Analyzing the importance of cryptography in ensuring online security.

When recently Edgartown bank in Massachusetts, USA needed more space they made a decision to do away with their steel enforced vault built in 1850. What seemed to be a simple re-furnishing task turned into a mammoth demolition exercise! Its only when they started digging deep, did they realise that it wasn’t that the vault was put in the Bank. But The bank was built, around the vault. Thus removing the vault meant destabilizing the complete infrastructure.

This small instance reveals a very important aspect of Banking. Safety is paramount. Banks have constantly been the biggest buyers of safe and vaults. Even today, banks pay tremendous attention to detail as regards safety and vaults, like the Federal Reserve Bank of New York, which claims to possess one of the world’s safest vaults. [1] The vault in New York is safeguarded by a comprehensive multi-layered security system, highlighted by a 90-ton steel cylinder protecting the only entry into the vault. The nine-foot-tall cylinder is set within a 140-ton steel-and-concrete frame that, when closed, creates an airtight and watertight seal. [2] In light of prevalent practices such as net banking, e-wallets and digital payment systems, the importance of security is further amplified.

Banks have always thrived (and done maximum business) on the notion of trust that customers place in them. Direct evidence of this principle can be found in the fact that banks act as trustees and guardians of the currency of their customers. Customers deposit large sums of money and are led to believe that a similar value of currency (as regards their bank balance) is present at the bank, despite the fact that it is common knowledge that banks often deal with monetary values and transaction amounts which are far greater than the actual amount of currency present at the bank at a particular point of time.

Need for Security

When the infamous thief Willie Sutton was asked why he robbed banks, he answered, “Because that’s where the money is.” While the witty comeback still “holds up” today, the weapon of choice now is more likely to be a pen/computer than a gun. The business of a bank/financial institution is constantly under threat from menaces of robbery, or even fraud. What is pertinent to note, is that banks have always placed tremendous value on security and will leave no stone unturned to ensure that safety standards remain high. [3]

The advent of technology has made fraud-inducing practices more prevalent and sophisticated, with them being at an all-time rise.[4] A survey on financial trends made by Assocham and PwC said that financial frauds led to approximately $20 billion (Rs 1.26 lakh crore) in direct losses annually. D S Rawat, Secretary-General, Assocham stated that “Financial fraud is big business, contributing to an estimated $20 billion in direct losses annually. Industry experts suspect that this figure is actually much higher, as firms cannot accurately identify and measure losses due to fraud. The worst effect of financial frauds is on FDI (foreign direct investment) inflows into India.” [5]

The report states that as 75% of the population of India has a mobile phone, ‘banking on the go’ has become the norm, so as to increase the convenience to the consumer. Which reflects in the Reserve Bank of India’s data which states that from a meagre INR 1819 crore in 2012, the volume of mobile banking transactions has risen to INR 1,01,851 crore in 2015.

Technology continues in the race with bank robbers, coming up with new devices such as heat sensors, motion detectors, and alarms. Bank robbers have in turn developed even more technological tools to find ways around these systems. Although the number of bank robberies has been cut dramatically, they are still attempted. [6]

Cryptography

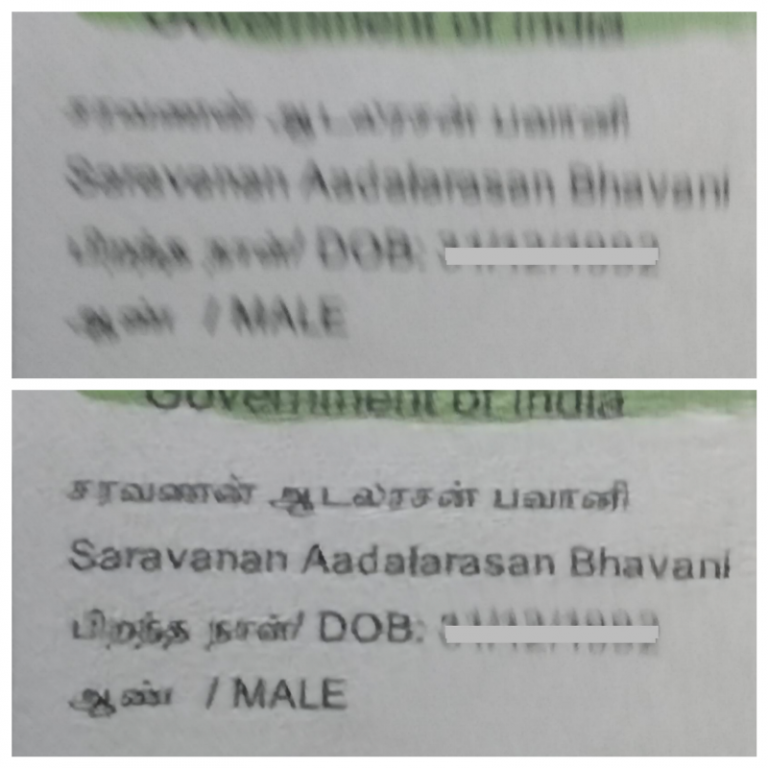

As the world moves digital there is a corresponding need of similar safety and security in the digital world. Cryptography plays a crucial role in ensuring complete safety in areas like e-mail to cellular communications, secure Web access and digital cash. Cryptography helps provide accountability, fairness, accuracy, and confidentiality. It can prevent fraud in electronic commerce and assure the validity of financial transactions. [7]

Cryptography secures the global information infrastructure by encrypting data flows and protecting data from third-party interception. Nowadays, cryptography secures data in transit and at rest, protects personal information and communications, and ensures the integrity of every online purchase. Cryptography has four key attributes:

1. Confidentiality: The protection of information and prevention of unauthorized access;

2. Privacy: Protecting the personal information of individuals;

3. Non-repudiation: The inability to deny an action took place; and

4. Integrity: Assurance that information cannot be manipulated. [8]

Cryptography also powers one of the most rapidly rising finance technology — Blockchain.

It has driven businesses to reimagine how their networks operate and has become synonymous with alternative business models. At its core, however, blockchain leverages a vast amount of public key cryptography to enable confidentiality, privacy and security of data and user identities. [11] Apart from its security benefits, blockchain also increases the speeds of different transactions. Instead of waiting days for a check to clear, a payment can be verified in seconds. There’s also less risk that payments will have to be denied because funds are unavailable. There’s no more “playing the float” since account debits and credits are instantaneous. [12]

Conclusion

Banks in India have started realizing that consumer experience and ease of banking are very important. This has led to several collaborations between the fin-tech start-ups and Banks. What would probably be the next wave in this collaboration is startups that focus on digital security helping banks bring the “offline” trust to the online world. Banks which focus on security and safety of digital consumers are more likely to build trust in the long run, and would most probably be the winners in the digital world.

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Ankit Ratan, [ CEO, Signzy ]