- According to Mastercard’s latest reports, disputes cost merchants an estimated $117.47 billion in 2023.

- Chargeback Field 2024 report shows that 53% of customers skip talking to merchants entirely, going straight to their banks.

- Staff time, transaction processing fees, sometimes shipping costs, and some other important resources lost during the event, apart from customer relationships.

Imagine losing a customer forever – not because of your product or service, but because of a simple misunderstanding about their transaction.

And this isn’t rare. Every day, thousands of good customers turn into disputes because they don’t recognize a charge or aren’t clear about shipping times.

You give time. You give energy. You risk your merchant account being frozen. And most likely, you lose customers as well.

It’s a win-win situation in reverse for merchants.

Ever thought about a solution? There’s only one

PREVENTION.

Yes, the best way to deal with a dispute is to never have it in the first place.

Due to all odds against you, having a good dispute-defense system becomes a necessity.

And if you are looking to build a dispute-defense system for your business, give 6 minutes to this guide. By the final paragraph, you’ll understand – what they are, why they happen, and practical steps to prevent them.

💡 Related Blog: AML Requirements for Payment Processors

What Are Transaction Disputes?

A transaction dispute occurs when cardholders question charges on their statements, requiring merchants to defend the legitimacy of their sales.

The impact runs deeper than many realize. As we saw in key highlights, 53% of customers directly head to banks. This means half of the time, merchants don’t even get a chance to resolve the concerns of their customers, which in turn affects customer relationships negatively.

As we can see, while initially created as a consumer protection against criminal fraud, these disputes have shapeshifted into a business challenge.

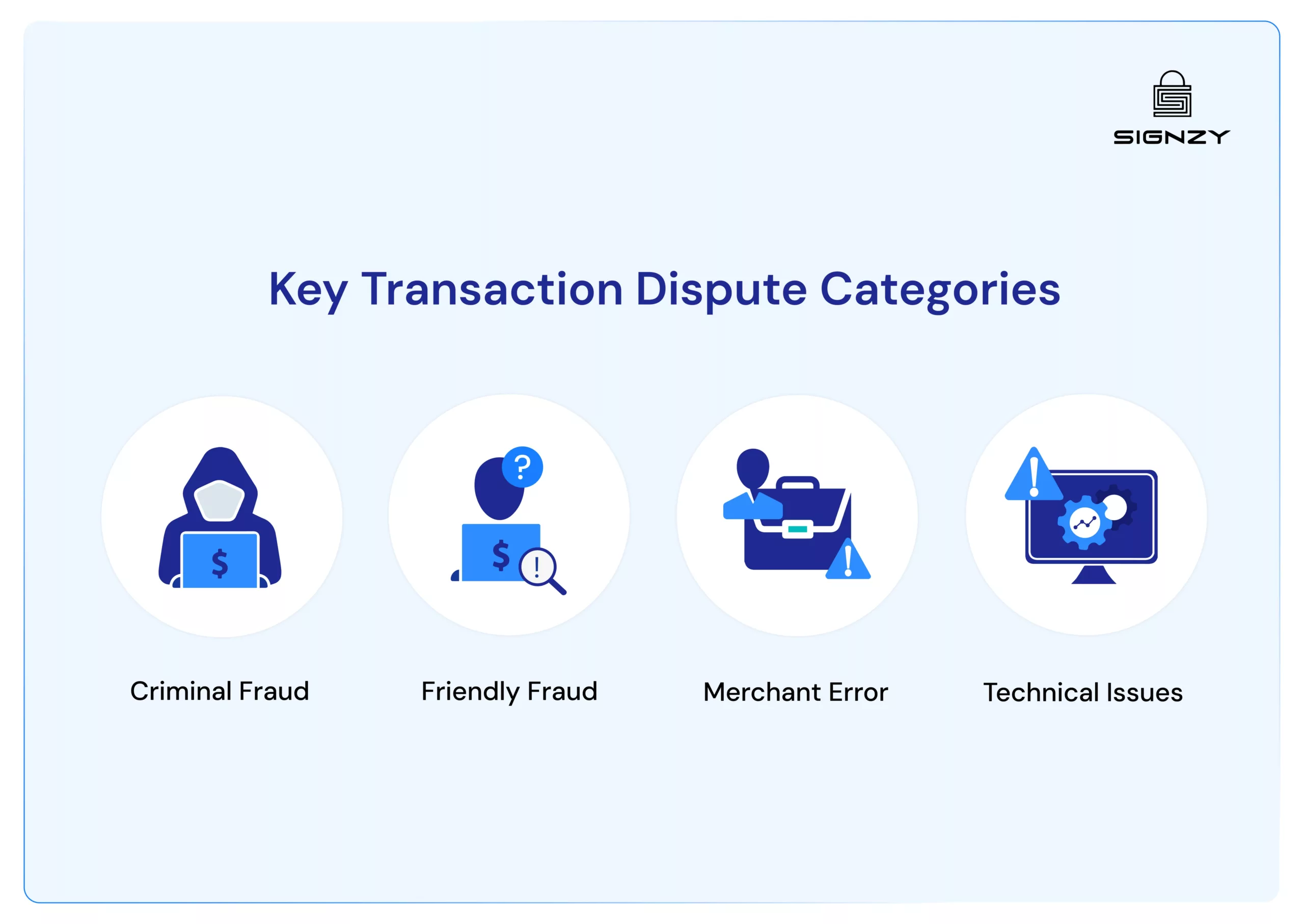

Key Transaction Dispute Categories

-

Criminal Fraud

Imagine running a small online store and suddenly discovering someone used stolen card details to place $5,000 worth of orders.

Not only does the business lose the products already shipped, but it also faces shipping costs, processing fees, and countless hours of investigation work. It’s particularly painful because even with solid security measures, sophisticated fraudsters keep finding new ways to fraud payment systems.

-

Friendly Fraud

Meet Sarah, a busy mom who sees an unfamiliar $89 charge on her statement. She files a dispute, not realizing it was her daughter’s subscription renewal from three months ago.

For merchants, these honest misunderstandings are heartbreaking – because 86% of all disputes fall into this category. The business did everything right, delivered value, yet still faces the dispute process simply because their billing descriptor wasn’t immediately recognizable.

-

Merchant Error

When the morning rush hits and a cafe’s payment system glitches, causing double charges for twenty customers’ breakfast orders. The staff is mortified, customers are frustrated, and now the business faces multiple disputes.

What makes this especially difficult is knowing that better systems or training might have prevented the whole situation – it’s a costly lesson that impacts customer trust.

-

Technical Issues

A software glitch causes authorization holds to show as charges twice on customer statements, even though they’re only charged once. Before the merchant can even explain, dozens of worried customers file disputes.

These technical hiccups, while eventually fixable, create real stress for both the business watching dispute notifications roll in and customers seeing incorrect charges on their accounts.

The Dispute Resolution Process

When a transaction dispute lands on a merchant’s desk, every hour counts.

Card networks enforce strict timelines – typically ranging from 7 to 21 days for initial responses. Missing these windows risks the entire merchant account’s stability. Here’s how each stage unfolds:

First Alert

When cardholders spot charges they don’t recognize or disagree with, most banks now offer dispute initiation through mobile apps or online banking. For merchants, this means dispute notifications can arrive any time, making rapid response systems essential.

Usually, businesses have roughly 48 hours to respond before customers fully commit to the dispute process.

Initial Bank Review

Banking partners serve as the first line of assessment in the dispute process. A regional bank receives a dispute claim for a subscription service charge. Before any action, their team examines the customer’s transaction history, spots a pattern of similar monthly charges, and notes no prior disputes.

This preliminary evaluation helps separate genuine concerns from misunderstandings, though merchants still need to provide comprehensive evidence to support their case.

Documentation Requirements

Include:

- Original transaction records with timestamps

- Proof of delivery with tracking details

- Customer communication history

- Clear product descriptions and images

- Relevant policies the customer agreed to

- IP addresses and device information

- Prior purchase history showing patterns

The Response Window

Picture a restaurant facing ten disputes from a single evening due to a system glitch. Their team must swiftly gather evidence, craft responses, and submit everything through proper channels – all while managing daily operations.

This 48-72 hour period often determines whether thousands in revenue stays in the business or gets returned to customers, making it the most intensive phase of the entire process.

Final Resolution Stages

The resolution phase brings its own complexity. Take an online course provider waiting for decisions on multiple dispute cases. While their team submitted strong evidence, banks typically need 3-5 business days for review, sometimes requesting additional information.

Each decision impacts not just immediate revenue but also shapes future dispute ratios and merchant account standing. For businesses operating on tight margins, this waiting period can feel particularly stressful, affecting cash flow planning and inventory decisions.

Common Triggers That Lead to Transaction Disputes

Each of these triggers represents common paths to disputes, often catching merchants off guard despite their preventable nature:

- Unclear Merchant Descriptors: When “Pete’s Coffee Corner” shows up as “PCE23 HOLDINGS NY” on statements, leading confused customers straight to their dispute buttons.

- Shipping Delays Without Updates: A package sits in customs for two weeks while the customer sees the charge but receives no proactive updates about the delay.

- Mismatched Product Expectations: The “genuine leather” bag arrives with synthetic materials, creating an immediate gap between advertising and reality.

- Subscription Renewal Surprises: That meditation app’s annual $99 charge hits right when the customer forgot they even had a subscription.

- Free Trial Auto-Conversions: Customers sign up for a free workout plan trial, miss the conversion notification, and dispute the first paid month’s charge.

- Multiple Authorization Holds: Hotels placing holds for incidentals but not clearly communicating the temporary nature of these charges.

- Digital Product Access Delays: Software purchase at midnight with a 24-hour activation window that wasn’t clearly communicated during checkout.

- Cart Currency Confusion: Prices displayed in USD but charged in EUR, creating unexpected totals on statements.

- Refund Timing Misalignment: Customer sees “3-5 days for refund” but disputes the charge on day 4 out of anxiety about the pending return.

- Quality Expectation Gaps: That “professional grade” kitchen knife arrives with clearly consumer-level quality, prompting immediate disputes.

- Missing Post-Purchase Support: Customers can’t find help with product activation and dispute charges out of frustration.

These triggers often combine to create perfect storms of dispute risk, making awareness of each crucial for prevention planning.

7 Transaction Dispute Prevention Strategies for Merchants

-

Clear Service Descriptions

When digital trading platforms explain their fee structures in plain language, including examples of how market fluctuations affect costs, clients understand exactly what to expect. It’s not just about listing fees – it’s about contextualizing them. “

✔️ 0.2% trading fee on market orders during high volatility periods”

❌ Fees may vary based on market conditions”.

The “o.2…” description can prevent disputes better than because it sets specific expectations.

-

Transparent Transaction Communications

Payment processors demonstrate this perfectly. Consider those sending real-time notifications for every stage of a high-value transaction: authorization, processing, clearing, and settlement.

When institutional clients see “Cross-border payment processing: Stage 2/4 – Intermediary bank confirmation received,” they’re less likely to raise concerns about processing times.

-

Systematic Documentation

You can treat every transaction as a potential dispute case.

For example, if you are a digital asset exchange, you can set archives, trade confirmations, wallet addresses, KYC/AML verification timestamps, IP address logs, device fingerprints, and multi-factor authentication records, and all client communications for automatic storing. When questions arise about any transfer, your evidence package is ready within minutes.

-

Proactive Risk Communication

The most successful approach? Real-time risk alerts before issues escalate.

Digital lending platforms monitoring unusual account activity don’t wait for clients to notice problems. When they spot irregular loan payment patterns, they often reach out first to discuss adjustment options.

-

Advanced Customer Authentication Protocols

For example, digital banking platforms implementing stepped authentication based on transaction risk levels show remarkable dispute reduction. Let’s understand it by example:

- Tier 1 – Standard transfers: Basic two-factor authentication suffices.

- Tier 2 – Large wire transfers or first-time international payments: Additional security layers activate – biometric verification, relationship manager confirmation

- Tier 3 – Extremely large transactions: Video verification

The above tiers are just examples; you can tweak and twist them as you find useful.

-

Educate Clients

Instead of dense terms and conditions, you can embed education into transaction processes. For example, when setting up recurring investment schedules, clients see clear visualizations of fee structures, market impact timing, and potential adjustment periods.

-

Streamline Refund and Adjustment Processes

Prioritizing rapid resolution can dramatically reduce formal disputes. Rather than rigid refund policies, implement smart thresholds. Example tiers: Transactions under certain amounts receive automated resolution options, while larger ones trigger immediate account manager review.

The Solution

With transaction disputes becoming more complex in the digital age, prevention starts with robust identity verification and fraud detection. We at Signzy understand this – which is why our suite includes Face Match API for biometric verification, Business Verification for merchant validation, and KYC solutions that help financial institutions verify customers before transactions occur.

FAQs

What exactly qualifies as a transaction dispute?

A formal challenge by cardholders questioning charges on their statements, requiring merchants to prove the sale’s legitimacy through their bank or card issuer.

How long do merchants have to respond to a dispute?

Visa allows 30 days for merchant responses, while Mastercard provides 45 days. Both recommend submitting evidence as early as possible.

What is friendly fraud in transaction disputes?

When legitimate cardholders dispute valid charges due to confusion about merchant names, forgotten purchases, or seeking to avoid proper return processes.

What documentation is essential for dispute resolution?

Transaction records, delivery confirmation, customer communications, product descriptions, and business policies form the core evidence package for dispute defense.