Platform

Customers across US, Middle East, India

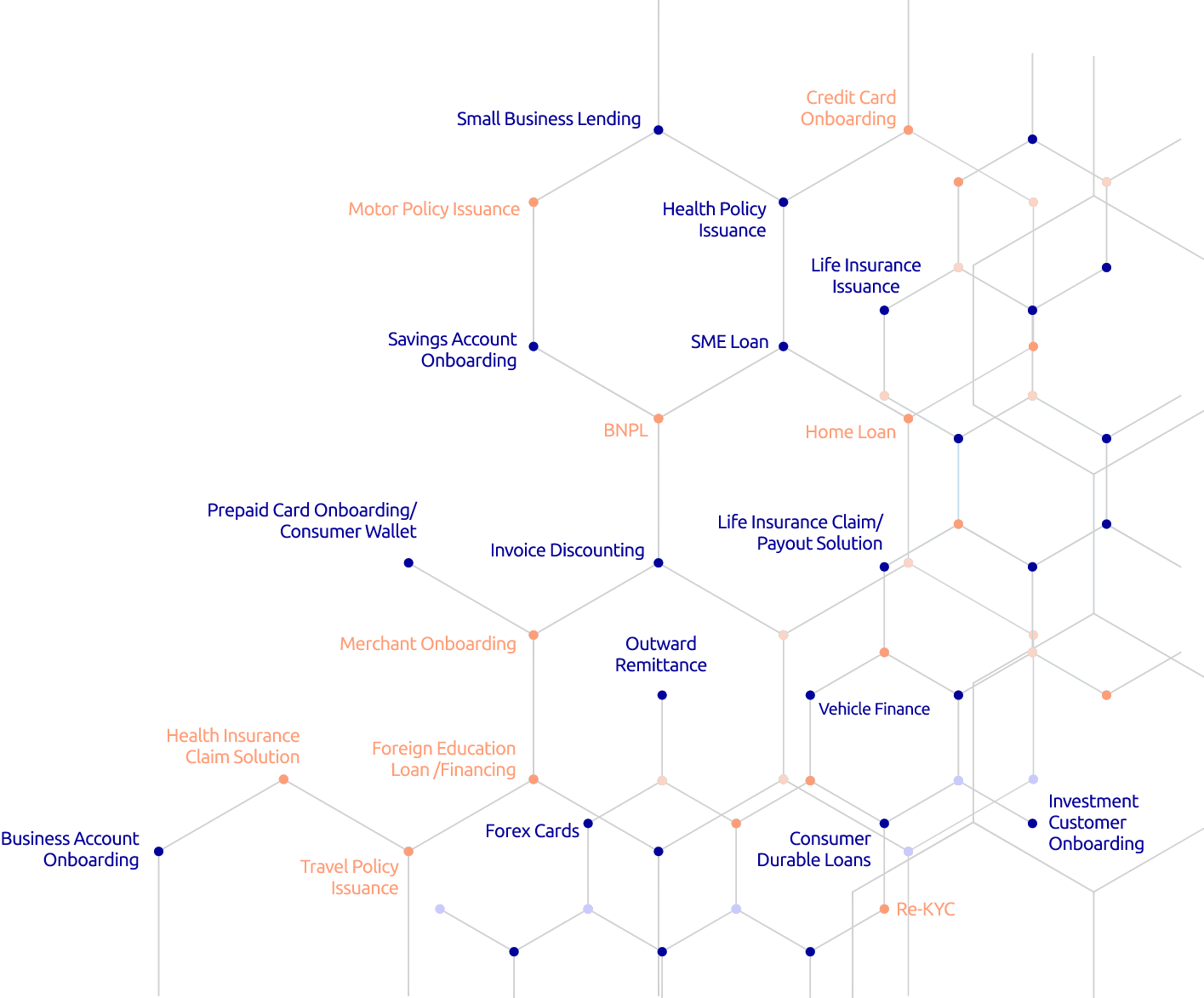

Use our platform to enable across

millions of customer daily

Use Cases

Modules

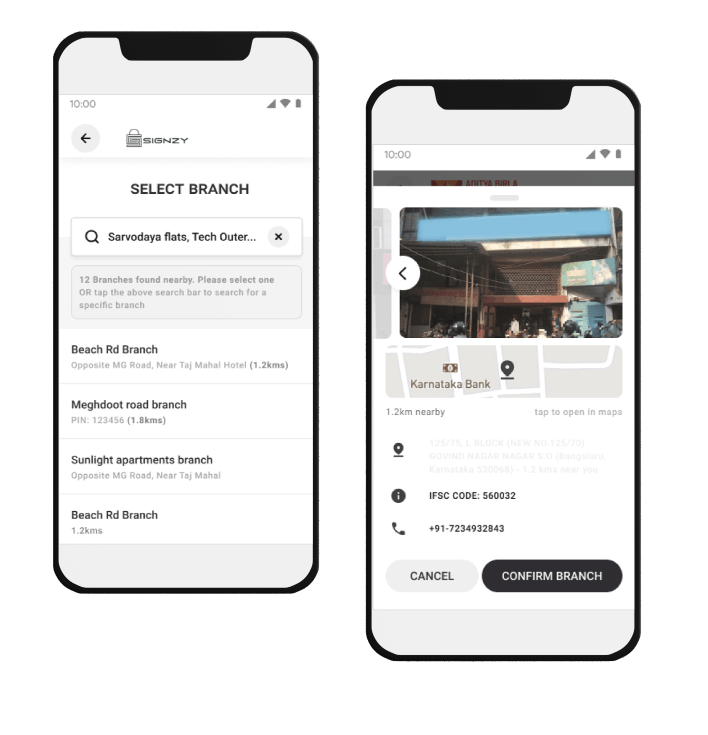

RM Assisted App

Android and iOS apps for RM Assisted

journeys on the fly

- One setup launch a new product within a day

- 5X more monthly lead generation

- 3X Increase in the productivity of sales

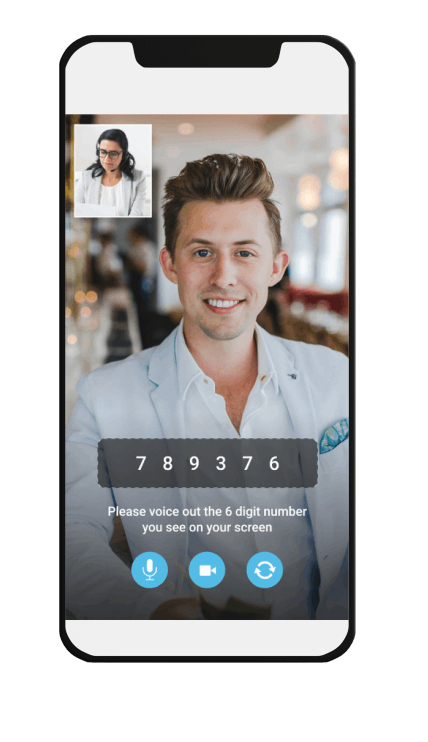

Front End- DIY Journey

Create a completely compliant, modern UI DIY

journeys along with Video KYC

- 66% reduction in customer dropouts

- Increase in flexibility of navigating through the onboarding journey

Risk/Decision Engine

Real time risk assessment made easy with

our comprehensive AI based Decision engine

- Create upto 7 levels of Rule engine within minutes

without working with complex flows - Instant risk assessment leading to overall 90%

reduction in TAT of risk checks - Designed to process over 200 custom rules and

validations at the same time - Capability to handle a million queries an hour.

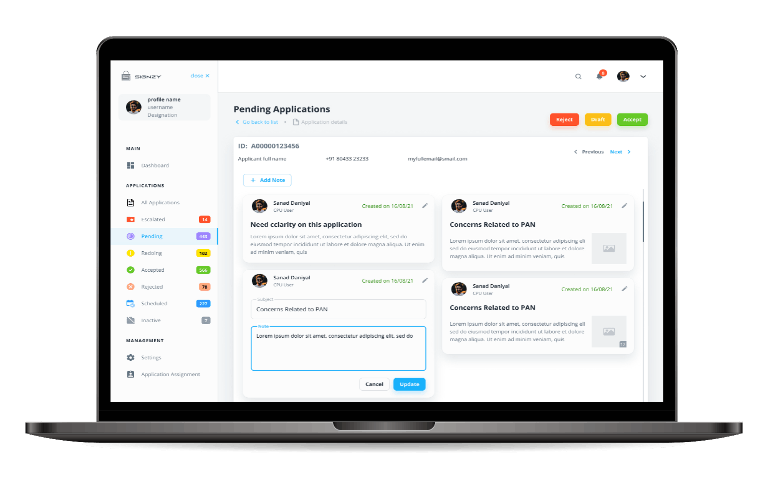

Backoffice

Empowering Backoperations users to be superstars by

automating major Operational tasks, achieve increased

productivity and combat fraud more effectively

- 360-degree view of applications across jurisdictions

and business verticals - Upto 60% reduction in back-office overheads

- Upto 70% reduction in manual eye-balling efforts

Enterprise Grade Security

Exercise Complete control over your data.

Customers can manage their own data, privacy,

security, Storage and Retrival.

- ISO 27001:2013 Certified & Compliant

- Certified ISO 27001 & SOC 2 Cloud Service Providers

- An Intrusion Detection and/or Prevention technologies

(IDS/IPS) solution that monitors and blocks potential

malicious packets

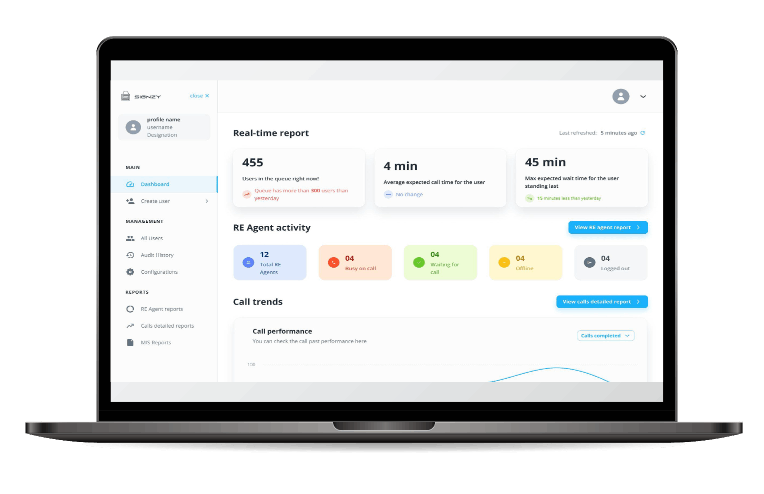

Deep User Analytics

Get deep insights into customer behavior by intelligent

tracking of relevant current and historical data across

desired time frame

- 40% increase in accuracy of analytical reporting

- Expedited user problem identification

- Improvement in Process efficiency to target major KPIs

Fintech APIs

Most comprehensive pre integrated API stack of over

240+ APIs across all financial use cases

- Single vendor contract leading to 30% cost reduction

- Zero third party support requirement

- GTM reduction from 6 months to 3 weeks

Distributor API

Building marketing funnels through digital

ecosystem allowing 3rd Party Distributors to

seamlessly connect with Bank

- Expansion of market funnel under one platform

- Increase distribution channel from few to hundreds in the

Signzy marketplace without any separate team involvement - Reduction in cost of acquisition of multiple partners

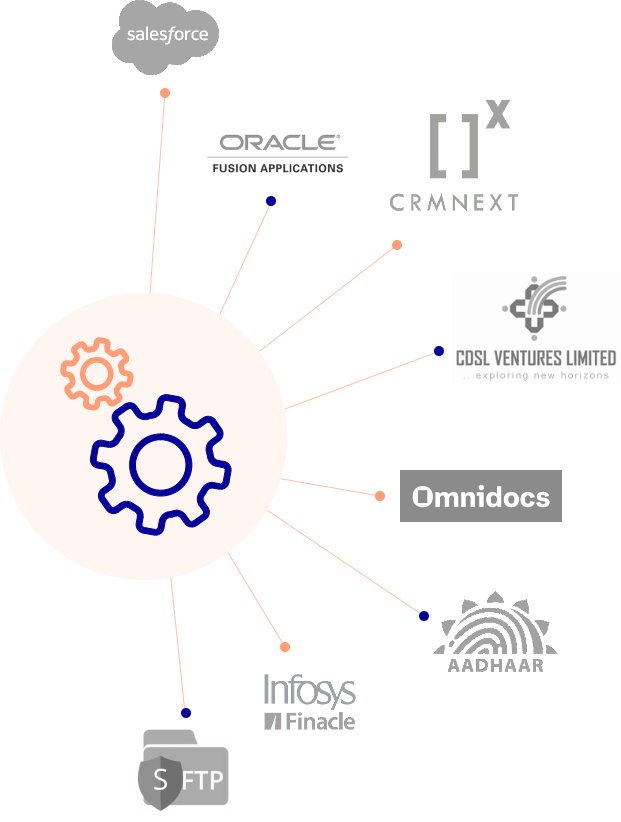

Integrate with

Pre- Existing Systems

Integrate your journey with your legacy systems with minimum

effort. Pre-Integrated systems to expedite your GTM

List of existing integrations:

- Salesforce

- Document Management System (DMS)Integration. Ex- KDR

- Oracle Fusion Integration

- SFTP Integration

- ECM Integration- OmniDocs (Newgen)

- Document Management System (DMS)Integration. Ex- KDR

- Oracle Fusion Integration

- Sending the data through REST API – API Integration

- Core Banking System Integration, Ex- Finacle

- Pull data from client System, Ex- Finacle Integration, KRA Integration

- CAMS Integration

- OnPremise client API integration

- Integration with client API and auto populating those specific information into the Signzy’s onboarding journey

- User Access Management (UAM) Integration

- CRM Integration

- UIDAI Aadhaar services Integration- eKYC

- Different type of integration interface for data exchange formats and protocols, Ex- CSV,xlsx,XML,JSON,image file,pdf file,DB Import/export

- Data transfer at some specific time based on some scheduler

job- cron job setup - Orchestrated system integration- It refers to the process of

automating multiple systems and services together.

Explore the platform in detail