Fintech APIs

GST Analytics

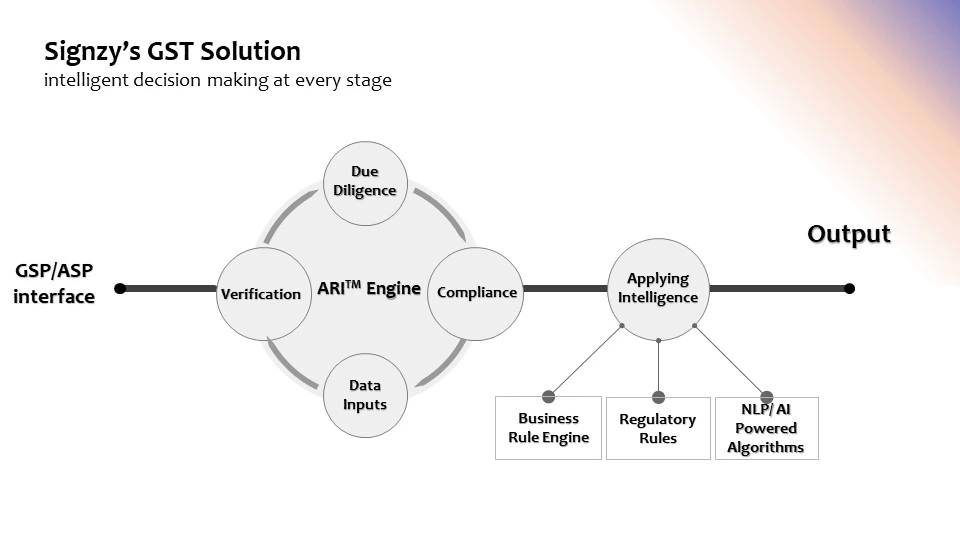

With the ever-changing regulatory environment, lenders are looking for new ways to make SME lending decisions faster and smarter to survive in the competitive landscape. GST analytics is a data-driven approach to making lending decisions simple for small and medium enterprises (SMEs). Lenders can make faster and more informed decisions about which SMEs they should lend to by leveraging data from the GST system.

Signzy’s GST analytics helps lenders identify potential growth areas within their portfolios and establish competitive strategies to take advantage of those opportunities. With the use of GST Data, the entire process gets

Features

Four Key Differentiators

Signzy’s GST Analytics has four key differentiators that, when combined with other features, give an unparalleled insight into a company’s financials and help to make faster and more informed decisions in the underwriting processes.

- Multi GSTN using OTP instead of a password

- Intelligent GSTN models using Industry & Market Analytics (GSTPrism)

- Customization without leaving API mode

- HSN, Demographic-based Statistics

Solution Benefits

Access to real-time GST data

Improved decision-making

Reduced risk

Improved customer experience

Improved Data Insights

Increased Transparency

Reduced Cost

How Signzy's GST Analytics helps SMEs Stay Compliant

Signzy’s GST Analytics plays a crucial role in helping lenders maintain compliance while supporting SMEs in their financial journey. Our solution aids lenders in identifying potential warning signs such as inconsistencies in a company’s GST filings, overclaims for input tax credits, GST statistics, or elevated tax liabilities. It provides a clear understanding of a company’s cash flow situation, by building balanced scorecards, enabling lenders to predict the company’s loan repayment capabilities accurately.

By utilizing our GST Analytics, lenders can make informed and responsible lending decisions, ensuring the protection of their clients’ data. This tool is invaluable for financial institutions as it not only helps them adhere to the tax regime but also empowers SMEs by facilitating easier access to credit. In essence, our GST Analytics solution is a win-win for both lenders and SMEs, fostering a more transparent and efficient lending environment.

FAQ

What is GST Analytics?

GST Analytics is a cloud-based software platform that leverages data from the Goods and Services Tax (GST) network to help lenders assess the creditworthiness of small and medium enterprises (SMEs). It provides real-time visibility into an SME’s financial health and business performance, enabling faster and more informed lending decisions.

How can GST Analytics help lenders make SME lending decisions?

GST Analytics offers several features and tools to aid lenders in making informed and swift lending decisions for SMEs. It can assess an SME’s creditworthiness, fast-track loan approvals, and help lenders make better use of data. Furthermore, it reduces business costs by eliminating the need for operational work and significantly reducing the risk in lending.

What data is available through GST without consent?

Without consent, GST Analytics can provide GST registration information and others, like addresses, Director Data, Contact Info, Compliance Statuses, Taxpayer Categorization, Turnover range, Nature of Business and HSN Codes.

Can you provide us with the raw data of GSTR 1, 2, and 3?

Yes, we can provide the raw data of GSTR 1, 2, and 3 with a consent-based API.

Can you verify if a GSTIN is Active or Inactive?

Yes, our APIs can verify active and inactive GSTINs.

What information is required to get the detailed GST report?

To get a detailed GST report, we either need the usernames and passwords and the corresponding GSTINs from the customer, or it can be done with the usernames and an OTP verification (which significantly reduces friction because of not needing to remember passwords).