Signzy vs Veriff: Comparing Document Support, Integration Capabilities, Pricing, and More

Now we’re talking. Veriff’s no joke – they’re one of the biggest names in identity verification. Estonian company, raised serious money, works with major brands.

Both platforms are mature, well-funded, and handle millions of verifications. This isn’t about picking between a startup and an established player – you’re choosing between two heavyweights.

Veriff’s known for smooth user experience and European compliance expertise. Signzy built for global coverage and handling complex verification scenarios. Both approaches work.

The decision probably isn’t about basic capabilities – we both nail the fundamentals. It’s about which platform fits better with your specific needs, team, and long-term plans.

This comparison gets interesting because we’re actually competing for the same customers. Similar scale, different philosophies.

Let’s dig into where each platform really shines and where you might hit limitations

Related Solutions

Quick Glance – Signzy vs. Veriff

| Feature | Signzy | Veriff |

|---|---|---|

| No-Code Integration | ✅ | ❌ |

| 340+ APIs Available | ✅ | ❌ |

| Banking-Grade Security | ✅ | ✅ |

| Real-Time Processing | ✅ | ✅ |

| Asia Market Expertise | ✅ | ❌ |

| Enterprise Support 24/7 | ✅ | ✅ |

| Metaverse Ready | ✅ | ❌ |

| Fortune 30 Partnerships | ✅ | ❌ |

| Document Coverage | ✅ | ✅ |

| AI-Powered Fraud Detection | ✅ | ✅ |

| Video KYC | ✅ | ✅ |

| Global Compliance | ✅ | ✅ |

💡 Related Blog:

Document Support

The Verdict: Veriff wins on document count, Signzy wins on document understanding.

Veriff’s 12,000 Documents Sounds Impressive

Veriff supports over 12,000 government-issued documents from 230+ countries. That’s genuinely impressive and it works well if you need broad global coverage right away.

Their platform handles 48 languages and different scripts including Latin, Cyrillic, Arabic, and Japanese. If you’re launching globally and need to accept whatever ID someone throws at you, that breadth matters.

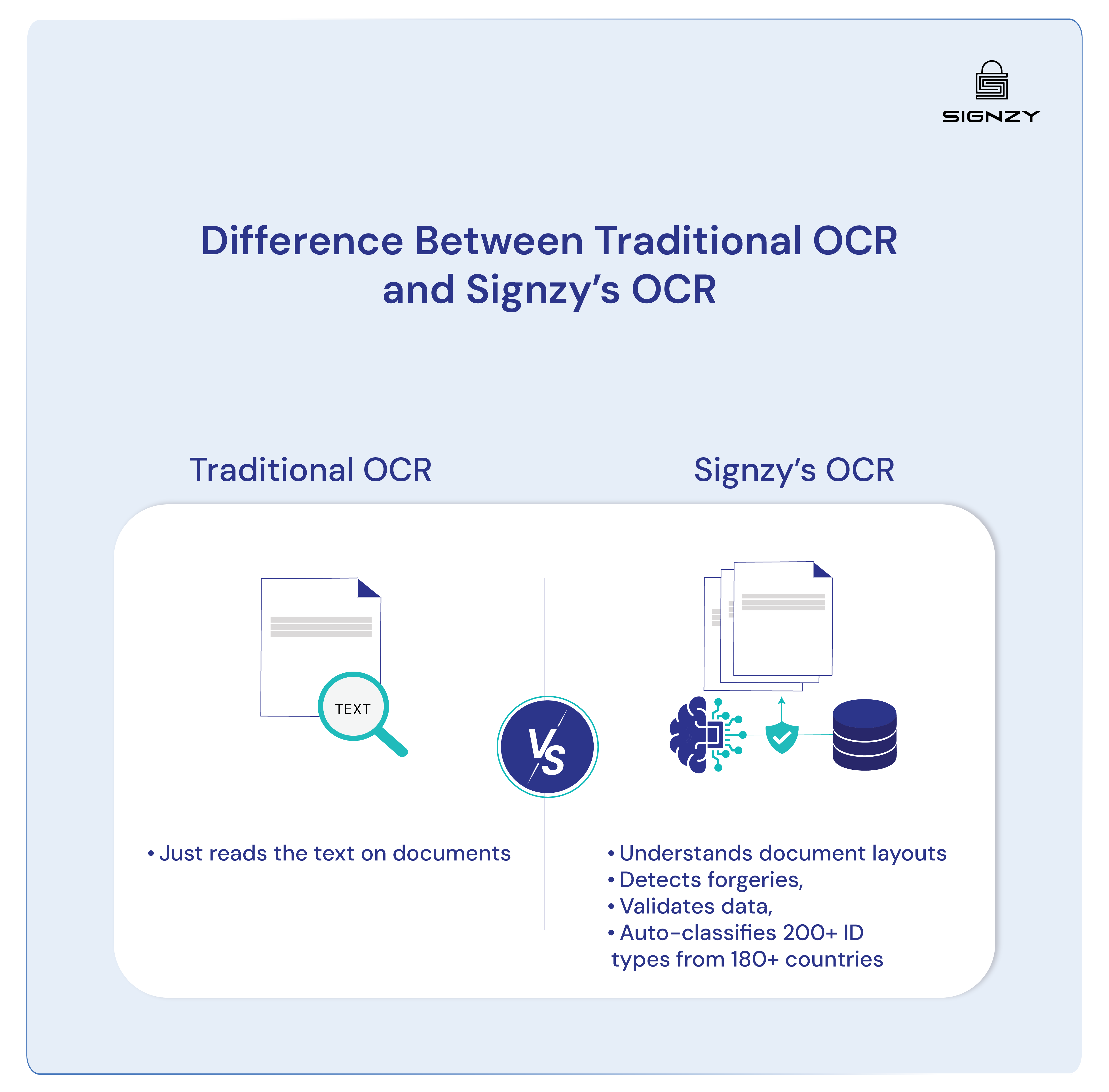

Signzy Actually Does Something Different

We, at Signzy, handle 200+ ID types from 180+ countries. Smaller numbers, but here’s the thing: our OCR does more than just reading text. It understands document layouts, catches forgeries, validates expiry dates, and figures out what type of document it’s looking at automatically.

When someone submits a document, instead of just extracting data, we’re determining if it’s legitimate, if it’s been tampered with, and if it meets compliance requirements globally. That’s a bigger deal than it sounds.

Bottomline

If you’re running a consumer app and need to verify people from everywhere immediately, Veriff’s document library gives you more options. If you’re in financial services where a fake document could cost you serious money or regulatory trouble, you probably care more about whether we can spot forgeries than whether we support every regional ID variant.

Integration Capabilities

The Verdict: Signzy eliminates developer bottlenecks, Veriff works well with strong dev teams.

Signzy’s No-Code Approach Actually Matters

We have 340+ APIs that plug into workflows without code. When we say no-code, we mean your compliance team can change verification rules without filing engineering tickets.

Need to add a new AML check for a specific region? Your operations team can do it. Regulator changes requirements? You can adapt the same day instead of waiting for the next development sprint.

Veriff’s Developer Approach Works Better Sometimes

Veriff gives you clean APIs and SDKs for iOS, Android, and web. If you have a strong engineering team and want full control over the implementation, their approach is solid. Good documentation, predictable integration patterns, free sandbox.

Some companies prefer this because they want their developers controlling exactly how verification works rather than giving that control to business teams.

Bottomline

We optimize for business team control. They optimize for developer control. Both work, but if your verification requirements change frequently or you don’t have tons of engineering resources, business team control usually wins.

Fraud Detection

The Verdict: Both stop fraud, but they’re solving different problems.

Veriff Does Identity Fraud Detection Well

Veriff analyzes 1,000+ data points including network and device analytics. They get 98% automation on fraud detection, which means most bad actors get caught without human review.

They’re really good at identity fraud. If someone’s using a fake ID or trying to impersonate someone else, Veriff catches it efficiently. For most consumer businesses, that’s exactly what you need.

Signzy Goes Beyond Identity Fraud

We have a patent on Fraudulent Behaviour Detection technology that predicts fraudulent behavior in real-time. This goes beyond “is this ID real” to “is this person likely to commit fraud based on their behavior patterns.”

Our system monitors transactions and adapts to new fraud patterns as they emerge. So we’re not just checking if someone is who they say they are, we’re analyzing if they’re behaving like someone who’s planning to do something fraudulent.

Bottomline

Veriff is optimized for identity fraud, which covers most online businesses. We tackle financial crime more broadly, including money laundering patterns and behavioral fraud that goes beyond simple identity theft.

Pricing

The Verdict: Veriff shows you costs upfront, we often cost less when you factor in everything.

Veriff’s Pricing Model is Transparent

Veriff starts at $0.80 per verification and goes up to $1.89 for premium features. They give you 15 days free with 50 sessions. No setup fees, which is nice.

This transparency makes budgeting easier. You know exactly what each verification costs, and basic fraud detection is included.

Signzy’s Pay-As-You-Go Model

We offer pay-as-you-go pricing so you can expand as and when needed. You can also go modular and pay for specific APIs if you don’t need the full suite. This flexibility means you’re not locked into packages that don’t fit your actual usage.

Our customers report 80% cost reduction and 60% fewer customer drop-offs because you’re only paying for what you use, when you use it. Plus, with our 340+ APIs available individually or together, you often don’t need other vendors.

When You Should Choose Us

Here’s when Signzy makes the most sense based on what we’ve seen.

- You’re in Financial Services Without Huge Tech Teams

Our no-code platform means smaller fintech companies and regional banks can implement enterprise-grade verification without massive engineering resources. You get sophisticated AML screening, behavioral fraud detection, and regulatory compliance without building it yourself.

We work with Fortune 30 companies and major banks because we handle the compliance complexity that consumer-focused tools miss.

- You Need Global Compliance Expertise

We’re a global platform that understands document variations and compliance requirements across all markets. Whether it’s validating visas, extracting addresses from utility bills, or processing vehicle registrations, we handle regional complexity automatically across 180+ countries.

This matters whether you’re operating in established markets like the US and Europe or expanding into Asia, Latin America, and other regions where document standards differ significantly.

- You Want a Partner, Not Just a Vendor

We work strategically with our enterprise customers on compliance strategy and regulatory guidance. If you need help designing compliant workflows or understanding regulatory requirements, we provide that consulting alongside the technology.

- You’re Building for Future Finance

We have a US patent for customer onboarding in the metaverse using VR and AR technology. If your roadmap includes crypto, DeFi, virtual banking, or other emerging financial tech, our innovation focus aligns with where finance is heading.

When Veriff Makes More Sense

There are definitely scenarios where Veriff is the better choice.

- Speed Trumps Everything Else

Veriff does 6-second verifications with 95% first-pass rates. If you’re optimizing purely for conversion and user experience, that speed advantage matters more than compliance depth.

- You Want Simple Vendor Relationships

Veriff’s self-serve model means less account management and fewer strategic discussions. If you prefer buying technology rather than partnering on compliance strategy, their approach reduces vendor overhead.

The Real Decision: Pick Between Signzy and Veriff

Both platforms work, but they solve different problems.

- If you need comprehensive compliance capabilities, behavioral fraud detection, and the flexibility to adapt quickly to regulatory changes, our pay-as-you-go approach with 340+ APIs usually delivers better business outcomes and lower total costs.

- If you’re running a consumer app where speed is everything and you want simple per-transaction pricing, Veriff’s 6-second verification might be worth the trade-offs in compliance depth and cost flexibility.

Want to see how our approach applies to your specific situation? Let’s talk about your actual requirements and show you the cost difference. Talk to Our Team Here.

FAQ

Does Signzy require technical knowledge to implement?

Can both platforms detect document forgeries?

Which is better for financial services compliance?

Do both platforms offer free trials?

Shivam Agarwal

Shivam heads the go-to-market strategy at Signzy. He holds the CFA charter and a strong background in financial operations, PE analysis and strategy. His prior roles include business strategy and private-equity analysis in the financial services and fintech domain, giving him deep insight into client needs, risk-adjusted economics and monetisation models for compliance & identity verification platforms.