraud and reducing operations costs usually pays back within the first year.

Liveness check use cases.

- Banking and financial services use liveness checks during account opening, loan applications, and high-value transactions to prevent identity fraud and meet Know Your Customer regulations that require verified customer identities.

- Fintech and digital payments rely on it for onboarding new users, authorizing payments, and preventing account takeovers in mobile banking apps, digital wallets, and peer-to-peer payment platforms.

- Healthcare providers implement liveness checks to secure patient portals, protect medical records, verify identities during telehealth appointments, and ensure only authorized individuals access sensitive health information.

- Government services use the technology for issuing digital IDs, processing passport applications, verifying benefit claims, and enabling secure access to citizen portals and online government services.

- Travel and hospitality deploy liveness checks at airport security checkpoints, hotel check-ins, and car rental services to match travelers with their documents and speed up verification while maintaining security.

- E-commerce and retail apply it for age-restricted purchases like alcohol and tobacco, preventing return fraud, and verifying identities during high-value transactions or account recovery processes.

- Education platforms use liveness checks to verify student identities during online exams, prevent cheating through proxy test-takers, and secure access to digital learning resources and credentials.

- Cryptocurrency exchanges require liveness verification during account creation and large withdrawals to comply with anti-money laundering laws and protect users from unauthorized access to digital assets.

How Signzy's liveness check API helps prevent fraud?

Signzy offers both active and passive liveness checks, so you can choose what works best based on your user's situation and network quality. The system uses smart face recognition that can spot and ask users to remove masks or glasses during verification. The entire fraud check happens in under 5 seconds without slowing down your onboarding process.

"Lighting was our biggest concern because our customers use the app everywhere. Signzy handles bright sunlight, dim indoor lighting, and even challenging backlighting situations without problems. We haven't had legitimate users blocked because of lighting issues, which honestly surprised us given how varied conditions can be." — Operations Manager, Digital Onboarding Platform.

The solution does more than basic liveness checks. It also catches deepfakes, face swaps, synthetic content, and other AI-generated fraud attempts. Signzy has verified over 100 million users and detects twice as much fraud by combining liveness checks with face matching, document verification, and identity verification in one system. You can integrate it quickly and customize it to fit your needs, with most businesses going live within 2-4 days.

Want to see how it works? Schedule a demo to learn how Signzy can protect your business.

FAQ

Can liveness check work in low-light conditions?

How accurate is liveness check technology?

Does the liveness check work with all skin tones?

What happens if a liveness check fails during verification?

Gaurav Gupta

Gaurav Gupta is the Global Product Head at Signzy, leading the strategy and development of the company’s KYC, KYB, AML, and digital onboarding products used by banks, fintechs, and financial institutions across global markets. He specializes in building scalable compliance and verification platforms, transforming complex regulatory and risk workflows into seamless, automated product experiences. Gaurav works at the intersection of product, engineering, and AI.

![Face Matching vs. Selfie Verification [Which is Right for You?]](https://cdn.sanity.io/images/blrzl70g/production/35569107cd3d0dc0e28b221813f008c8301a7f78-2560x600.webp)

![Video KYC: Pros, Cons and Key Differences [2025]](https://cdn.sanity.io/images/blrzl70g/production/7bbc8274feeb85b1d7452245a7fe034b8105e572-2560x600.webp)