KYC AML Compliance

AML + KYC Compliance that scales with your ambition

Verify customer identities with forensic precision, then monitor their transactions for suspicious patterns. Our unified platform catches both identity fraud and money laundering across 180+ countries — because one without the other leaves you vulnerable.

100M+

Users Verified

2x

Fraud Detection

<3s

API Response Time

Trusted by industry leaders

Compliance that doesn’t kill growth

Explore a unified platform where bulletproof KYC verification meets relentless AML monitoring

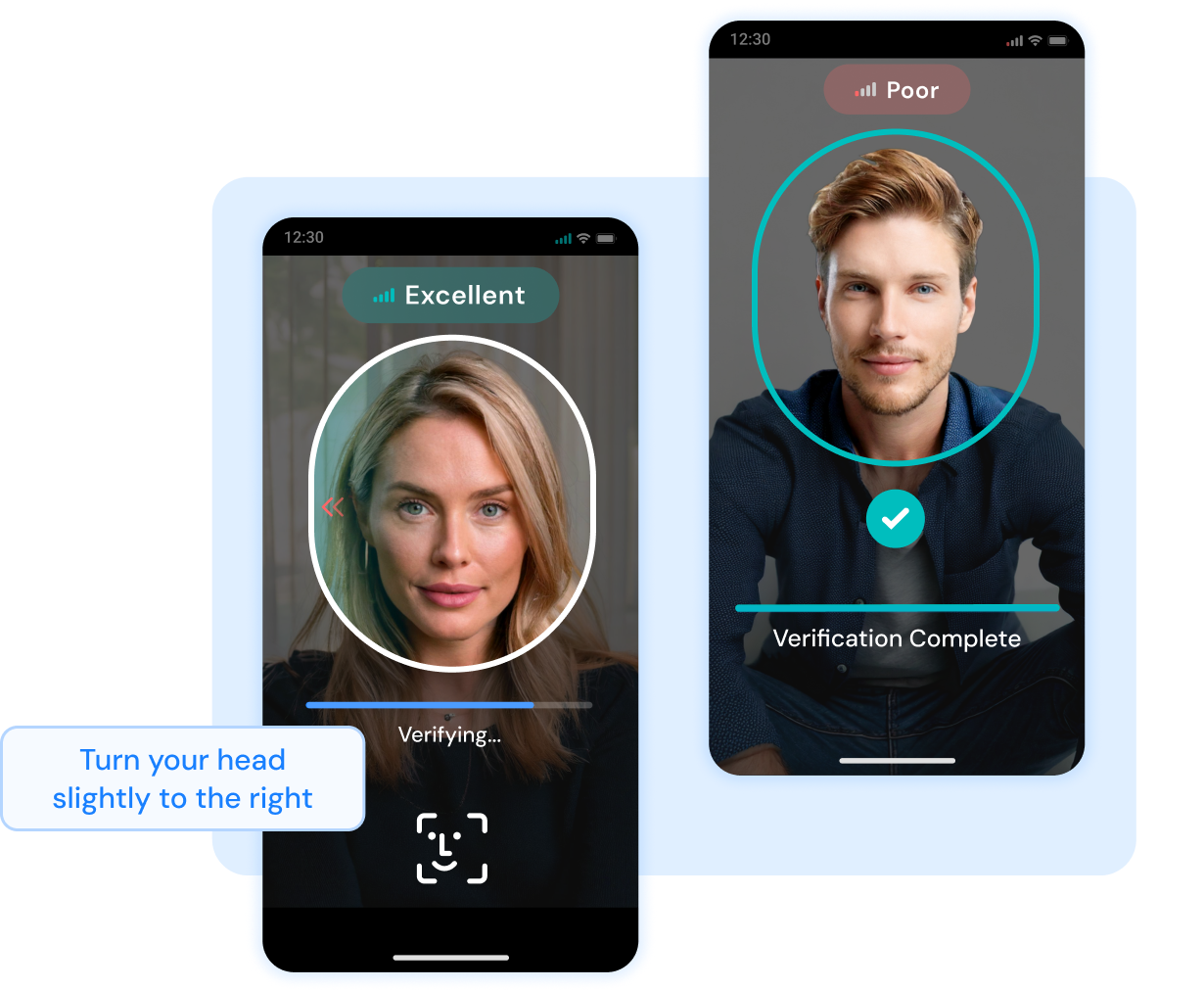

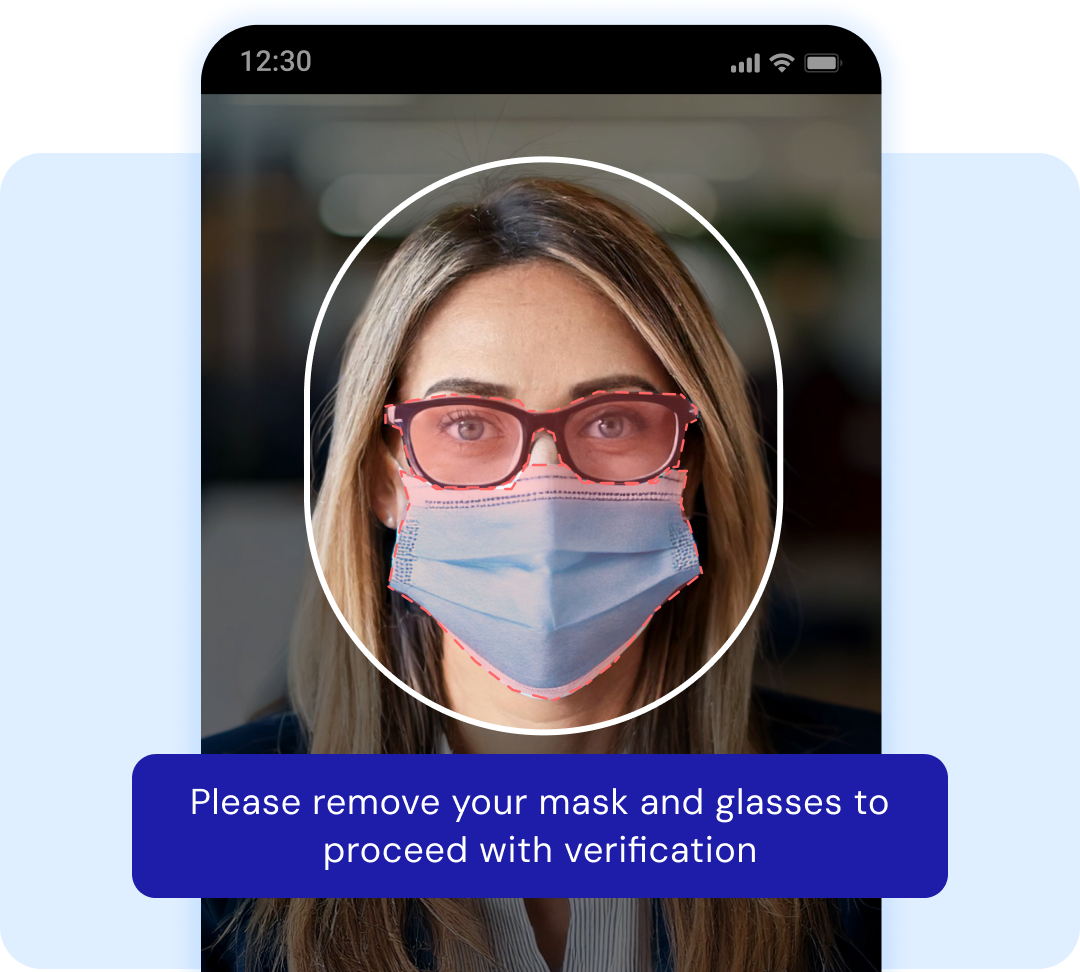

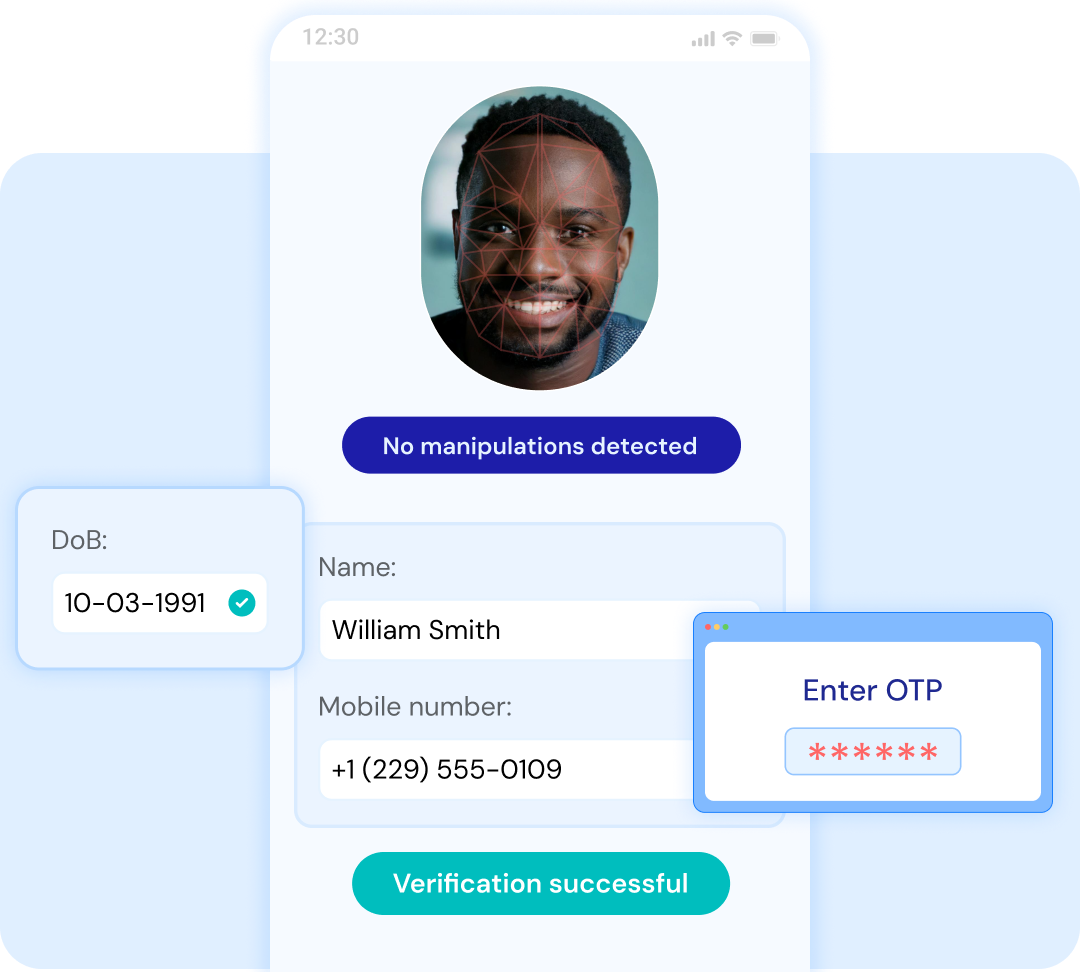

Deepfake-resistant KYC with global document intelligence

Our AI analyzes 10,000+ document formats across 180+ countries, detecting forgeries, tampering, and synthetic identities. Advanced liveness detection and biometric matching ensure the person behind the ID is real. From passports to national IDs, we verify authenticity in 50+ languages with forensic precision.

AI-powered AML monitoring that evolves with threats

Screen against 1,000+ sanctions lists, PEP databases, and adverse media while monitoring transaction patterns for money laundering. Our machine learning spots structuring, layering, and emerging schemes in real-time. Get precision alerts on real threats, not noise—keeping legitimate customers moving.

Regulatory confidence from onboarding to ongoing monitoring

Enter new markets fearlessly with KYC/AML workflows that adapt automatically. Our platform tracks identity verification requirements and AML regulations across jurisdictions. Meet BSA, EU directives, and local compliance standards without rebuilding your entire stack.

Catch financial crime before it happens

From KYC onboarding to AML alerts, eliminate compliance silos with intelligence that connects every dot.

One Touch KYC

Simplify the Know Your Customer (KYC) process with AI and sophisticated fraud detection algorithms to provide a seamless, efficient, and highly secure user verification.

AML Screening

Stay one step ahead of fraud and money laundering — mitigate risk and screen users against Politically Exposed Persons (PEP), sanctions lists, adverse media, etc.

Transaction Monitoring

Analyse financial transactions to detect suspicious activities while also ensuring compliance with increasingly stringent AML regulations.

Risk Assessment

Build comprehensive risk profiles based on customizable risk levels. Analyze cashflow data, credit reports, risk patterns, and much more.

Developers love us for a reason!

Integrate the API during lunch hour, customize based on your needs, and go live within 2-4 weeks!

Related Blogs

FAQ

What is Signzy's AML Screening & Monitoring solution?

Signzy's AML Screening & Monitoring solution is a comprehensive platform designed to help financial institutions prevent financial crimes, including money laundering, fraud, andterrorist financing. It offers real-time transaction monitoring, AI-powered risk assessments, false-positive reduction, and seamless integration with existing compliance workflows.

How does Signzy's AML solution help reduce false positives?

Signzy's platform uses AI-driven analytics to intelligently identify true threats and minimize false positives. By analyzing transaction data with high precision, it allows compliance teams to focus on high-risk cases and improve decision-making accuracy.

What compliance regulations does Signzy's AML solution support?

The solution is built to support global and local AML regulations, including FATF, OFAC, and CFT requirements. It integrates seamlessly with financial institutions' compliance frameworks to ensure adherence to regulatory standards and reduce compliance risks.

How does the real-time transaction monitoring work?

The AML solution monitors transactions in real-time, flagging suspicious activities as they occur. Through advanced AI and rule-based detection, it tracks anomalies in customer behavior, cross-references data with global sanction lists, and triggers alerts based on predefined risk criteria.

Can Signzy's AML solution integrate with other banking systems?

Yes, Signzy's AML platform is designed for easy integration with a variety of banking and financial systems, including core banking platforms, KYC/AML databases, and third-party fraud detection services. Integration is streamlined with API-based connectivity, ensuring smooth workflow automation.

How does your AML solution ensure data privacy and security?

Signzy follows industry-standard security protocols, including encryption (AES-256), data anonymization, and secure access controls to ensure that sensitive customer data is protected.

The platform is fully compliant with global data privacy regulations like GDPR and CCPA.

Is your AML solution customizable?

Yes, Signzy's AML solution is highly customizable. Financial institutions can tailor the risk thresholds, detection rules, reporting formats, and other aspects of the platform to meet their specific regulatory requirements and business needs.

How quickly can the AML platform be deployed?

The deployment process is quick and efficient, typically taking a few weeks to integrate and configure the AML solution into your existing systems. Signzy provides full technical support to ensure smooth implementation.

![FINRA Rule 2090: Know Your Customer Requirements [2026 Guide]](https://cdn.sanity.io/images/blrzl70g/production/ed4b5a8ceb78cf2f2d98312cecca21829dd5a6f5-1354x318.webp)