3 Major Reasons Why Your Business Can not Skip Out On KYB

March 31, 2022

5 minutes read

Do you know how many shell companies are there in India?

Apparently, no one does. But, authorities identified 230,000 shell companies in the last 3 years. Scrutinized data mining revealed nearly 300,000 shell companies involved in hawala and other illegal transactions. Just government regulations won’t cut it to cut down on these launderers. Individual enterprises need to take action. Each business needs to know with whom they are getting involved.

When it comes to low, mid, or even high-level corporate collaborations, KYB (Know Your Business) is the ultimate evaluation mode to secure business interests and stay compliant with AML(anti-money laundering) obligations. Before an enterprise associates with another company, it should ensure authenticity. KYB provides this while verifying the organization on multiple dimensions.

Ponemon Institute concluded that companies unnecessarily spend more than $4 million due to not taking action and investing in regulatory and compliance practices. KYB, unlike KYC, verifies enterprises and businesses instead of customers. They use certified identification parameters that include the owner’s OVDs(Officially Verified Documents), CRN(Company Registration Number), etc.

Here are the 3 major reasons why you should always have KYB processes set up for your enterprise’s collaborations.

Reason 1- Safe and Secure Business Relationships

Any B2B service and interaction depends on mutual interests and understanding. The changing world of digital technology impacts significantly on your business. On top of this, business partners do not have directive authority over their partner’s vendors. Hence there is a constant and inevitable need to verify trust between the businesses for a stable relationship. This is where KYB forms a reliable standard for building trust and acts as a secure communication channel.

KYB essentially solidifies the reliance of companies and businesses on each other. Additionally, it also provides security and safety from external threats. Many regulatory bodies demand this as well. Hence a regulations compliant tag requires processes involving KYB.

Reason 2- Increased B2B Conversions

Any company that has accessed KYB processes generates more credibility and trust. Partner organizations receive a positive impression. The process is solid and safe with multiple identity checks and verification procedures. Since everything can be automated, any face-to-face fiddle can also be avoided. Trust between involved parties is directly proportional to a greater B2B conversion rate.

This way, the relationships help establish a well-formed reputation for the enterprises. Trust directly impacts the conversion rate; it is relevant for up-and-coming start-ups to ensure they have a built-in KYB process. KYB helps organizations identify themselves without any physical presence at sites or offices. It also helps provide interest-oriented services that increase the conversion rate for B2B services.

Reason 3- AML CFT Compliance

The increase in financial crimes worldwide makes it necessary for governments and law enforcement agencies to ensure regulatory measles. For example, the 1970’s Bank Secrecy Act in the US was established to combat tax evasion and unlawful drug dealings. This was the first step in AML’s history. In addition, organizations like FATF((Financial Action TaskForce) and FinCEN (Financial Crimes Enforcement Network) are aimed at this same goal of AML and following government regulations.

AML practices safeguard the safety interests of businesses. Non-compliance with AML is an expensive deal. Companies pay more than $5 million to regulatory authorities for non-compliance with AML.

The 4AMLD, the anti-money laundering directive from the European Union, dictates and encourages financial institutions to follow KYB practices. This keeps a tab on potential money laundering and terrorism funding initiatives. Therefore, KYB is mandatory for AML implementation. As a matter of fact, it is the cornerstone in identifying potential dangers in B2B interactions.

A Bonus 4th Reason For You:

KYB Reduces Operational Costs

It is no novel fact that automation and digitization help reduce operational costs and TAT. It also helps reduce human interventions and, in essence, human resources. But KYB, primarily digital KYB, takes this up a notch. Digital KYB, just like Digital KYC, maintains the status quo of technological independence. The processes involved are designed to create minimal human intervention while providing the safe and secure fortification it demands. This reduces errors, resulting in costs saved from human errors while maintaining security for the businesses. As it reduces the TAT, this increases the scalability of operations. This renders the future of processing faster for the involved enterprises.

To summarize, KYB is an effective method for creating secure business relations. This is done by reducing the total operational expenses, enhancing the conversion rate in B2B services while complying with AML policies and procedures.

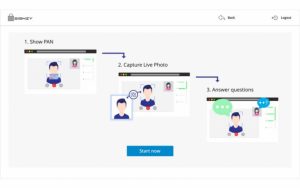

If you wish to create a fortified and user-friendly Digital KYC/KYB process, we can help you with the best resources in the industry. From scratch, Signzy helps build entire onboarding and KYB processes for our clients. These are incredibly customizable too. Of course, you can understand how secure they are as we use state-of-the-art AI rule engines and APIs on our website.

About Signzy

Signzy is a market-leading platform that is redefining the speed, accuracy, and experience of how financial institutions are onboarding customers and businesses – using the digital medium. The company’s award-winning no-code GO platform delivers seamless, end-to-end, and multi-channel onboarding journeys while offering totally customizable workflows. It gives these players access to an aggregated marketplace of 240+ bespoke APIs that can be easily added to any workflow with simple widgets.

Signzy is enabling ten million+ end customer and business onboarding every month at a success rate of 99% while reducing the speed to market from 6 months to 3-4 weeks. It works with over 240+ FIs globally, including the 4 largest banks in India, a Top 3 acquiring Bank in the US, and has a robust global partnership with Mastercard and Microsoft. The company’s product team is based out of Bengaluru, and it has a strong presence in Mumbai, New York, and Dubai.

Visit www.signzy.com for more information about us.

You can reach out to our team at reachout@signzy.com

Written By:

Signzy

Written by an insightful Signzian intent on learning and sharing knowledge.