RBI's 2025 Gold Loan Compliance Overhaul: What You Should Know

- RBI released comprehensive Master Directions in June 2025, updated in September 2025, consolidating over 30 scattered circulars from three decades into one unified regulatory framework.

- Seven key changes include tiered LTV limits, 12-month bullet caps, 7-day gold return with penalties, standardized valuation, 1 kg pledging limits, and stricter auctions. April 1, 2026, deadline.

- Signzy's Contract360, One Touch KYC, NDD checks, and Aadhaar eSign help lenders automate verification, contracts, and compliance before the April 2026 deadline efficiently.

India's gold loan market is witnessing triple-digit year-on-year growth. The market has grown to ₹3.38 lakh crore as of October 2025, up 128.5% year-on-year according to RBI data.

That kind of growth does not go unnoticed. As the market expanded, so did concerns about how lenders were operating.

Valuation practices varied widely across institutions. Borrowers faced delays getting their gold back after repaying loans. Different lenders followed different rules, creating confusion and inconsistency.

Finally, the RBI decided it was time to standardize. In June 2025, the regulator released Master Directions that pulled together over 30 scattered circulars from the past three decades. These directions got another update in September 2025.

Now every lender in the gold loan business, whether you are a large public sector bank or a small cooperative society, has until April 1, 2026, to get your house in order. That means updating how you calculate LTVs, how you value gold, how quickly you return collateral, how you handle auctions, and more.

If you are still figuring out where to start, this guide is for you. But first, let’s see the current state of gold loans in India.

Ensure RBI Compliance with Signzy

What's happening with gold loans in 2026? Current state of the market explored

- Gold loans are now one of the fastest-growing retail credit segments in India. As said earlier, outstanding gold loans hit ₹3.38 lakh crore by October 2025, recording a massive 128.5% year-on-year growth.

- The organized market is on track to double in less than two years: The combined gold loan market (banks and NBFCs) reached ₹11.8 lakh crore in March 2025 and is projected to hit ₹15 lakh crore by March 2026, according to ICRA.

- Surging gold prices have unlocked significantly higher borrowing capacity: Gold prices jumped nearly 64% in 2025 to around ₹1.35 lakh per 10 grams, allowing borrowers to get larger loans against the same amount of jewelry.

- There's massive room for growth as formalization increases: Indian households hold approximately 25,000 tonnes of gold, but the organized lending sector currently taps into only about 5.6% of this potential.

This explosive growth, combined with regulatory concerns about inconsistent practices and borrower protection gaps, prompted the RBI to issue comprehensive Master Directions in June 2025.

What are the RBI's new gold loan rules? Quick recap

RBI's new gold loan rules merge decades of fragmented regulations into a single set of standards, giving all lenders until April 1, 2026, to comply. Here are the seven key changes:

Rule #1: The loan-to-value ratio now follows a three-tier structure

The RBI has replaced the old flat 75% LTV cap with different limits based on loan size. The new calculations should be done with new rates:

- Loans up to ₹2.5 lakh: 85% LTV (up from 75%)

- Loans between ₹2.5-5 lakh: 80% LTV

- Loans above ₹5 lakh: 75% LTV

In practice, if someone pledges gold worth ₹1 lakh, you can now lend up to ₹85,000 instead of ₹75,000, as long as the loan stays under ₹2.5 lakh. That extra ₹10,000 makes a real difference for rural and small-town customers who use gold loans for emergencies or business needs.

Small borrowers get easier access to credit, while bigger loans stay at conservative limits to keep risk under control. The regulator wants to help the bottom of the pyramid without taking on too much risk.

Rule #2: Bullet repayment loans face a 12-month cap with stricter LTV calculations

Bullet repayment loans (where customers pay everything at the end) are now capped at 12 months maximum. But there's a bigger change in how you calculate LTV.

The new rule: When calculating LTV, you must include the interest that will be due at maturity, not just the loan amount.

Say you have gold worth ₹10 lakh and you charge 18% interest for 12 months.

- Before: You calculated LTV on ₹7.5 lakh (the loan amount)

- Now: You must calculate LTV on ₹7.5 lakh + ₹1.35 lakh interest = ₹8.85 lakh total

To stay within 75% LTV when the loan ends, you can only give around ₹6.3-6.4 lakh upfront (about 63-64% of the gold value).

So if you do a lot of bullet loans, your lending amounts per customer will drop by 10-15%. You might need to push customers toward monthly payments instead, or accept giving out less money per loan.

🟢 Signzy advantage: Signzy's Gold Compliance Firewall automatically factors in accrued interest when calculating LTV for bullet repayment loans, ensuring compliance with the maturity-based calculation requirement and preventing lending teams from inadvertently breaching limits.

Rule #3: Lenders must return pledged gold within seven working days

The RBI now says you have seven working days to return gold after the loan is paid off. If you're late, you pay the customer ₹5,000 for each day of delay. Basically, you now need to configure your processes and systems to handle gold returns quickly and accurately.

The ₹5,000 daily penalty is meant to hurt enough that you take this seriously. If your branches currently take 10-15 days to return gold, you need to fix that before April 2026.

Rule #4: Gold valuation follows standardized, transparent processes

The RBI wants everyone to value gold the same way. Here's what you must do now:

- The customer must be present when you check the gold

- Use 22-carat gold as your standard (if the gold is of a lower purity, convert it to 22-carat equivalent)

- Use the lower price of: yesterday's closing price OR the average of the last 30 days

Before this, different lenders used different methods. Some used 18-carat as the base, others used 24-carat. Some used today's price, others used old prices. Customers got confused and couldn't compare offers easily.

This puts everyone on the same page. You can't compete by using generous valuation methods anymore. You'll need to compete on service speed and customer experience instead.

Rule #5: There are limits on how much gold you can pledge

RBI wants to stop customers from borrowing too much across multiple lenders. If one person has pledged 5 kg across different banks and NBFCs, it becomes a bigger problem if they default. Hence, RBI has now set limits per customer:

- Maximum 1 kg of gold ornaments total (across all lenders)

- Only 50 grams can be gold coins (must be 22-carat coins issued by banks)

You need to check if the customer has already pledged gold somewhere else. Right now, there's no easy way to do this. The industry will probably need a central database (like the one for property loans) to make this work properly.

Lenders are also required not to take these types of gold as collateral:

- Raw gold or silver (not made into jewelry)

- Gold ETFs or mutual funds

- Gold that's already pledged elsewhere

- Gold where ownership is unclear or disputed

Rule #6: Credit appraisal requirements depend on loan size

Here's good news for small loans: if the loan is up to ₹2.5 lakh, you don't need detailed income checks. This means no income proof and no credit score checks. Just the gold value matters.

You can approve these loans much faster. Customers in villages, self-employed people, and anyone without salary slips can get loans in hours instead of days. Speed becomes your advantage in this segment.

For loans above ₹2.5 lakh, you need full checks:

- Income proof and repayment capacity check

- Purpose of loan (personal or business, not both)

- Regular checks on how the money is being used

- Documents showing the loan is used as stated

To put it in a line: You need two different processes. A quick one for small loans, and a detailed one for bigger loans.

🟢 Signzy advantage: Signzy's workflow engine creates separate fast-track processes for loans under ₹2.5L (minimal checks) and detailed appraisal paths for larger loans, automatically routing applications based on amount without manual intervention.

Rule #7: Auction and renewal processes have become more stringent

The RBI has made three areas stricter to avoid problems and protect customers:

- Auction process: You need to announce auctions publicly in at least two newspapers (one local, one national). The starting bid must be at least 90% of the current market value. You and your related parties cannot participate in the auction. Any surplus after loan recovery must go back to the customer within seven days.

- Loan renewals: Renewals are only allowed if the loan still falls within LTV limits. For bullet repayment loans, customers must clear the accrued interest before they can renew. Each renewal needs a fresh credit assessment.

- Loan top-ups: Top-ups can only happen if they stay within LTV limits. The customer needs to make a formal request, and you must conduct a fresh appraisal before approving.

Who needs to comply with RBI's new gold loan rules?

The June 2025 Master Directions (updated in September 2025) apply to all regulated entities involved in gold lending. If your institution offers loans against gold or silver collateral, these rules are mandatory. Here's who falls under the new framework:

#1: Commercial banks

This includes all scheduled commercial banks operating in India, both in the public and private sectors. Small finance banks and regional rural banks are also covered.

The only exception is payment banks, which aren't authorized to lend against collateral anyway. If you're a bank offering gold loans (including agriculture loans backed by gold jewelry), full compliance is required by April 1, 2026.

#2: Non-banking financial companies

All NBFCs that provide loans against gold or silver must follow these guidelines. This covers dedicated gold loan NBFCs like Muthoot Finance and Manappuram, as well as diversified NBFCs that have gold loans as part of their product mix.

The rules apply regardless of your NBFC category or the size of your gold loan portfolio. There are no exemptions based on ticket size or business model.

#3: Cooperative banks and housing finance companies

Urban cooperative banks and primary cooperative banks offering gold loans fall under this framework. Housing finance companies that extend gold-backed loans are also covered.

Even if gold lending is a small part of your overall business, compliance is mandatory. The RBI has made it clear that the rules apply uniformly across all regulated lenders, regardless of institution type.

Existing loans will continue under the old framework until maturity, but any renewals or top-ups after April 2026 must comply with the updated norms.

How lenders can meet RBI's new gold loan norms with Signzy?

The April 2026 deadline is not far off, and meeting the new Master Directions requires more than policy updates. You need technology that can handle document verification, borrower authentication, digital contracts, and compliance checks at scale.

Signzy helps lenders automate the heavy lifting of compliance.

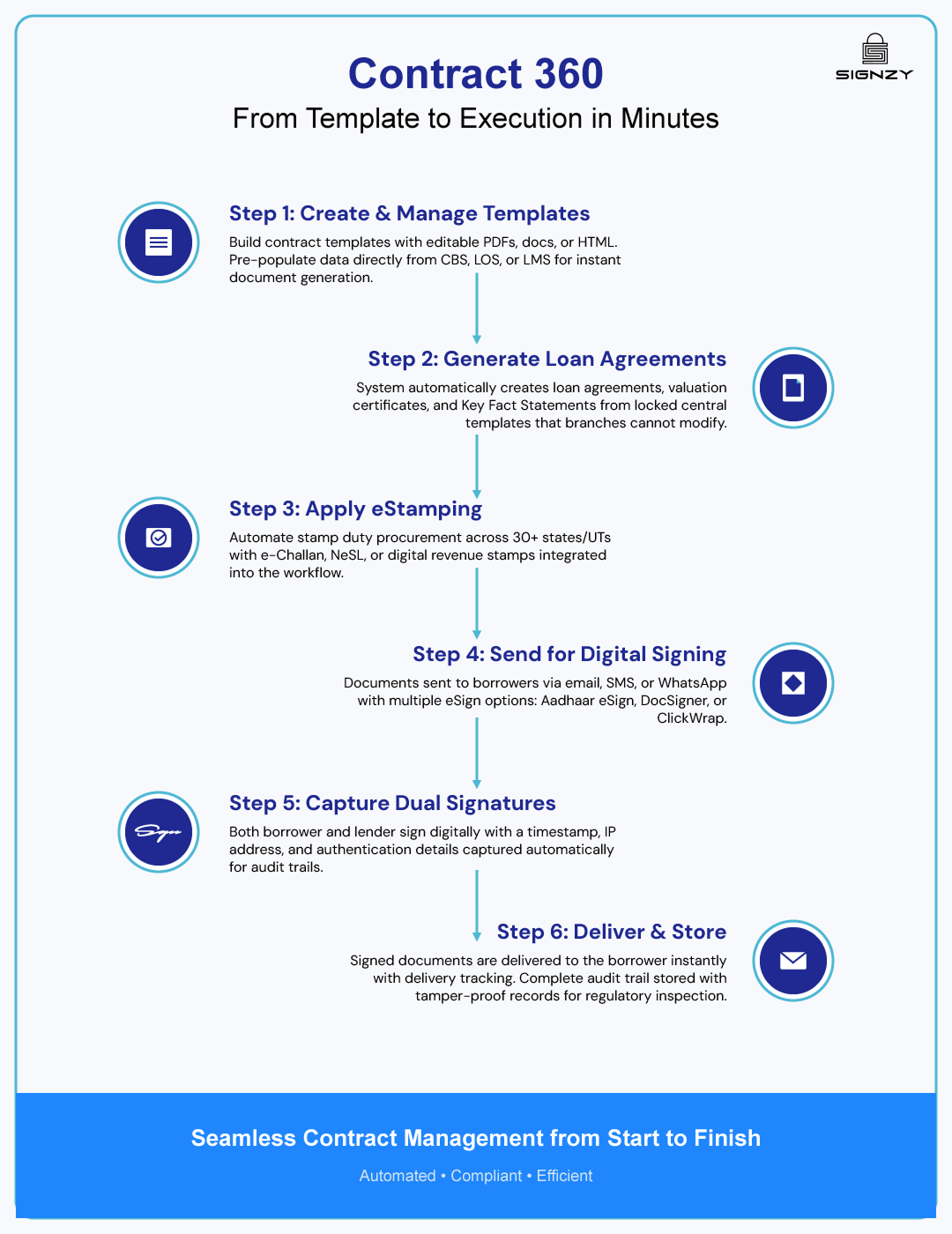

Contract360: End-to-end digital contract management

Gold loan agreements need to be executed quickly, tracked properly, and stored securely. Contract360 handles the entire contract lifecycle digitally. You can create loan agreements from templates, send them for signing through multiple methods, including Aadhaar eSign, track who signed when, and store completed contracts with full audit trails.

The platform supports automated workflows, so once a loan is approved, the contract gets generated and sent to the borrower without manual intervention. It also integrates eStamping, which is critical for loan agreements in many states.

Everything is timestamped, logged, and audit-ready, which helps when regulators come checking.

“RBI's new LTV calculations with accrued interest are going to slash our bullet loan disbursals by 15%. We brought in Signzy's Contract360 to automate the new calculations and help shift customers to monthly repayment options. Already transitioned 1,400+ loans in our pilot branches successfully." — Head of Gold Loans, Regional Cooperative Bank.

Supporting verification suite: One Touch KYC, NDD checks, and Aadhaar eSign

The new rules require tighter borrower verification and faster documentation. Signzy's verification tools work together to cover these needs.

"The ₹5,000 daily penalty rule for gold returns has us completely rethinking our operations. Signzy's system now sends automatic alerts 3 days before the 7-day deadline. We've been testing it for 2 months and haven't missed a single return deadline across 15 pilot branches." — Operations Manager, Gold Loan NBFC.

- One Touch KYC: Verifies borrower identity in seconds using document OCR, face match, and liveness detection. The system extracts data from ID cards, matches the selfie with the ID photo, and checks if the person is physically present (not using a photo or video). This covers the identity verification requirement for loans above 2.5 lakh and speeds up the process for all borrowers.

- NDD (Negative Due Diligence) checks: Screens borrowers against databases like PEP lists, sanctions lists, watchlists, and adverse media. This is important for compliance and helps you avoid lending to high-risk individuals. The checks run in real time, so you get results before disbursing the loan.

- Aadhaar eSign: Let borrowers sign loan agreements digitally using their Aadhaar number and OTP. It is legally valid under the IT Act and eliminates the need for physical signatures. Borrowers can sign from anywhere, which is useful when they are not visiting the branch. The signed document includes a timestamp, an IP address, and authentication details for audit purposes.

To know more, book a demo to see how Signzy can help your institution meet RBI's new gold loan requirements without slowing down operations.

FAQ

Can lenders repledge gold that borrowers have already pledged with them?

What happens to unclaimed gold after loan repayment?

Can lenders or their related parties bid in gold auctions?

What is the minimum reserve price for gold auctions?

Can borrowers pledge gold for both personal and business purposes simultaneously?

Madhu Srinivas

Madhu is the Chief Risk and Compliance Officer at Signzy. Before joining Signzy, he was the CEO and cofounder of Difenz - a risk management platform acquired by Signzy. Madhu enjoys talking about governance, fraud prevention, and compliance risks in India.

![Video KYC: Pros, Cons and Key Differences [2025]](https://cdn.sanity.io/images/blrzl70g/production/7bbc8274feeb85b1d7452245a7fe034b8105e572-2560x600.webp)

![AML Regulations India: Laws, Regulators, and More [2026 Guide]](https://cdn.sanity.io/images/blrzl70g/production/eba10e392ea6647d3a8aa7460e7407e9fea46658-5693x1334.png)