Signzy vs Persona - Which Identity Verification Platform Wins in 2026?

So you need identity verification and everyone’s telling you different things about which platform to pick.

Your dev team wants something that won’t make them hate their lives. Your compliance team needs something bulletproof. Your CFO wants to know why this costs so much. And your customers? They just want to get verified without jumping through hoops.

Both Signzy and Persona solve the same basic problem – they check if people are who they say they are. Both have happy customers and solid tech.

But here’s the thing: the “best” choice depends entirely on stuff that’s specific to you. Where your customers are, what documents they have, how your team works, what you can actually afford.

Let’s figure out which one makes sense for your situation.

Related Solutions

Signzy vs Persona Quick Glance

| Feature | Signzy | Persona |

|---|---|---|

| Global Coverage (180+ Countries) | ✅ | ✅ |

| Document Verification | ✅ | ✅ |

| Biometric Verification | ✅ | ✅ |

| Configurable Workflows | ✅ | ✅ |

| No-Code Platform | ✅ | ✅ |

| API Integration | ✅ | ✅ |

| KYC Compliance | ✅ | ✅ |

| KYB Verification | ✅ | ✅ |

| AML Screening | ✅ | ✅ |

| Bank Account Verification | ✅ | ❌ |

| Digital Contracting | ✅ | ❌ |

| Enterprise Scale | ✅ | ✅ |

💡 Related Blog:

Signzy

Platform Overview

Unlike pure-play identity verification companies, Signzy built something different: a modular platform where you can start with just identity verification and expand as needed. This pay-as-you-use approach means you’re never paying for capabilities you don’t need, but you’re never stuck rebuilding integrations when you want to expand.

Signzy also actually consolidates the entire stack. We handle the document and biometric verification, then seamlessly move into credit assessment, bank account verification, ongoing AML monitoring, and even digital contracting – all through the same integration.

It’s why major banks and Fortune 30 companies choose us: they get enterprise-grade verification capabilities plus everything else they need for complete customer lifecycle management.

Feature Suite

- Beyond Basic Verification: We verify documents and biometrics like everyone else, but then we keep going. Real-time credit scoring, bank account validation, transaction monitoring, UBO verification, and digital contract execution all happen in the same platform with the same data set.

- Revenue Optimization: Our integrated approach means your verification data immediately feeds into risk assessment and compliance workflows. Instead of rebuilding customer profiles across multiple systems, everything flows seamlessly from onboarding through ongoing relationship management.

- Actual Innovation: While others focus on incremental verification improvements, we’re building for the future of financial services. One Touch KYC (recognized by Gartner), metaverse onboarding capabilities, and behavioral fraud detection that learns from our massive transaction dataset.

Pros

- Stop vendor juggling: One platform replaces 3-4 different vendors, eliminating integration headaches and data silos

- Built for financial scale: Major banks trust us with their core operations – not just pilot projects

- Works where others fail: Strong performance in emerging markets and complex regulatory environments

- Revenue impact: Verification data immediately improves credit decisions and reduces operational costs

- Future-ready: Innovation roadmap aligned with where financial services is heading, not just identity verification

Cons

- Feature abundance: The platform can do more than basic identity verification, which might feel overwhelming if that’s all you need

- Learning curve: Full platform potential requires understanding how the pieces connect

Pricing

Simple pay-as-you-use model. Want just vKYC verification? Pay per verification. Need a risk assessment too? Pay for those calls separately. Most customers start with one or two APIs and expand over time. No platform fees, no forced bundles for capabilities you don’t use.

Persona

Platform Overview

Persona took the opposite approach from most identity verification companies. Instead of building a rigid platform with fixed workflows, they created the most configurable identity system in the market. Their thesis: every business has unique identity requirements, and forcing them into preset workflows creates friction and missed opportunities.

This philosophy has paid off. Persona ranked #1 across all use cases in Gartner’s Critical Capabilities report and highest for execution in the Magic Quadrant. They serve over 3,000 customers including OpenAI and LinkedIn, precisely because they can adapt to any business model or industry requirement without compromising on security or compliance.

Feature Suite

- Ultimate Flexibility: Persona’s no-code workflow builder lets you design exactly the identity verification process you need. Want document verification for some users, database checks for others, and full biometric verification for high-risk cases? You can configure all of this without touching code.

- Industry-Agnostic Design: Whether you’re running a dating app, crypto exchange, or healthcare platform, Persona adapts to your specific requirements. Their building blocks approach means you’re not forced into workflows designed for other industries.

- Advanced Fraud Prevention: Persona’s fraud detection goes beyond standard checks. They identify fraud rings, detect synthetic identities, and use behavioral analysis to catch sophisticated attacks that bypass traditional verification methods.

- Global Document Mastery: Document verification across 200+ countries with expertise in handling complex international documents, multiple scripts, and regional variations that trip up other platforms.

- Enterprise Identity Hub: Centralized identity management that grows with your business. Store, manage, and act on identity data across your entire customer lifecycle with detailed audit trails and privacy controls.

Pros

- Configure anything: Most flexible identity platform available – if you can imagine the workflow, Persona can build it

- No engineering required: Complex verification flows can be built and modified by business teams, not just developers

- Fraud leadership: Cutting-edge protection against emerging threats including AI-generated attacks and sophisticated fraud techniques

- Universal application: Works for any industry, business model, or regulatory environment

Cons

- Identity only: Exceptional at verification, but you’ll need other vendors for credit, banking, or financial services capabilities

- Configuration overhead: Maximum flexibility can lead to over-engineering simple verification needs

- Premium positioning: Advanced configurability comes at a cost that may not justify simple verification requirements

- Integration complexity: Connecting to other financial services requires additional vendor relationships and integrations

Pricing

Persona uses usage-based pricing starting at $250/month, charging only for successful verifications. They offer startup programs for eligible companies and custom enterprise pricing for large implementations. The pricing reflects their premium positioning as the most configurable platform in the market.

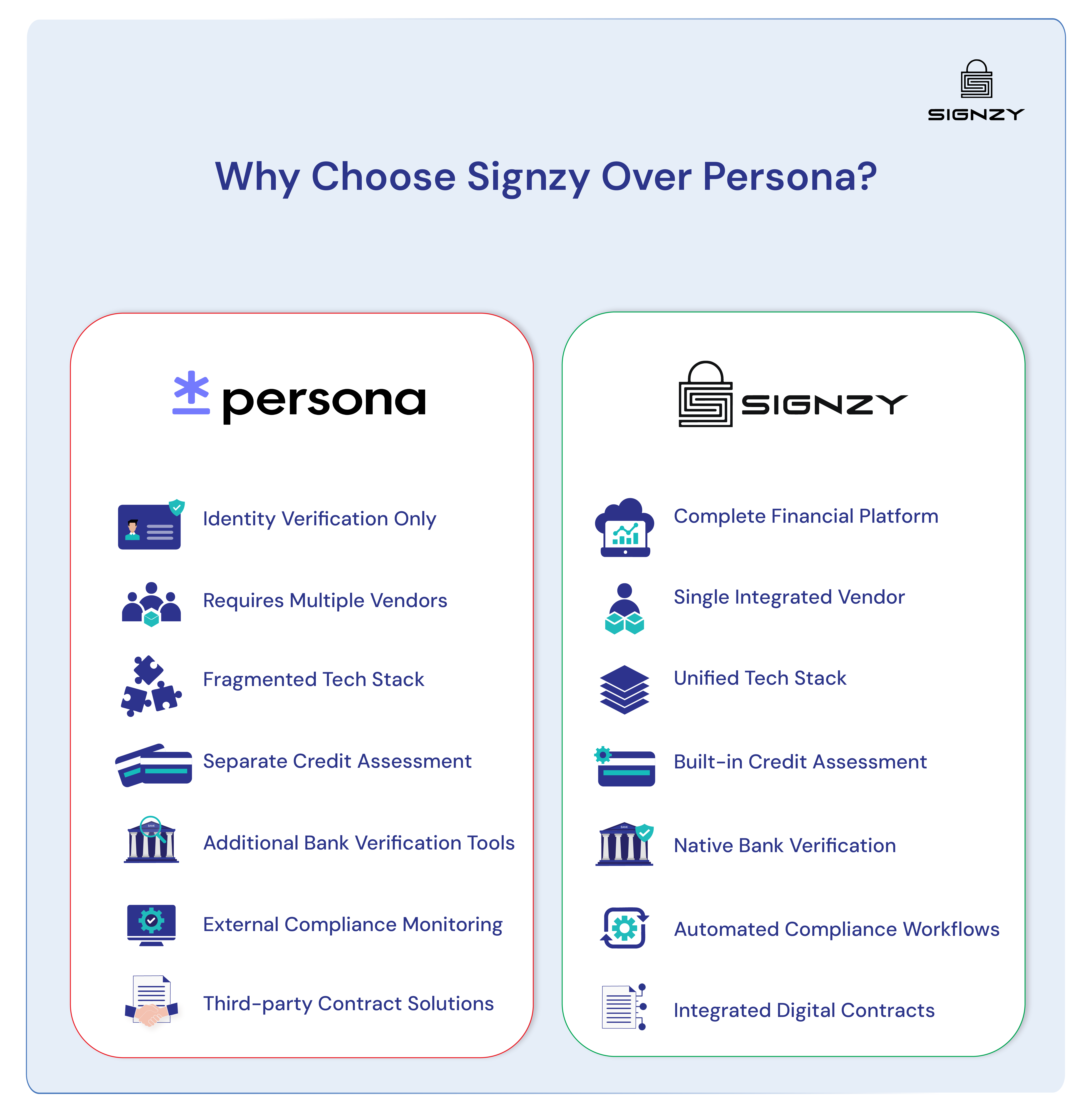

Why Choose Signzy Over Persona?

If you’re building anything in financial services, the choice becomes pretty clear once you think beyond just identity verification. Persona excels at verification, but then you’re back to finding separate vendors for credit assessment, bank verification, compliance monitoring, and digital contracts. You end up with great verification feeding into a fragmented tech stack.

With Signzy, your verification data immediately improves credit decisions, speeds up bank account validation, and feeds into ongoing compliance workflows. For fintech and financial services companies, this integrated approach typically saves 6-8 months of vendor evaluation and integration work while reducing total costs significantly. The verification might be comparable, but the business impact is night and day different.

To know more about how exactly Signzy can help your platform, book a demo here.

FAQ

How does Signzy's financial services focus compare to Persona's flexibility?

Does Signzy provide fraud detection comparable to Persona's advanced capabilities?

Can I use Signzy for non-financial industries like Persona?

Does Signzy require engineering resources like Persona's no-code approach?

Shivam Agarwal

Shivam heads the go-to-market strategy at Signzy. He holds the CFA charter and a strong background in financial operations, PE analysis and strategy. His prior roles include business strategy and private-equity analysis in the financial services and fintech domain, giving him deep insight into client needs, risk-adjusted economics and monetisation models for compliance & identity verification platforms.

![9 Best Identity Verification Software for 2026 [US Guide]](https://cdn.sanity.io/images/blrzl70g/production/5ff0079f1de485dd7d67cea676b5877b8d019e34-2821x663.png)

![10 Best SSN Verification Services: Features Compared [2026]](https://cdn.sanity.io/images/blrzl70g/production/48620bfb8e6520ba651a76bd880b2fd9b5400d1e-1366x320.webp)