How to Lookup a Company's EIN Number? [2026 Guide]

- A company’s EIN (Employer Identification Number) is its core business tax ID, required for IRS filings, opening bank accounts, hiring employees, and building credit, making EIN lookup a critical step in any business verification process.

- Unlike personal SSNs, there is no single public IRS EIN search for all businesses; the most reliable ways to find or verify an EIN depend on whether the entity is public, private, or tax-exempt, using sources like SEC filings, state registries, and official records.

- Accurate EIN verification tools like Signzy play a central role in KYB, compliance, and fraud prevention, helping organizations confirm legal existence and avoid onboarding shell or misrepresented companies.

You know that nine-digit number the IRS gave you when you started your business? That's your EIN, and you probably haven't thought about it since the day you got it. Until now, when you suddenly need it for a vendor form, a bank account, or tax filing, and you have no idea where you put the confirmation letter.

Here's the thing: finding your own EIN is usually pretty easy once you know where to look. But verifying someone else's EIN? That's a different story. Whether you're checking out a new vendor, onboarding a contractor, or just doing your due diligence before signing a deal, you need to make sure the business you're dealing with is actually legitimate.

This guide walks you through both scenarios. We'll cover the fastest ways to find your own EIN, explain why businesses need to verify other companies' tax IDs, and show you which verification methods actually work versus which ones waste your time.

Related Solutions

What is an EIN?

An Employer Identification Number (EIN) is a nine-digit identifier assigned by the Internal Revenue Service (IRS) to businesses operating in the United States. Also known as a Federal Tax Identification Number, it functions like a Social Security Number but for business entities. The EIN format follows the structure XX-XXXXXXX and is used for tax filing, opening business bank accounts, hiring employees, and establishing business credit.

Why do companies need to verify a business’s EIN number?

Companies verify EINs for numerous operational, legal, and financial reasons, but these fundamentally boil down to two main imperatives that drive business decision-making.

- Regulatory Compliance: Companies must verify EINs to meet IRS tax reporting requirements, satisfy Know Your Business (KYB) regulations under anti-money laundering laws, and fulfill due diligence obligations in regulated industries. This includes accurate Form 1099 filing, backup withholding compliance, and adherence to the Bank Secrecy Act provisions that require financial institutions to verify business identities.

- Fraud Prevention: EIN verification protects organizations from business identity theft and engagement with shell companies or fraudulent entities. This validation confirms that the business claiming an EIN is legitimate and actively operating, preventing financial losses and reputational damage.

These two drivers work together rather than separately.

Regulatory frameworks like KYB exist because fraud imposes real costs on businesses and the broader economy. When regulators require EIN verification, they're essentially mandating the same checks that good risk management would demand anyway.

Ways to find EIN: How to look up your company's EIN number?

Finding your own company's EIN is usually straightforward since you would have received it during the business formation process. The challenge often lies in remembering where you stored this information or which documents contain it.

Most businesses can locate their EIN through official IRS correspondence, existing business records, or by directly contacting the tax authority that issued it.

#1. EIN Confirmation Letter from the IRS

When the IRS approves your EIN application, they send a confirmation letter containing your nine-digit number. The delivery method depends on how you applied:

- Online applications: Immediate confirmation available for download as PDF

- Mail applications: Physical letter arrives within four weeks

- Fax applications: Confirmation sent via fax within four business days

The confirmation letter is your primary official record of the EIN. Many business owners misplace this document or forget where they saved the digital copy. Check your email inbox and spam folders if you applied online, as the IRS sends a confirmation email with the letter attached. For physical copies, look through your business filing cabinet, safe, or wherever you store important tax documents.

If someone else handled your business formation, such as an attorney, accountant, or formation service, they likely have a copy in their records.

#2. Business documents and financial records

Your EIN appears on numerous business documents you've accumulated since formation. This makes your existing paperwork a reliable source for locating the number without contacting the IRS.

Below are some common places to find your EIN:

- Tax returns

- Loan applications

- Business bank accounts

- State licenses and permits

- Vendor contracts

#3. Contacting the IRS directly

If you cannot locate your EIN through documents, you can call the IRS Business and Specialty Tax Line at 800-829-4933. The line operates Monday through Friday from 7:00 AM to 7:00 PM in your local time zone. Be prepared for potentially long wait times, especially during tax season from January through April.

👉 Important considerations: The IRS cannot provide EINs to unauthorized individuals, so only business owners, officers, or authorized representatives can request this information. If you're calling on behalf of a business where you're an employee but not an owner, you'll need written authorization from an officer of the company.

How to verify an EIN number for another business?

Unlike looking up your own EIN, verifying someone else's number involves limited access since tax information is protected under federal privacy laws.

You'll typically need the business to provide their EIN directly, then cross-reference it against public databases or use specialized verification services to confirm accuracy.

Before we discuss each method in detail with all the nuances, below’s a quick reference table of all available methods to verify EIN along with their coverage range:

| Verification Method | Public Companies | Private Companies | LLCs & Partnerships | Nonprofits | New Businesses (<1 year) | Small Businesses |

|---|---|---|---|---|---|---|

| SEC EDGAR | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ |

| Business Credit Bureaus | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ |

| State Registries | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| IRS TEOS | ❌ | ❌ | ❌ | ✔️ | ✔️ | ✔️ |

| EIN API (Signzy) | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

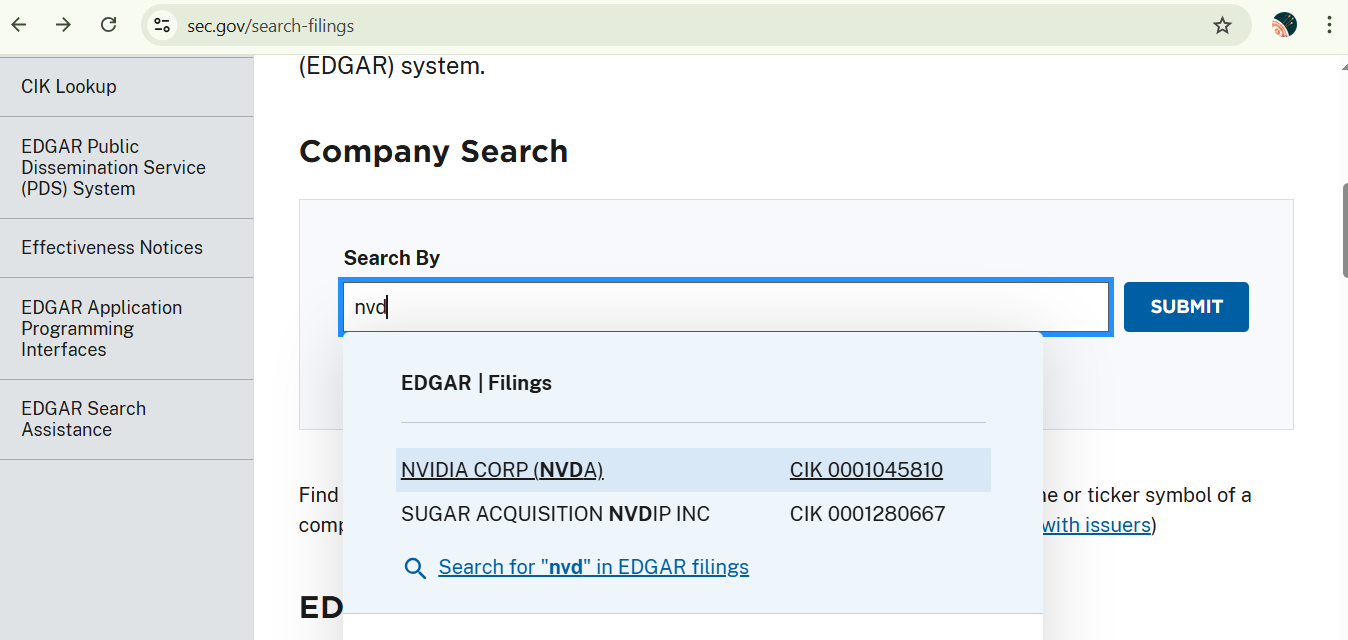

SEC's EDGAR system for publicly traded companies

Companies that issue publicly traded securities must register with the Securities and Exchange Commission and file regular reports. The EDGAR (Electronic Data Gathering, Analysis, and Retrieval) system at sec.gov/edgar provides free public access to these filings going back to 1994.

To find a company's EIN in EDGAR, search by company name, ticker symbol, or Central Index Key (CIK) number.

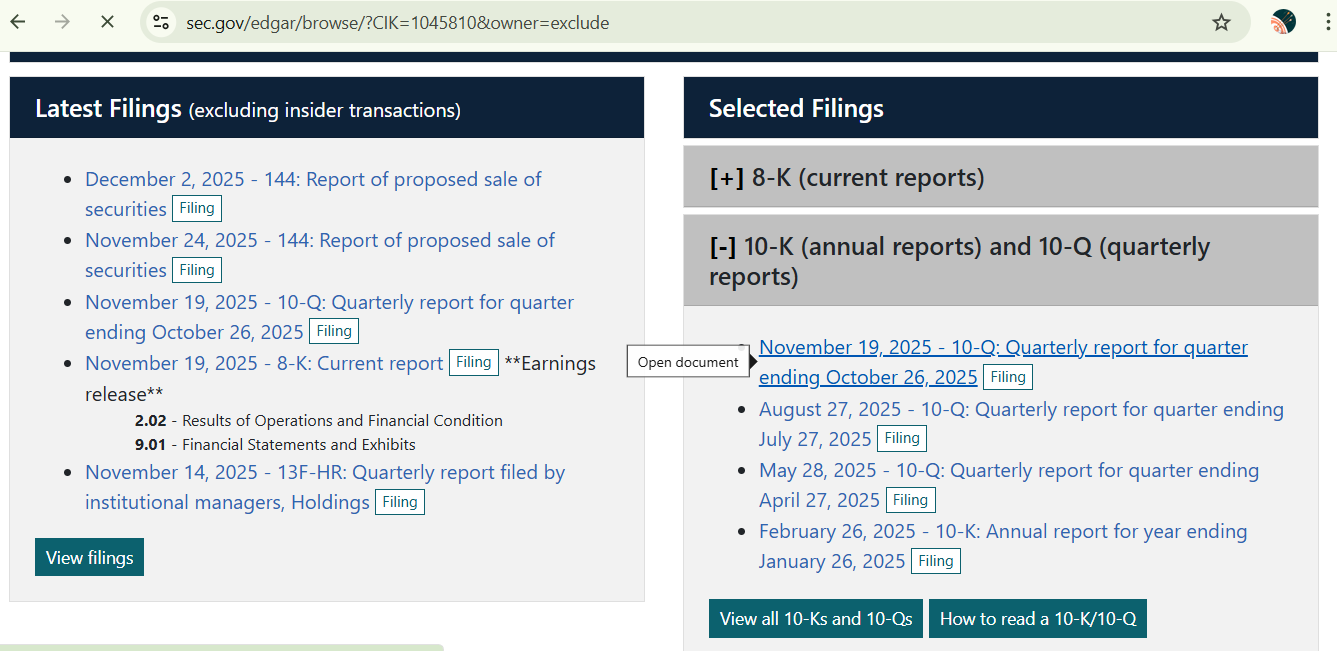

Once you locate the company, look at their most recent Form 10-K (annual report), Form 10-Q (quarterly report), or Form 8-K (current report for major events).

The EIN typically appears in the header section of these documents, usually on the first page alongside other identifying information like the company's address and fiscal year end.

Alternative SEC documents containing EINs:

- Form S-1: Registration statement for initial public offerings

- Form S-4: Registration for mergers and acquisitions

- Proxy statements (DEF 14A): Annual shareholder meeting materials

- Form 20-F: Annual report for foreign companies

EDGAR is completely free and provides extensive financial information beyond just the EIN, including audited financial statements, management discussion and analysis, risk factors, and executive compensation. The system is highly reliable because companies face significant penalties for filing inaccurate information with the SEC.

👉 Important consideration: This method only works for publicly traded companies and certain other entities required to file with the SEC, which represents roughly 10,000 to 15,000 companies out of more than 30 million businesses operating in the United States. Private companies, small businesses, partnerships, and most LLCs don't file with the SEC and won't appear in EDGAR.

💡 Related Blog:

Business credit bureaus and commercial reports

Unlike consumer credit reports that require authorization, business credit information is considered commercial data and can be accessed by parties with a legitimate business purpose.

Dun & Bradstreet is the largest and most comprehensive credit bureau. You can purchase a business credit report directly through their website, with prices typically ranging from $61.99 for a basic report to $189.99 or more for comprehensive reports with financial analysis.

Experian Business and Equifax offer similar services with their own scoring models. Experian's Intelliscore Plus ranges from 1 to 100, while Equifax uses a Payment Index from 0 to 100.

👉 Important consideration: Once again, not all businesses appear in credit bureau databases. Newly formed companies typically need 6-12 months of credit activity before they appear. Very small businesses that operate on a cash basis or don't establish trade credit may never appear.

Secretary of State business registries

Every state maintains an online database of businesses registered within its jurisdiction, accessible through the Secretary of State website or equivalent agency. These databases are free and allow you to search for businesses by name, filing number, or registered agent.

The information displayed varies significantly by state. It’s best to google your client’s Secretary of State website directly:

1- Search “[State in which your client’s business is located] + Secretary of State”. For example, if your client is located in Wyoming, you should search: “Wyoming Secretary of State”

2- Check for something in lines of: “Search for a business entity”

3- Enter name, ticker, or whatever information database asks. If it requires EIN (which we don’t have at the moment), you would need to try a different method.

Some states like Delaware, Nevada, and Wyoming provide extensive details including formation dates, business structure, registered agent information, business addresses, officer and director names, and current status.

Other states provide minimal information limited to just the business name and basic registration details due to privacy and identity theft concerns.

However, you can still use these databases to confirm that a business is legitimate and properly registered. Look for the business status, which should show as "Active," "Good Standing," or similar language. Businesses showing "Dissolved," "Suspended," or "Forfeited" have compliance issues and may not be reliable partners.

IRS Tax Exempt Organization search

The IRS doesn't maintain a public database where you can search any company's EIN by name. However, for nonprofit organizations and charities, the IRS offers the Tax Exempt Organization Search (TEOS) tool at irs.gov/charities-and-nonprofits. This free database allows you to search for 501(c)(3) organizations and other tax-exempt entities by name, location, city, state, or EIN.

This method only works for tax-exempt organizations. For-profit businesses, regardless of size, don't appear in this database. If you need to verify a for-profit company's EIN, you'll need alternative methods.

You can verify whether an organization's tax-exempt status is current or has been revoked, which is particularly important for donors claiming charitable deductions or grantmakers conducting due diligence. The database includes organizations that had their exempt status automatically revoked for failing to file required returns for three consecutive years.

Using EIN verification APIs

Regtech providers like Signzy, Sumsub, Persona provide EIN verification APIs to automate the entire manual work you’d typically do with other methods. These APIs operate through a straightforward request-response model that fits seamlessly into your existing workflows.

When you submit a business name and EIN to the API, the system queries multiple authoritative databases simultaneously, ending the limitations of usual manual methods.

But remember, if you went with API providers which don’t layer intelligence on normal character matching, your users might get irritated. One user, when signing up for Fiverr (freelance servicing marketplace) shared the frustration on Reddit,

“I am going rounds with support who just keep sending me back to the stupid online form that doesn't work, and will only accept my information if I enter it incorrectly, at which point it will fail matching IRS records (it will only accept it as an S-Corp, not a Sole Proprietorship, I am not a S-Corp),”

When you work with Signzy’s EIN verification API, Here’s how it typically works:

- Integration setup: Sign up for Signzy's EIN Verification API and receive your API credentials (key and secret). Your development team integrates the API into your vendor onboarding system, payment workflow, or compliance dashboard. Integration typically takes 2-4 hours.

- Submit verification request: When verifying a business, your system sends an API request containing the business legal name, EIN number, and optionally the state and address for enhanced matching. The API accepts requests 24/7 with 99.9% uptime and no queue delays.

- Real-time multi-source verification: Signzy's system immediately queries IRS business master files, state Secretary of State databases, business credit bureaus, and sanctions lists simultaneously.

- Receive structured results: Within 2-5 seconds, receive a comprehensive response including verification status (verified/mismatch/invalid), business details (formation date, structure, registered agent, status), individual validation check results (EIN format, name match, state registration), risk indicators and red flags, and a unique verification ID for audit trails.

Below are more details about Signzy’s EIN verification API and the difference this method makes.

"Before Signzy, we'd spend days manually checking EINs through different state databases, sometimes hitting dead ends with private companies that weren't in SEC filings. Signzy has literally changed everything. Our onboarding time has dropped from three days to same-day approvals, and we haven't had a single fraudulent vendor slip through since implementation." — Chief Compliance Officer, Supply Chain Solutions provider (200+ employees)

Why choose Signzy's EIN Verification API?

There are endless reasons 600+ global platforms including 10+ Fortune 30 rely on Signzy for regulatory compliance automation.

When talking about EIN verification API specifically, you can enjoy benefits like:

✓ 100% Data accuracy from official sources

All business data comes directly from authoritative government databases and official records, ensuring complete accuracy with zero room for error. Signzy maintains coverage across all 50 U.S. states, pulling information from IRS records, Secretary of State databases, and verified business registries.

The system refreshes data every 2 hours, so you're always working with the most current information available when making critical onboarding decisions.

⚡ Eliminate manual lookups and validate instantly

Manual EIN verification creates bottlenecks in vendor onboarding and leaves room for human error when transcribing data across systems. Signzy automates the entire workflow into a single API call that delivers results in seconds:

- Bulk verification: Upload hundreds of EIN entries and validate them simultaneously

- Universal coverage: Works for all business types, not just public companies or nonprofits

- Instant results: Get comprehensive validation within 2-5 seconds per business

- Automated decisioning: Integrate directly into onboarding workflows for real-time approvals

Stop wasting hours on manual database searches and eliminate verification backlogs completely.

🔔 Real-time monitoring and risk alerts

EIN verification shouldn't end after onboarding. A vendor might be legitimate today but file for bankruptcy next month, or a partner could be added to a sanctions list without your knowledge. Traditional one-time verification creates blind spots where you're unaware of status changes that materially affect your risk exposure until problems emerge.

Signzy provides ongoing monitoring that tracks verified businesses continuously and sends automatic alerts when critical changes occur, including bankruptcy filings or financial distress indicators, new litigation or judgment entries, additions to government watchlists or sanctions lists, business license suspensions or revocations, and significant address or ownership changes.

This proactive approach transforms EIN verification from a point-in-time check into continuous risk management throughout the entire business relationship.

📊 30+ Business data points beyond basic EIN validation

A simple EIN match doesn't tell you enough about business legitimacy or risk exposure. You need comprehensive intelligence about who owns the company, whether they're financially stable, if they have legal issues, and whether they appear on any sanctions lists.

Traditional verification methods force you to piece together this information from multiple sources, assuming you can access them at all. Signzy, on the other hand, returns extensive business intelligence in every verification response:

- Identity data: Legal name, DBAs, registered address, contact information

- Tax information: Federal EIN, state tax IDs, filing status

- Ownership details: Ultimate Beneficial Owner identification and structure

- Financial indicators: Bankruptcy filings, judgments, liens

- Compliance screening: Government watchlists, sanctions lists, debarment records

- Operational status: Business licenses, registration standing, formation date

This comprehensive view lets you make informed decisions about business relationships without conducting separate background checks.

🧩 Modular platform: Expand beyond EIN verification

EIN verification integrates seamlessly with Signzy's broader compliance suite, allowing you to build a comprehensive identity and risk management system through modular additions.

In simple words, you implement only the capabilities you need today while maintaining the flexibility to add features as your compliance requirements evolve.

For example, start with EIN validation and expand to KYC (Know Your Customer) verification for individual identity checks, KYB (Know Your Business) verification for comprehensive business due diligence, UBO (Ultimate Beneficial Owner) identification for ownership transparency, and more.

If you need any further information about how exactly Signzy automates EIN verification, or other use cases, you can book a quick demo with us HERE.

FAQ

What is the easiest way to find a company’s EIN number online?

Can I verify a company’s EIN without contacting them directly?

Is it legal to look up a business’s EIN number?

How accurate are EIN lookup tools and databases?

Why is EIN verification important for KYB and vendor onboarding?

Gaurav Gupta

Gaurav Gupta is the Global Product Head at Signzy, leading the strategy and development of the company’s KYC, KYB, AML, and digital onboarding products used by banks, fintechs, and financial institutions across global markets. He specializes in building scalable compliance and verification platforms, transforming complex regulatory and risk workflows into seamless, automated product experiences. Gaurav works at the intersection of product, engineering, and AI.

![How to Lookup a Company's EIN Number? [2026 Guide]](https://cdn.sanity.io/images/blrzl70g/production/3ceee4c0b2fac3923bd2303cd5b313631bea7258-2560x600.webp)

![5 Best Tools to Verify an EIN Number [Free + Paid] - 2026](https://cdn.sanity.io/images/blrzl70g/production/5acdb26c768fcb06fbd9cfbfb94a408cb3d22bd1-2560x600.webp)

![EIN Verification: All FAQs Answered [Complete Guide - 2026]](https://cdn.sanity.io/images/blrzl70g/production/f957efa7f6a4907bf20ab5686783f10f4f6fed8e-2560x600.webp)