Long gone are the days when entities used IP addresses to verify location as a vital identity attribute. There are a number of challenges associated with IP address verification:

- IP addresses can be easily spoofed. This means that a malicious actor can make it appear as if they are coming from a different IP address than they actually are. This makes it difficult to verify the identity of a user or device based on their IP address alone.

- IP addresses can be shared. This means that multiple devices or users can be using the same IP address. This makes it difficult to determine which device or user is responsible for a particular activity.

- IP addresses can be dynamic. This means that they can change over time. This can make it difficult to track the activity of a particular user or device.

- IP addresses can be used as a proxy: A fraudster can use a proxy server to hide their IP address. This makes it more difficult to track them down and identify them.

On the other hand, Geolocation technology uses a variety of data points, including IP addresses, to determine the location of a device. It is more accurate than an IP address alone.

In 2020, Financial Action Task Force (FATF) acknowledged the importance of geolocation data in strengthening digital identities in its “Guidance on Digital Identity.” As an example of dynamic, digital customer data sources that enable regulated entities to capture essential authentication information, geolocation was specifically highlighted.

What is Geolocation Technology?

Geolocation technology is a powerful tool that can be used to improve KYC compliance. By tracking the location of customers, financial institutions can identify potential risks and take steps to mitigate them.

For example, if a customer opens an account from a different country than they are known to live in, this could be a red flag. Financial institutions can use geolocation technology to flag these accounts for further review.

How Does Geolocation Help in KYC?

Geolocation technology can be used to help in KYC in a number of ways. For example, it can be used to:

- Verify customer identities. By cross-referencing a customer’s IP address with their physical address, financial institutions can confirm that the person who is opening an account is who they say they are.

- Identify potential risks. By tracking the location of customers, financial institutions can identify potential risks, such as customers who are opening accounts from different countries or who are using proxies or VPNs.

- Prevent fraud. By tracking suspicious activity, such as customers who are making large or unusual transactions, financial institutions can prevent fraud and protect their customers.

Overall, geolocation technology is a valuable tool that can help financial institutions to comply with KYC regulations and reduce the risk of fraud.

Here are some of the specific ways in which geolocation can be used to help with KYC:

- Verifying customer identities: When a customer opens an account, financial institutions can use geolocation technology to verify their identity. This can be done by cross-referencing the customer’s IP address with their physical address. This helps to ensure that the person who is opening the account is who they say they are.

- Identifying potential risks: Financial institutions can use geolocation technology to identify potential risks. For example, if a customer opens an account from a different country than they are known to live in, this could be a red flag. This information can be used to flag accounts for further review.

- Preventing fraud: Financial institutions can use geolocation technology to prevent fraud. For example, if a customer makes a large or unusual transaction, this could be a sign of fraud. This information can be used to block transactions and protect customers from fraud.

Use Cases For Banks – Geolocation Technology for KYC

Banks can use Geolocation Technology to verify customer identities, identify potential risks, and prevent fraud.

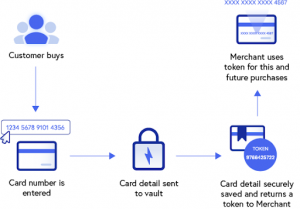

Use case 1: When a customer opens an account, the bank can use geolocation technology to verify their identity by cross-referencing the customer’s IP address with their physical address. This helps to ensure that the person who is opening the account is who they say they are.

Use Case 2: The bank can also use geolocation technology to identify potential risks. For example, if a customer opens an account from a different country than they are known to live in, this could be a red flag. This information can be used to flag accounts for further review.

Use Case 3: The bank can use geolocation technology to prevent fraud. For example, if a customer makes a large or unusual transaction, this could be a sign of fraud. This information can be used to block transactions and protect customers from fraud.

Use Case 4: For merchant onboarding, financial institutions can use geolocation to verify that the business is located where they claim they are. This is especially useful in cases where the user is onboarding digitally.

Detecting financial fraud in 2023 with Signzy’s Geolocation API

Signzy’s Geolocation API is a powerful tool that can be used to verify the identity of users and prevent fraud. It uses a variety of data points to determine the location of a user. This information can then be used to verify the user’s identity and to identify potential fraudsters.

The API is easy to use and can be integrated with any existing system. It is also highly accurate and reliable. Signzy’s Geolocation API is a valuable tool for any organization that wants to improve its KYC process and prevent fraud.

Here are some of the benefits of using Signzy’s Geolocation API for KYC:

- Accuracy: It uses a variety of data points to determine the location of a user, which helps to ensure that the information is accurate.

- Reliability: It is available 24/7 and can be used to verify the identity of users even in remote locations.

- Ease of use: It can be integrated with any existing system and does not require any special training.

- Affordability: It is priced competitively and offers a variety of pricing plans to fit any budget.

Financial institutions have less confidence in the true identity of their customers due to cybercriminals’ expertise in IP address fraud and other forms of location deception. With Signzy, banks, payment service providers, and other financial institutions can restore confidence and accuracy to their fraud detection tools.