How Signzy Can Help Banks Combat the Rising Tide of Fraud

February 1, 2024

3 minutes read

News headlines across India blared: “Banks Recorded Rs 1 Trillion in Fraud-Related Write-Offs.” A staggering figure, it paints a concerning picture of a financial landscape riddled with deceit. While Dinesh Khara, Chairman of State Bank of India, claims the ‘loan write-off era’ is ending, the statistics tell a different story – one of evolving fraudsters and vulnerable systems.

Digging deeper into the data from Business World, we see a worrying shift: private banks now dominate fraud-related write-offs, their share skyrocketing from 12% in 2016 to 74% in 2023. Even more alarming, while the overall number of frauds has gone up, the financial involvement has decreased. This suggests smarter, more sophisticated scams slipping through the cracks.

So, where does hope lie? Enter technology, and with it, Signzy.

The Technological Shield

Traditional fraud detection methods are akin to swatting flies with a newspaper – reactive, inefficient, and ultimately futile. The need of the hour is proactive, intelligent systems that anticipate and thwart fraud before it can wreak havoc. This is where advancements in AI and machine learning take center stage.

Signzy Steps Up:

Signzy’s suite of digital trust solutions utilizes cutting-edge AI and ML algorithms to create an impregnable barrier against fraud. Here’s how:

- Digital KYC and Onboarding: Verify customer identities in real-time with facial recognition, liveness detection, and document verification. Eliminate fake or stolen identities used for fraudulent activities.

- Continuous Transaction Monitoring: Analyze every transaction in real-time, flagging suspicious patterns and anomalies that might indicate fraud. Say goodbye to delayed detection and hefty losses.

- AI-powered Risk Scoring: Build dynamic risk profiles for each customer based on their behavior, transaction history, and external data sources. Proactively identify high-risk individuals and transactions before they can cause damage.

- Automated Investigation and Alerting: Receive instant alerts for suspicious activity, allowing for swift action and minimizing potential losses. No more time lost in manual investigations.

The Future of Security in Banks

The battle against fraud is a constant evolution, and Signzy is at the forefront. With its commitment to continuous innovation and cutting-edge solutions, Signzy empowers banks to build a future of trust and security. Imagine a financial landscape where:

- Loan approvals are instant and secure, free from the fear of fraudulent applications.

- Transactions flow seamlessly, unhindered by the specter of hidden scams.

- Customer trust thrives, knowing their finances are protected by an invisible yet invincible shield.

This is the future Signzy is building, brick by digital brick. Let’s join hands and create a banking ecosystem where fraud is not a headline, but a distant memory.

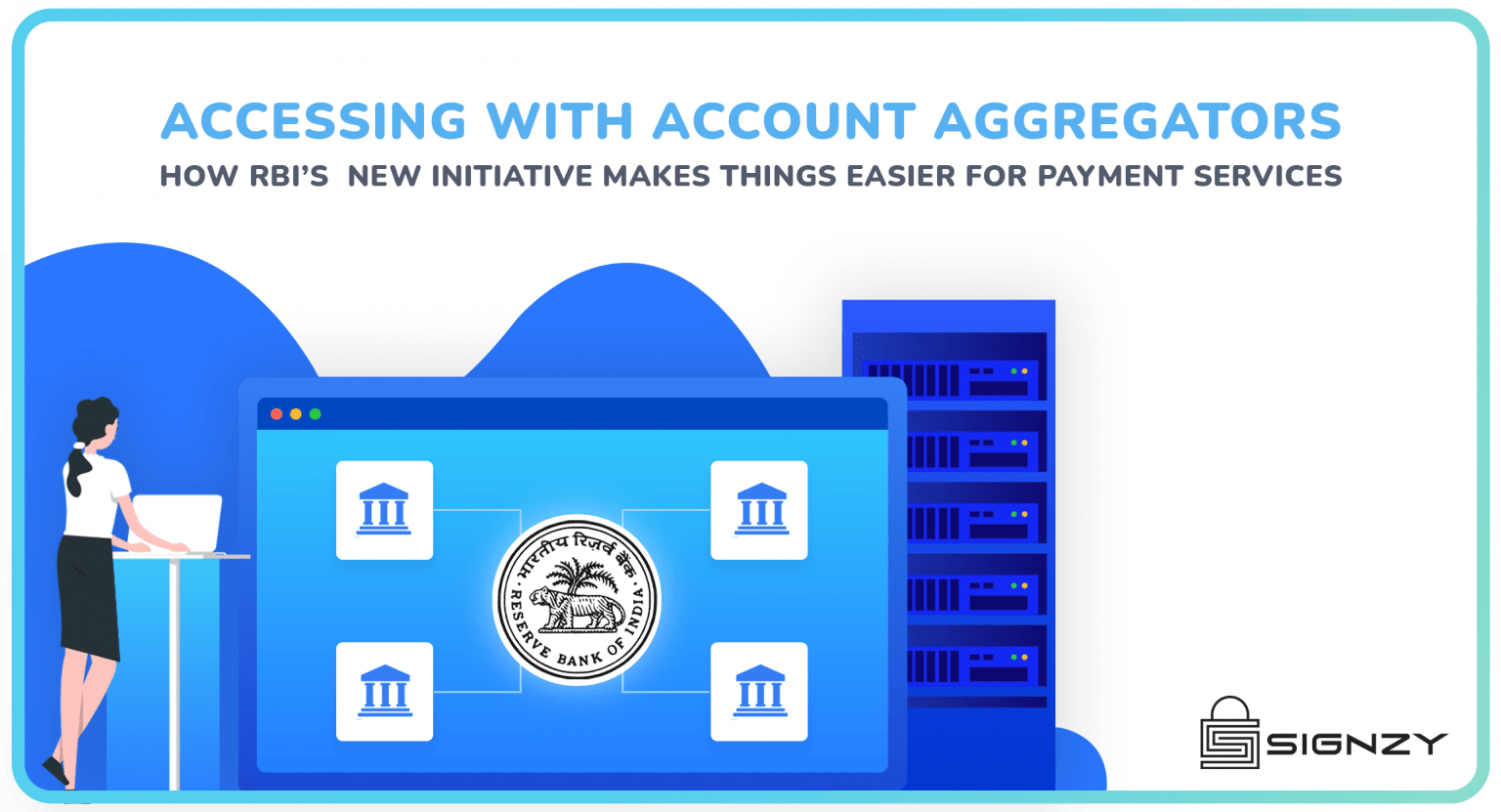

About Signzy

Signzy is a market-leading platform redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering customizable workflows. In addition, it gives these players access to an aggregated marketplace of 240+ bespoke APIs, easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru and has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

Contact us directly!