Fintech APIs

KYB – Know Your Business

Streamlining Compliance Through Instant Verification!

Accelerated KYB for Streamlined Compliance

The majority of frauds in banking are due to human complicity. Identifying high-risk clients and business associates is pivotal for safeguarding a company’s reputation. This proactive approach serves as a preventive measure against accusations of criminal negligence related to the facilitation of illicit financial transactions.

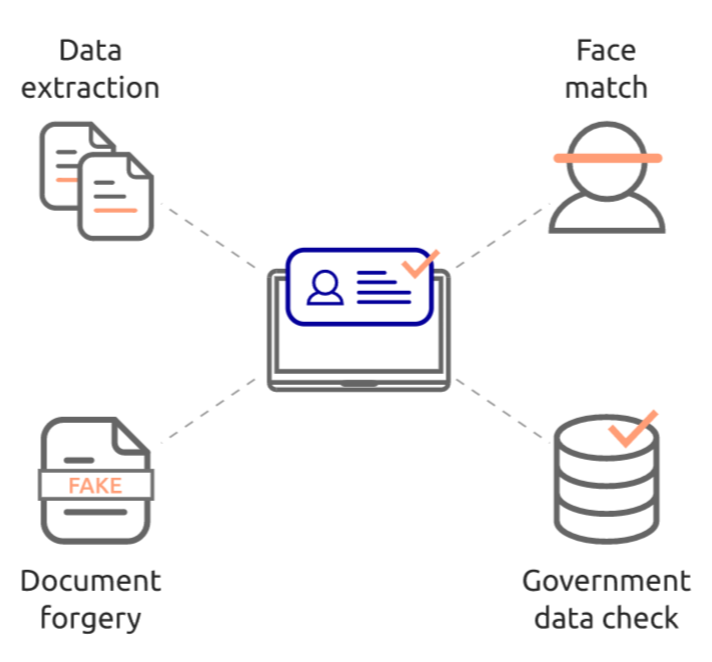

Utilizing state-of-the-art artificial intelligence, our onboarding technology imbues document and data processing with human-equivalent cognition, while maintaining uncompromising security standards. Our comprehensive solution encompasses a range of features: from image extraction and data classification to object detection, validation, and forgery assessment.

Person does

Real time API does

Secure, compliant and scalable video KYC

The Reserve Bank of India made an amendment on January 9, 2020 to the KYC norms allowing banks and other lending institutions regulated by it to adopt a Video-based Customer Identification Process (V-CIP) as a consent-based alternate method of identity verification for Customer Onboarding.

Signzy Video KYC is being used to onboard over 150,000 customers every month by SEBI-regulated institutions. This solution has matured over dialects, browsers and low-internet scenarios. Read more about our solution here.

Secured digital contracts

enabled by biometrics

Digital contracts are well suited to facilitate the re-engineering of business processes occurring at many firms involving a composite of technologies and business strategies that aids the instant exchange of information. The digital contracts have their own merits and demerits. On one hand they reduce cost, saves time, fasten customer response and improve service quality by reducing paper work, thus increasing automation. On the other hand, since in electronic contract, the proposal focuses not on humans who make decisions on specific transactions, but how risk should be structured in an automated environment. Therefore the object is to create default rules for attributing a message to a party so as to avoid any fraud and discrepancy in the contract.

Algorithmic risk

intelligence

Current systems lack ability to analyse online BIG Data. Our algorithms analyze traditional + non-traditional sources – social media, news, court cases etc. creating intelligent linkages between entities thus providing detailed due-diligence algorithmically in realtime.

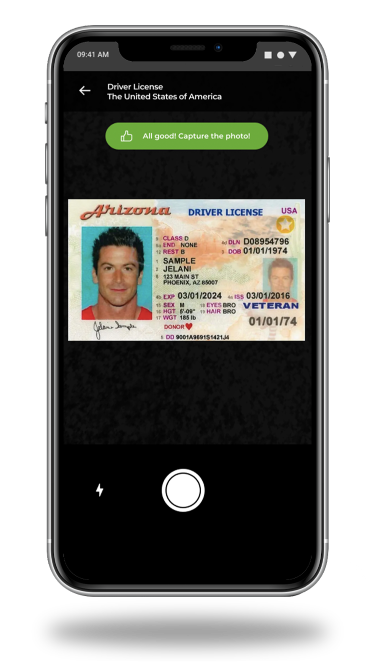

Identity Verification

ID firmly, but with a human touch

Effortlessly Verify and Onboard legitimate Customers

Achieving business verification at unparalleled speed is no longer a distant goal but an immediate reality! Signzy’s KYB revolutionizes the traditional process by leveraging advanced technologies to conduct swift and accurate validations. With this expedited approach, companies can not only meet but exceed compliance standards, thereby streamlining operations and enabling a faster go-to-market strategy.

Go beyond basic verification!

Signzy’s Identity Authentication automates the verification process and helps businesses boost conversion rates, comply with AML and KYC legislation, and better detect fraud — all while providing a definitive decision in seconds.

Enhanced user

experience

Smart and interactive verification and onboarding systems to make user journeys hassle-free and straightforward.

Scalable backend

operations

AI and ML-based core regulatory engines help businesses scale faster, reduce cost and cut turnaround time, to offer a seamless experience in business processing.

Seamless and

interactive UI

Creative and easy to use interface to provide a convenient interactive experience for the user making the whole journey seamless.

Customer identity

verification

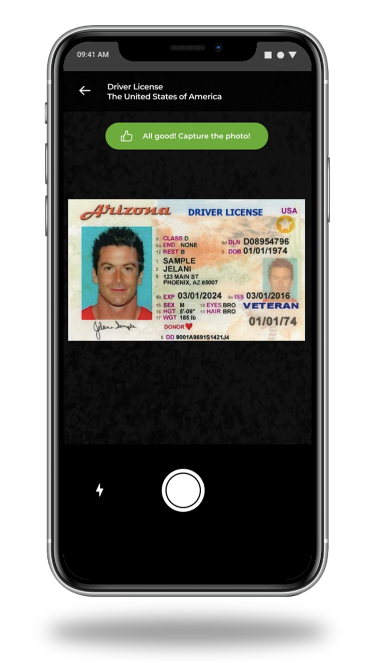

Authenticate your customer’s identity by capturing and verifying OVDs in real-time.

Why is there a need for identity verification?

Address the conflict between risk and growth

Identity verification has always been imperative for businesses. However, as the world has become digitalized, the need for a digital identity verification solution has become apparent.

Failure to know your customer’s identification can escalate to fraudulent behaviour, which can lead to revenue loss through chargebacks, a loss of trust, and eventually brand degradation.

An identity verification solution must assist companies in resolving key disputes. Safeguarding the company’s image and revenue entails mitigating the risk of fraud by meeting KYC identity verification requirements.

Majority of frauds in banking are due to human complicity. Our onboarding technology uses AI to provide human-like like intelligence to documents/data, but which cannot be compromised.

Done in 30 seconds

Real-time id check

OVDs are checked in real-time to verify the user

Image forensics

Images are matched with the user’s face to authenticate both.

Biometrics check

Facial and other biometric checks are carried out

Verification complete

And you are all set to Go!

Features

Signzy systems have been designed for banking grade technology. This means that they meet the strictest infosec regulations and data security requirements.

Unlimited video storage

& instant retrieval

Unlimited videos of user verification can be stored on the database and can be retrieved at any time.

Geo-location capture

& IP check

Geo-tagging will ensure the customer’s exact location with a thorough check on the IP address.

Video forensics for pre-

recorded risk detection

Video forensics is used for any pre-recorded risk and spoof detection to prevent fraud, enhancing protection for your enterprise.

Digital forgery

check

Any kind of digital forgery will be detected and flagged rendering any malpractice attempts void.

Seamless and

interactive UI

Creative and easy to use interface to provide an easy experience for the user making the whole journey seamless.

End-to-end

encryption

The end-to-end encryption for video, channel and communication helps ensure maintaining the highest security and privacy.

Customer identity

verification

Authenticate your customer’s identity by capturing and verifying OVDs in real-time.

Time stamp &

audit trail

Definite time stamps and audit trails for every application and video interaction help to find.

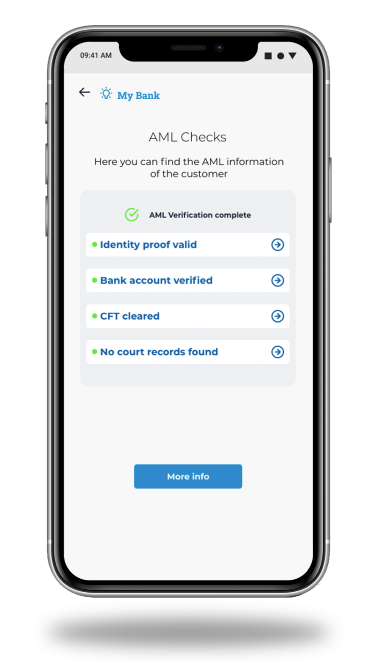

AML Check

Anti-Money Laundering (AML) Compliance check and Screening done in Seconds

Manage your AML process

Prevent money laundering and financial crimes with our complete AML compliance solution to screen out the suspicious entities within seconds

- Verify customers across the globe

- Screening within a second

- Enhanced data security

- Rely on the experts

Algorithmic risk intelligence + KYC = Less risk, more efficiency

According a report by deloitte, Customer Due Diligence must be the focus to mitigate AML compliance and risks. Our AML compliance check has algorithms which analyze traditional + non-traditional sources – social media, news, court cases etc. creating intelligent linkages between entities thus providing detailed due-diligence algorithmically in realtime.

You can’t escape AML

What is AML?

- Collection of policies, rules, and regulations aimed at preventing the illicit generation of profits.

- Mandatory compliance for Financial institutions under Bank Secrecy Act (BSA) of 1970 and USA Patriot Act.

- Apply to a small number of transactions and illegal activities, but their consequences are far-reaching.

Who is Impacted?

- Financial institutions that issue credit or enable customers to open accounts are responsible for performing enhanced due diligence and verifying customers to ensure they are not involved in a money laundering scheme.

- They must check where large amounts of money came from, keep an eye on illegal activity, and track significant cash transactions.

What are the best practices

for AML check?

- AML Compliance Check revisit the policies regularly, Improvise them through periodic reports, write them down and state them clearly to executives, staff, and regulators.

- Appoint an experienced person to monitor communication procedure and compliance of your team to regulations.

- Ensure that the training program is up-to-date to keep modern money laundering methods at bay.

- Seek help from a third party to review the program at regular intervals.

Why do you need AML

Compliance Technology?

- While the above practices may seem simple, they aren’t beneficial in terms of cost and efficiency.

- Leveraging automation can fasten the process, reduce regulatory risk, avoid unnecessary repetitive tasks and discrepancies caused due to human errors.

- Hence, using a software for AML compliance can streamline the process and quickly detect any suspicious or unusual activity.

Simple, slick and smart AML compliance solution

Real-time id check

Images are matched with the user’s face to authenticate both.

AML check against global database

Retrieved data is cross- checked with Government and other valid global databases

Verification complete

And you are all set to Go!

Did you know?

Every year, an estimated $800 billion to $2 trillion gets laundered around the world, according to the United Nations Office on Drugs and Crime. And Anti-Money Laundering programs currently catch only 1% of that money. Global identity verification is essential for keeping more dirty money out of our economy.

Anti-money laundering FAQ’s

"What Is Anti-money Laundering In Simple Terms?"

Anti-money laundering (AML) refers to a collection of policies, rules, and regulations aimed at preventing the illicit generation of profits. Financial institutions are required to comply with AML initiatives under laws such as the Bank Secrecy Act (BSA) of 1970 and the more recent USA Patriot Act.Anti-money laundering laws can only apply to a small number of transactions and illegal activities, but their consequences are far-reaching. AML targets a wide range of activities, from corruption and tax evasion to manipulating the market and trading with illicit goods, as well as hiding any of these.Since the majority of criminals and terrorists rely heavily on a cash flow of laundered money for their illegal activities, having the appropriate AML checks in place has broader crime-reducing implications.

"What Are The Anti-money Laundering Regulations?"

Anti-money laundering (AML) refers to a collection of policies, rules, and regulations aimed at preventing the illicit generation of profits.Financial institutions are required to comply with AML initiatives under laws such as the Bank Secrecy Act (BSA) of 1970 and the more recent USA Patriot Act.Anti-money laundering laws can only apply to a small number of transactions and illegal activities, but their consequences are far-reaching.AML targets a wide range of activities, from corruption and tax evasion to manipulating the market and trading with illicit goods, as well as hiding any of these.Since the majority of criminals and terrorists rely heavily on a cash flow of laundered money for their illegal activities, having the appropriate AML checks in place has broader crime-reducing implications.

"What Are Anti-money Laundering Checks?"

Under the AML regulation laws, all businesses, and financial institutions, in particular, are obligated to do everything in their power to identify money laundering tactics and report them.In addition to running a series of Anti-Money Laundering checks when they first take on a client, companies should also proactively monitor the behaviour of their customers so they can detect any suspicious activity in due time.The due diligence required from businesses includes many AML checks, ranging from simple Know Your Customer (KYC) checks and Identity Verification, to standard Electoral and Mortality Register ID checks, and even enhanced PEP (Politically Exposed Persons) and Sanctions searches.AML checks are crucial for some industries, including housing, law, and accountancy to name just a few. New laws are impacting these industries with hard fines handed out for those who don’t comply with the rules and regulations.

What Is The History Of Anti-money Laundering?"

AML laws became prominent in 1989, when a group of countries and organizations around the world formed the Financial Action Task Force (FATF). Its mission is to devise international standards to prevent money laundering and to promote the implementation of those standards.In 1990, the Financial Crimes Enforcement Network (FinCEN) was established by the US Department of Treasury “to safeguard the financial system from illicit use, combat money laundering and promote national security.”In October 2001, shortly after the 9/11 terrorist attacks on the United States, FATF expanded its mandate to include efforts to combat terrorist financing through the passage of the USA Patriot Act.

Start your journey to digital transformation now