UBO Check

Identify and verify the UBO of a company

Streamline the whole UBO check process and make AML compliance effortless for your business. Prevent fraud by identifying business shareholding patterns and ultimate beneficial owner (UBO) before onboarding.

Trusted by industry leaders

Verify every business confidently

160M+

Businesses Verified

Grow fearlessly with APIs that scale with your business. Millions trust Signzy for secure and seamless partner verification.

97%

API Accuracy

Access unmatched global data coverage and near-perfect precision to ensure you never let a fraudulent company in.

180+

Countries Coverage

Screen businesses in 180+ countries and 50 U.S. states against company databases and registries to verify business names, TINs, and more.

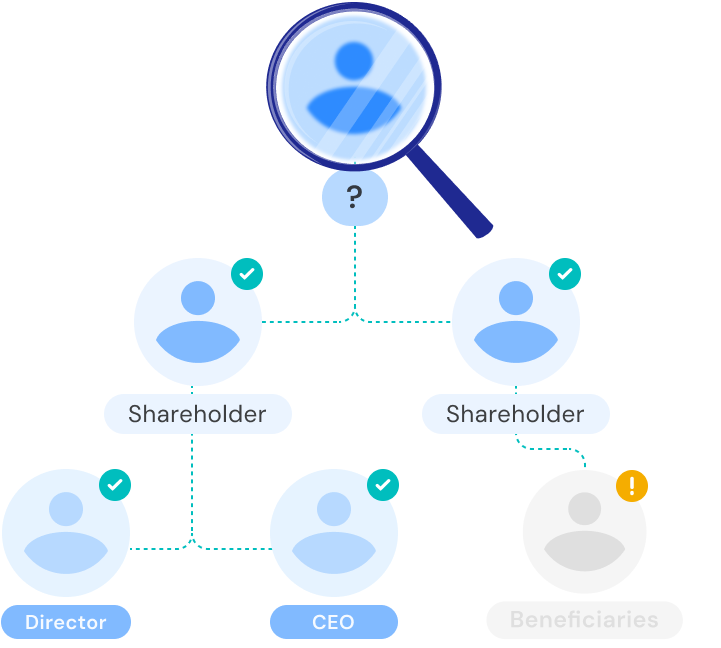

Identify UBOs with enhanced transparency tools

Recognise individuals who ultimately own or control a company to protect your business against fraud.

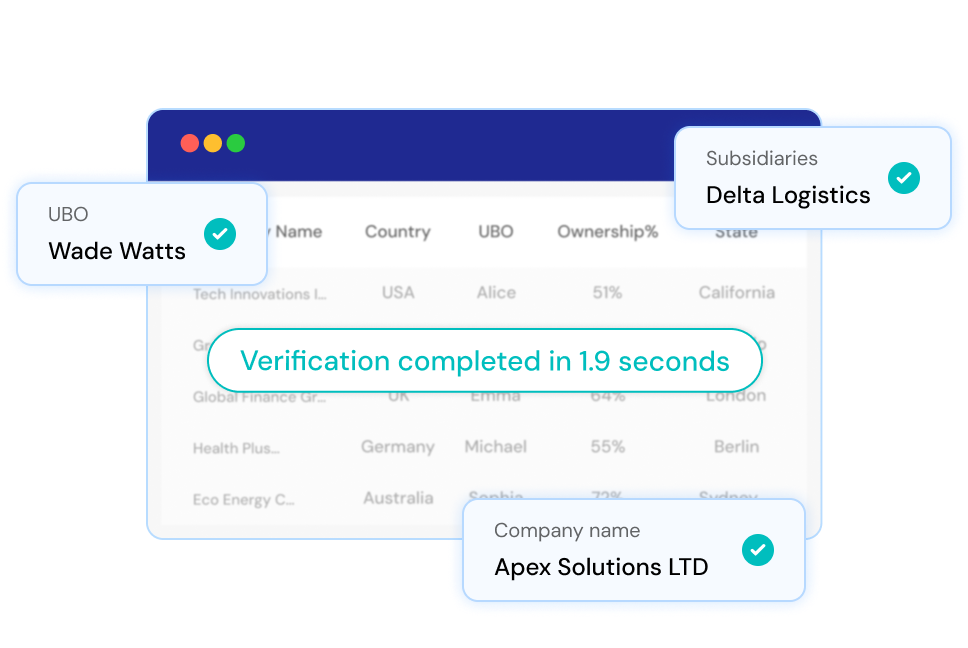

Automate the complex UBO verification process

Conducting UBO checks for KYC, KYB, and AML compliance can be complicated and time-consuming. Speed up the process by verifying through UBO data on millions, and get data on registered capital and subsidiaries to make strong business decisions.

Build business relations on transparency

Learn the beneficial ownership, control, and shareholder structures of a business you’re working with and dodge any risks of money laundering. Fight terrorist financing, corruption, and financial fraud with one tool.

Comply with updated due diligence laws

Access global data of audit reporting and dodge bad actors working through shell corporations to carry out fraudulent activities. Always stay up-to-date and compliant with global and local KYB regulations.

Fight fraud while keeping your users happy

Let Signzy be your partner against fraud - It’s our job to keep you secure while you scale!

Meet us where you work

We are flexible and integrate easily with your existing or aspiring tech stack.

Grows with you

Our support and functionality always scales with your business and needs.

Tech first, not trend-first

We were using AI and ML for verification before they were buzzwords in the industry.

Never non-compliant

Our teams work dedicatedly on global + local regulations, so you never go to bed worrying about compliance.

Privacy-friendly

We are in the business of both data and trust, which means your information is always safe with us

User first, always

We help you reduce drop offs and strike the delicate balance between speed and security

Expand fearlessly and minimize business risk

We don’t just stop at UBO checks—explore the complete business verification stack.

Document Verification

Validate bank statements, articles of incorporation, UCC filings, and many more documents to build a comprehensive company profile.

Database Checks

Validate business data for in-depth business intelligence and streamline your KYB processes including vendor onboarding, verification, and detailed data retrieval.

Business Verification

Get everything from government-approved watchlists and bankruptcy filings to org details like state registrations to streamline your KYB process.

EIN Verification

Get accurate validation of EINs against official records to support KYB with details such as business name, license, industry, address, and more.

Built to be quick and keep pace.

Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks!

Related Blogs

FAQ

What is a UBO check?

A UBO (Ultimate Beneficial Ownership) check identifies the individuals who ultimately own or control a business entity. This process ensures transparency, prevents financial crimes, and helps businesses comply with AML (Anti-Money Laundering) regulations.

Why is UBO verification important?

UBO verification is crucial for:

- Regulatory compliance with AML, KYC, and FATF guidelines

- Risk mitigation to prevent fraud, money laundering, and shell companies

- Enhanced due diligence for banks, fintechs, and financial institutions

- Transparency in corporate structures, ensuring legitimacy in business relationships

What types of businesses need UBO checks?

UBO verification is essential for:

- Banks & Financial Institutions for corporate KYC (KYB) and due diligence

- FinTech & Payment Companies for onboarding business clients

- Investment & Wealth Management to comply with anti-money laundering regulations

- Crypto Exchanges & Gaming to prevent financial crime and meet regulatory requirements

How long does a UBO check take?

Signzy's AI-powered UBO check completes verification within minutes, automating data extraction and compliance checks in real-time.

How does Signzy ensure compliance with UBO regulations?

Signzy's UBO verification aligns with:

- FATF (Financial Action Task Force) guidelines

- EU's AMLD (Anti-Money Laundering Directives)

- FinCEN's UBO disclosure rules

- Other global and country-specific AML/KYC frameworks

Can Signzy verify UBOs for international businesses?

Yes, Signzy's UBO check solution supports multi-jurisdictional verification,analyzing global business ownership structures and ensuring compliance with international regulations.

How does Signzy protect UBO data?

Signzy ensures end-to-end encryption, secure API integrations, and strict data protection measures to safeguard sensitive ownership information while maintaining compliance with data privacy laws.

![How to Lookup a Company's EIN Number? [2026 Guide]](https://cdn.sanity.io/images/blrzl70g/production/3ceee4c0b2fac3923bd2303cd5b313631bea7258-2560x600.webp)

![How to Verify Legitimacy of a Business: KYB Guide [2026]](https://cdn.sanity.io/images/blrzl70g/production/cd6d78e1cf2a2102945329f730ec063fe21cb5a9-2560x600.webp)