Online Identity Verification

Onboard today with tomorrow's technology.

Enabling global companies to build trusted users while maintaining the regulatory compliances worldwide.

Seamlessly Onboard Global Users

Stay globally

accessible.

Our digital onboarding solution is globally compliant and can be used in over 240+ countries.

Keep up with legal compliance.

Stay compliant to KYC, KYB, AML and other requirements for various geographies.

Optimize your user experience.

Streamline the onboarding experience unique for your digital products.

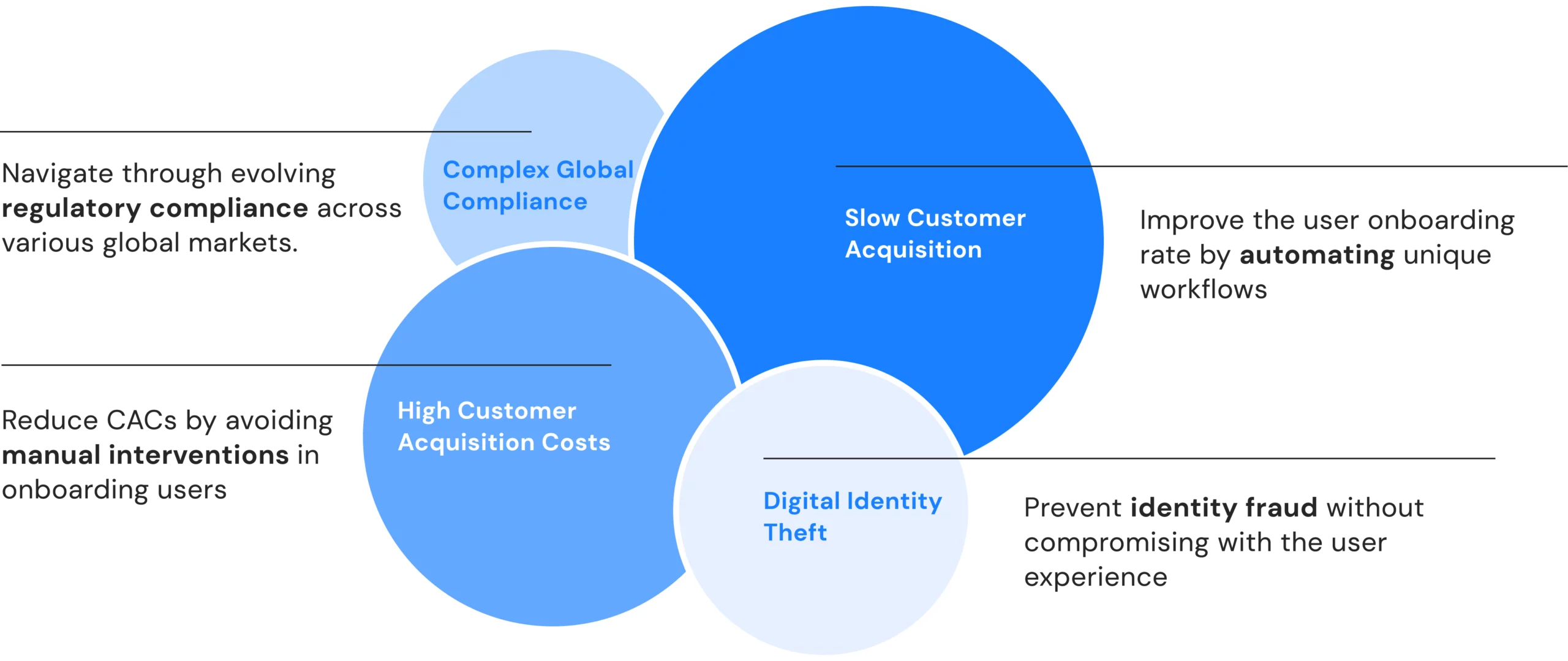

User Onboarding Challenges & Signzy’s Solution

Signzy’s Verification Solutions

Pioneering Patents

Innovation at scale

Digital Onboarding in the Metaverse

Signzy has a patent for real-time customer onboarding in the Metaverse for financial institutions.

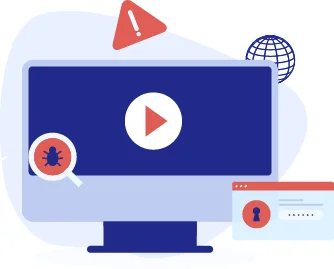

Video Based Fraud Detection Techniques

Signzy has been granted a patent for AI powered Fraudulent Behaviour Detection (FBD) technology, which can predict in real-time the likelihood of fraudulent behaviour by individuals.

News & Announcements

Websites can't replace conversations.

Let's talk?

We’re just one call away, ready to answer all your queries and provide the perfect solution for your business needs.

Error: Contact form not found.

Change country

United States

United States

API Marketplace

Menu

Usecases

Menu

Industries

Menu

Our Company

Menu

Resources

Menu

- 4320 Winfield Rd. Suite 200. Warrenville, Illinois 60555

India

India