Financial crimes, especially Money laundering, have become a matter of great concern in the US due to companies’ huge dependence on advanced technology.

And therefore, financial organisations, anti-money laundering units, regulatory authorities, and the government are required to roll out stringent measures for combating financial fraud happening in the country.

What is Anti-Money Laundering (AML)?

AML is an umbrella term of policies, rules, guidelines, and practices that financial institutions have to adhere to.

Why?

To prevent fraudsters from passing off money they have gained unlawfully as legitimate earnings.

The AML/CFT procedure, which is essential for maintaining the integrity of the financial system and thwarting illegal activity, is handled by a number of government entities in the US.

To maintain security and openness, these organizations monitor, record, and oversee financial activities. Their role is inevitably essential to preserve the security of the financial system.

FinCEN and OCC are two primary government agencies in AML/CFT.

FinCEN – Financial Crimes Investigation Network – responsible for the implementation of requirements as mentioned in Bank Secrecy Act. Facilitates AML transaction monitoring, screening, and reporting for financial institutions and suggest measures to detect and prevent financial frauds.

OCC – Office of the Comptroller of the Currency – regulates government banks and loan associations. Also oversees AML/CFT practices within financial organisations.

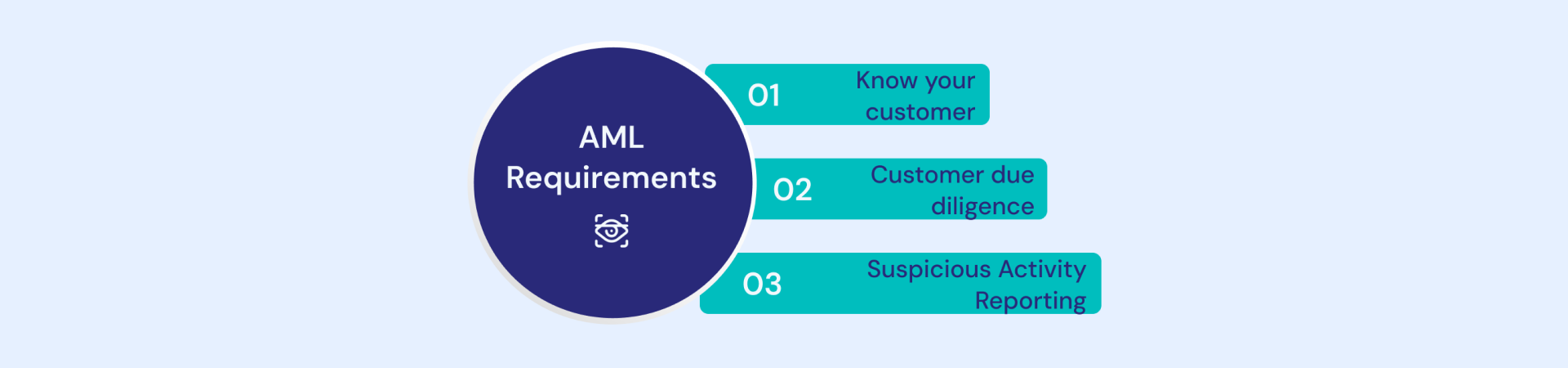

AML requirements

In order to be in compliance with different AML laws and regulations, financial organisations have to fulfill specific requirements.

This entails putting customer due diligence (CDD) and know your customer (KYC) systems into place, reporting questionable client behavior, and continuously monitoring the transactions of clients.

1. Know Your Customer (KYC)

A KYC program entails a number of procedures intended to ascertain an individual’s veracity. This usually involves additional AML tests in addition to identity verification.

KYC is essentially a kind of small background check that a consumer has to clear in order to create an account in a financial organization.

Financial organisations must also confirm important information about their business partners, such as third-party contractors, before doing business with them. The KYC procedure is frequently referred to as “Know Your Business” when it is used for businesses as opposed to individuals.

2. Customer due diligence (CDD)

Customer due diligence refers to the actions a financial organisation needs to perform to evaluate and reduce a customer’s risk of money laundering.

Financial organisations are required to adhere to the CDD rule by following the below mentioned steps:

- Determine and confirm the identities of their clients

- Determine and confirm the beneficial owners of businesses opening an account

- To create client risk profiles, understand the nature and goals of your relationships with clients

- Keep up-to-date client data and report unusual transactions through continuous risk-based monitoring

Financial organisations are allowed to perform varying levels of due diligence based on the amount of risk they determine during the account opening process.

Why? Because the risk of money laundering fluctuates.

The varying levels include:

-Standard due diligence: for clients with typical risk profiles

-Simplified due diligence: for clients who pose less risk than average

-Enhanced due diligence: for clients with higher-than-average risk

3. Transaction monitoring

Financial organizations are expected to continuously monitor the transactions of their customers.

What’s the main objective of transaction monitoring? Finding unusual activity that might be a sign of money laundering or other financial crimes.

Normally, transaction monitoring is done automatically; only when unusual activity is discovered, does manual processing become necessary.

Many factors need to be considered during transaction monitoring, such as the recipient of the funds, the amount of the transaction, the account’s transaction momentum, and the origin and destination of the funds.

4. Suspicious activity reporting (SAR)

According to U.S. law, companies must report suspicious activity (SAR) within 30 days of the transaction’s completion when it is discovered. Among the possible instances of questionable activity are:

- Huge cash dealings

- Overseas fund transfers

- Possible insider trading transactions

- Increased activity on inactive accounts

- Transactions that don’t fit the recipient’s specified business category

- Transactions that seem to be designed to get beyond the need for reporting and record-keeping

What are the three lines of defense in AML?

It is challenging for a single individual or department to manage the complicated process of managing inherent, operational, and other forms of risk within an organization.

And, this is why the need for a multi-layered risk management strategy – The three Lines of Defense arises.

This strategy assigns various responsibilities for the compliance risk management process to personnel and organisational departments. This makes it possible to take a better-coordinated approach to risk management as it lays out three distinct sets of roles and duties along with how they should support one another.

-Your everyday operations

-Your compliance and risk management procedures

-Your internal auditing process

…are your three lines of defense when it comes to AML.

These defenses represent three categories of personnel at a financial institution or other high-risk organization. Operations are protected against money laundering by employees and the procedures they adhere to.

Every employee who interacts with customers is the first link in the defensive network, and from there, internal procedures and best practices provide further protection.

Signzy helps simplify AML/KYC compliance

You may get off to a good start by locating free internet policy templates and comprehensive compliance walkthroughs.

However, real peace of mind only comes from having the assurance that every transaction you do on a regular basis complies with AML regulations. That is the level of security provided by a platform like Signzy.

In this battle, Signzy’s KYC API acts as a formidable barrier. With the help of this cutting-edge technology, financial organisations may instantly get insights into data breaches, confirming the accuracy of consumer data and spotting any dangers.

Signzy can also help you detect compromised credentials, stop fraudulent transactions, and improve compliance by incorporating the APIs into transaction monitoring systems.