Age Verification API

Age Verification

Maintain top-notch security against cyber crimes with age verification APIs. Stay compliant to the regional age-related regulations across the globe and keep fraudsters at bay.

Efficient.Secure.Password-free

<3

Sec API Response Time

Users never settle for slow, and neither should you. Signzy’s quick response time means 60% less dropoffs for businesses.

100M+

Users Verified

Grow fearlessly with APIs that scale with your business. Millions trust Signzy for secure and seamless verification.

2x

More Fraud Detection

Have a secure and seamless onboarding journey. Fight fraudsters and low pass rates with 1 tool.

Trusted by industry leaders

Build trust at first sight

Keep minors out and onboard honest users with confidence. Verify users of any age with zero gaps or guesswork.

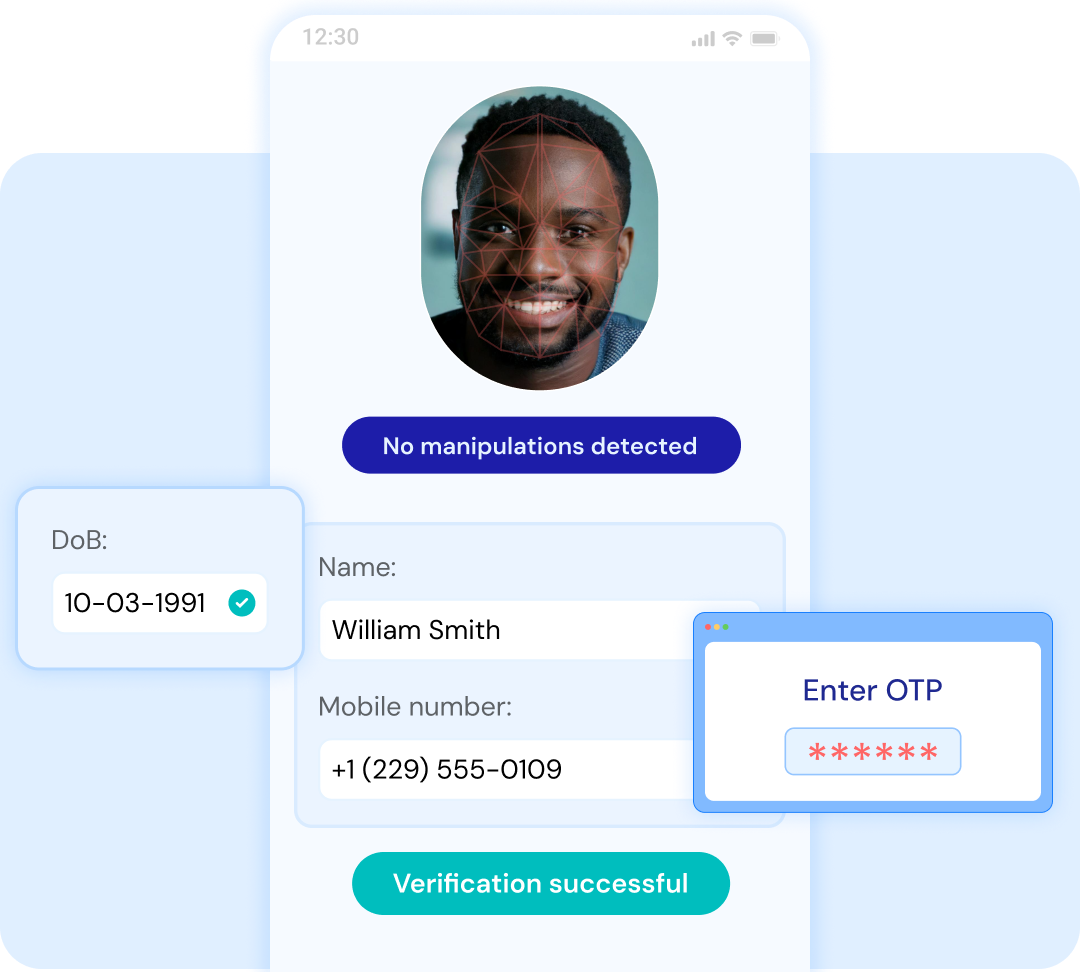

Verify user age within seconds

Validate user age with gaming, e-commerce, social media platforms, and many more to swiftly and accurately onboard users by automating age verification.

Identify and eliminate fraudsters

Verify users against global databases and lists to ensure only legitimate and age-appropriate customers are onboarded on your business.

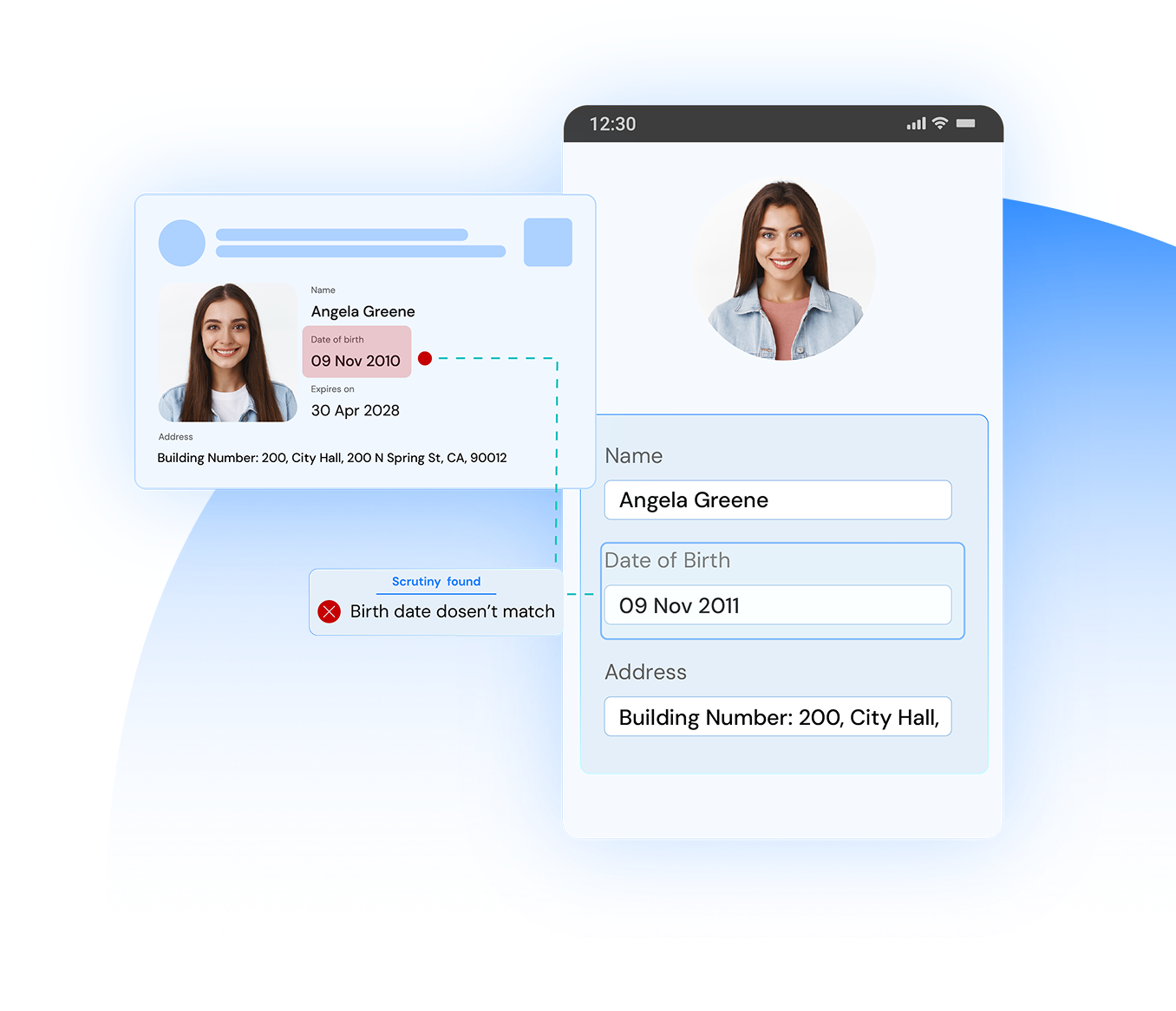

Offer the best user experience

Provide a secure and delightful user experience with your brand’s design guidelines. Get real-time age feedback on selfies or government IDs, reducing chances of false positives and negatives.

Reliable identity checks for all your use cases

Discover background and identity checks that fight imposters on the front line

Food, Drink & Lifestyle

Gaming & Gambling

Banking

E-commerce & Deliveries

Media, Social & Streaming

Events & Entertainment

Get the complete ID verification stack

Make your entire background verification process seamless for KYC, KYC, or AML checks

Developers love us for a reason!

Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks!

Related Blogs

FAQ

What is the Age Verification API?

Age Verification API helps businesses confirm users meet minimum age requirements. It provides fast, automated age checks to help you comply with regulations and prevent underage access to age-restricted products and services.

How does the Age Verification API determine a user’s age?

The Age Verification API verifies age by analysing government-issued IDs and cross-referencing trusted data sources. It delivers real-time results with high accuracy, minimising both false approvals and false rejections.

Why do businesses need age verification?

Age verification helps you comply with legal requirements across industries. It protects minors, reduces regulatory risk, and helps prevent fraud by confirming users are who they claim to be.

Does age verification help with fraud prevention?

Yes. By validating both age and identity against trusted sources, Age Verification API helps you detect and block fraudulent accounts, ensuring only legitimate, age-appropriate users are onboarded.