- FinCEN receives approximately 2 million Suspicious Activity Reports (SARs) annually from financial institutions in the U.S.

- The UN estimates $800 billion to $2 trillion is laundered globally each year. Structuring is one of the key methods used to integrate these funds.

- First-time structuring violations can lead to penalties of up to $250,000 for individuals and $500,000 for organizations, plus up to 5 years of imprisonment per violation.

Money flows through the global financial system like water – and just like water, it can find hidden paths to move undetected. At the heart of many of these operations lies a deceptively simple technique: structuring.

If you’re running a business, you already know the importance of handling cash transactions properly.

But here’s what many business owners don’t realize.

When a customer or supplier suggests breaking down large payments into smaller ones “to keep things simple” – they might be unknowingly asking you to commit this federal crime.

Apart from legal consequences, getting caught in a structuring investigation can destroy your business relationships and banking privileges – even if you were an unwitting participant.

Got 6 minutes? Because, that’s all it takes to understand structuring and why it matters to your business.

It starts from here.

What is Structuring in Money Laundering?

Structuring occurs when individuals deliberately split large financial transactions into smaller amounts to avoid mandatory reporting requirements.

Wondering why this matters? The financial system relies on transparency and reporting to maintain its integrity. When someone attempts to bypass these safeguards through structuring, they can potentially be masking criminal activity.

That’s why regulatory bodies worldwide have established strict reporting thresholds and monitoring systems.

In the United States, financial institutions must report cash transactions exceeding $10,000. Similar frameworks exist across other major economies – Canada mandates reporting at CAD 10,000, Australia at AUD 10,000, the United Kingdom at £10,000, and the European Union at €10,000.

💡 Related Blog: What is Money Laundering? How Can Your Business Counter It?

Examples of Structuring

Think about a business owner who receives $30,000 in legal cash revenue but wants to avoid paperwork. Breaking this amount into four $7,500 deposits might seem clever, but it’s actually a federal crime – even though the money was earned legitimately.

Got it? Let’s simplify even more. Here’s another example

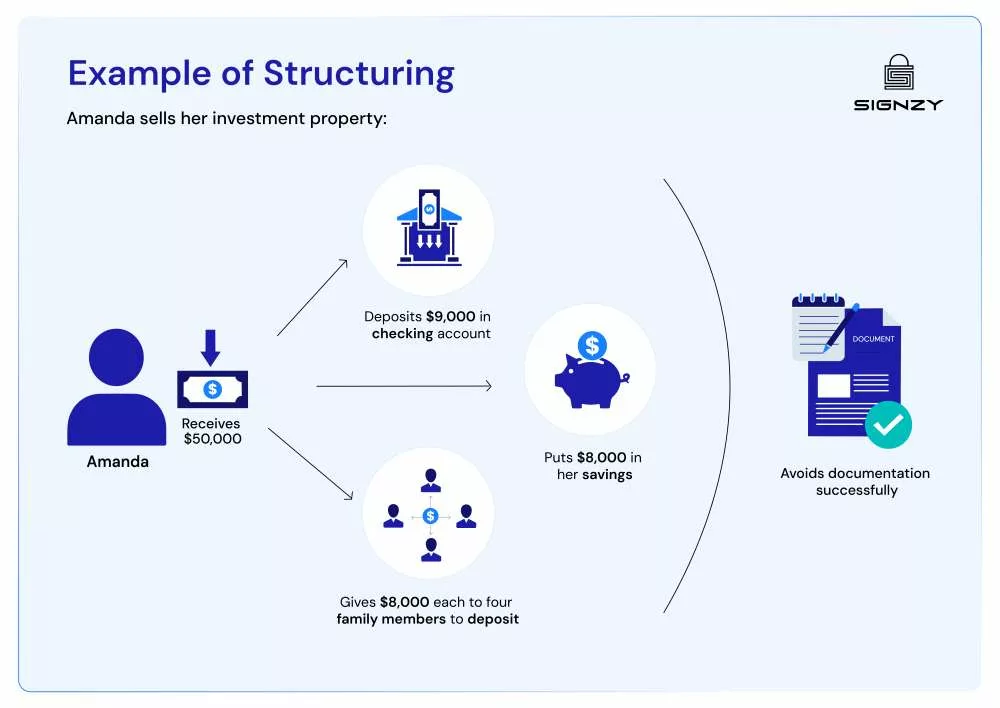

Amanda sells her investment property:

- Receives $50,000 in cash payment

- Deposits $9,000 in her checking account

- Puts $8,000 in her savings

- Gives $8,000 each to four family members to deposit

- Avoids documentation successfully or we can say it “plays the system.”

In the above scenario, despite legal sources, Amand is committing structuring violation.

While similar in nature, don’t confuse structuring with its complex cousin: Smurfing.

Difference Between Structuring and Smurfing

Simple structuring often involves a single player or small group working with their own accounts. Think of it as a solo performance: one person trying to fly under the radar by making smaller deposits. They might use a handful of accounts, stick to local branches, and keep their operation relatively straightforward.

Smurfing, on the other hand, brings in the whole orchestra. It involves networks of people (called smurfs) who coordinate their activities across multiple banks, cities, and sometimes countries. These operations often use shell companies, fake identities, and complex transaction patterns that make simple structuring look like child’s play.

How Exactly Does Structuring Work?

Those engaging in structuring typically employ sophisticated patterns to evade detection.

Some spread their transactions across multiple days, creating a pattern that appears natural at first glance.

Others distribute their activities geographically, using different branches or institutions to create an illusion of unrelated transactions.

The most complex schemes combine various methods; the most prominent ones among them include:

- Same-Day Patterns: Breaking up big money moves throughout a single day – like splitting your coffee budget into tiny bits. They’ll hop between branches, mix up their transaction types, and time everything just so.

- Multi-Day Distribution: Spreading deposits across days or weeks, similar to how someone might space out their holiday shopping to avoid a shocking credit card bill. The goal is to make each transaction look normal and unrelated.

- Branch Distribution: Playing a financial version of hopscotch across different bank locations. They pick branches far apart, hoping the distance will mask the connection between transactions.

However, banks and regulators have developed sophisticated red flags and indicators to catch wrongdoers. Knowing these can be useful for businesses as well since you can also get under scrutiny if regulators find a link between you and wrongdoers (those who are playing the system).

Rest easy – you can just look for the flags listed below and avoid most of the problems.

| 🚩 Multiple deposits just under reporting limits, especially in quick succession

🚩 Rapid-fire transactions across different branches in one day 🚩 Cash deposits instantly followed by wire transfers 🚩 Sudden explosion of account activity after months of quiet 🚩 Branch visits that look more like a city tour 🚩 Precise online transfers hovering right under limits 🚩 Structured patterns that repeat weekly or monthly 🚩 Transactions that dodge reporting requirements by tiny margins 🚩 Multiple people making similar deposits to the same account |

Regulatory Framework and Compliance

Staying compliant is a must – but it doesn’t have to be a constant source of stress either.

The key is understanding not just what the rules are, but why they exist and how they work together. Let’s walk through the regulatory framework that keeps money moving safely.

Bank Secrecy Act

The Bank Secrecy Act stands as the foundation of anti-structuring efforts. While bankers might joke about drowning in paperwork, these requirements create crucial paper trails that help catch criminal activity.

Financial institutions have to report currency transactions exceeding $10,000 through Currency Transaction Reports (CTRs). But here’s what many don’t realize – banks are required to aggregate related transactions occurring in a single business day. So splitting $15,000 into two deposits won’t fool anyone.

Reporting Rules

Everyone knows about the $10,000 reporting threshold – it’s practically become dinner table conversation in banking circles. But there’s more to it than just a simple number. A series of $3,000 deposits could trigger just as many red flags as a $9,999 transaction. Most institutions use sophisticated monitoring systems that track transaction patterns over 30, 60, and 90-day periods.

Suspicious Activity Reporting

When something suspicious pops up, financial institutions have exactly 30 days to file a Suspicious Activity Report (SAR). If they need more information? They get an extra 30 days – but that’s it.

In cases involving senior managers or large sums, many institutions file within 24 hours. These reports are confidential – financial institutions can’t even tell their customers they’ve filed one to avoid tipping off potential wrongdoers.

Penalties

Breaking structuring laws carries federal prison sentences of up to 5 years per violation. Fines can reach $250,000 for individuals and $500,000 for organizations. Plus, prosecutors can seize structured funds along with any property bought with that money. Recent cases have seen combined penalties exceeding $1 million – even for first-time offenders.

Prevention and Detection Measures

As the famous quote goes, prevention is always better than cure. But what does effective prevention actually look like in practice?

Let’s explore how

Monitor Transactions

Remember when catching suspicious transactions meant manually reviewing stacks of paper reports? Those days are long gone. Modern monitoring systems work around the clock, processing millions of transactions and spotting patterns that might signal structuring.

These systems watch how money moves, when it moves, and where it goes. When a pattern breaks – like someone who typically makes one large monthly deposit suddenly switching to multiple smaller ones – the system notices.

It’s rather like having a really observant friend who knows exactly when something seems off about your routine.

Use Human Intervention

While technology does the heavy lifting, it doesn’t beat human judgment (at least for now) when it comes to understanding context.

Experienced professionals know that structuring isn’t always obvious. Sometimes it’s in the subtle things – the nervous questions about deposit limits, the rushed transactions right before closing time, or the unusually complex explanations for simple transfers.

Build Better Risk Assessment

The trick to effective monitoring? Understanding that not every account needs the same level of attention.

- Some accounts naturally handle more transactions than others.

- Some deal primarily in cash

- Some rarely see physical currency.

Modern risk assessment takes all this into account, adjusting its watchfulness based on real patterns rather than rigid rules.

Protect Every Channel

Here’s the thing about modern banking – money moves in more ways than ever before. That means monitoring needs to cover everything from traditional teller windows to the latest payment apps.

When someone tries to structure transactions by mixing different channels, good detection systems connect those dots immediately.

The Solution

Looking at these complex verification challenges? Let’s be honest – catching structured transactions isn’t easy when you’re juggling multiple verification processes.

That’s where Signzy steps in with intelligent solutions like our Criminal Screening API and PEP Screening modules. They work together seamlessly to help detect and prevent structuring attempts through real-time verification.

Think of us as having an extra set of very smart eyes monitoring things round the clock

FAQs

Is structuring still illegal if the money comes from legitimate business?

Yes. The act of deliberately breaking up transactions to avoid reporting requirements is illegal, regardless of whether the funds are from legal sources. The crime lies in the attempt to evade reporting.

How do regulators determine the intent behind transactions?

They examine pattern consistency, timing, communications, and overall behavior. Multiple transactions just below thresholds, especially when paired with attempts to hide relationships between deposits, strongly indicate intent.

What should you do if you suspect structuring?

File a Suspicious Activity Report (SAR) within 30 days. Don’t inform the suspected party – that’s illegal. Document all relevant transactions and maintain confidentiality throughout the investigation.

Are there exceptions to structuring rules?

No blanket exceptions exist, but legitimate businesses can work with their financial institutions to establish expected transaction patterns and documentation for regular operations that might otherwise raise flags.