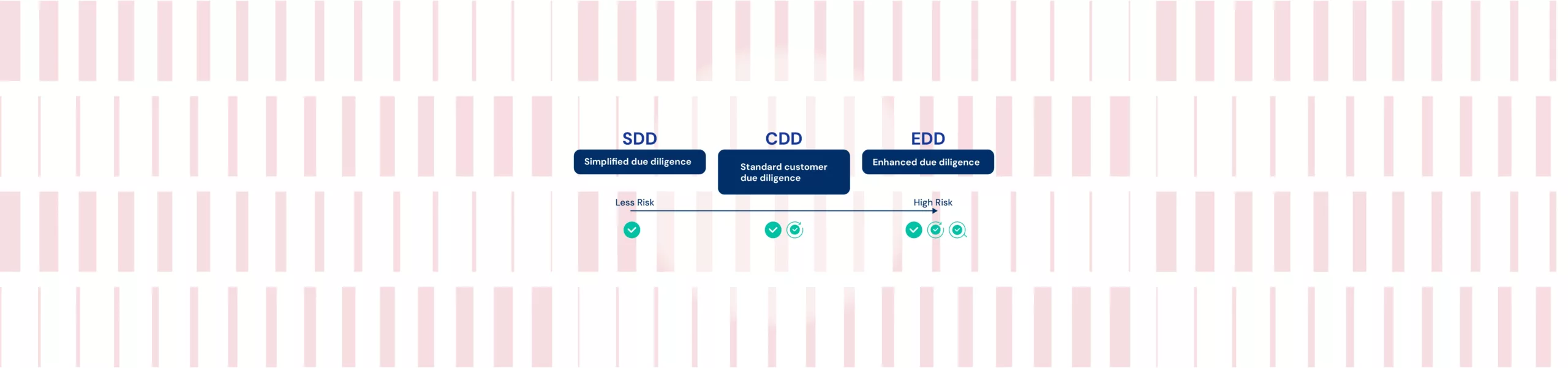

Levels of Due Diligence: Simplified, Standard, and Enhanced Due Diligence

September 30, 2024

6 minutes read

It is necessary for all financial institutions to conduct due diligence on their clientele. The level of due diligence is determined by the risk profile of the concerned client and falls in line with the risk-based approach prescribed by the AML/CFT regulations.

Due diligence is not a one-and-done process. Businesses need to monitor their customers and maintain vigilance to ensure that clients are subject to the appropriate and updated due diligence standards.

What is Due Diligence and When is it Required?

Due diligence is an ongoing process that involves collecting vital information about your business clients. One might believe that low-risk clients don’t need any due diligence due to the direct relation between a client’s risk profile and degrees of due diligence. However, that is not the case.

Here’s a list of the situations that call for a business to conduct due diligence on its clients:

- Establishing a new business relationship: Businesses need to conduct due diligence for any new clients that they onboard. This includes collecting the client’s personal information and performing their risk assessment. The business must also verify the authenticity of the identity documents submitted by the customer.

- Specific Transactions: Businesses need to conduct due diligence for customers when they execute certain transactions. These can include transactions that exceed a regulatory limit, are out of the ordinary course of business for the client, or transactions that involve high-risk individuals or locations.

- Suspicious Transactions: Customers who execute transactions that create suspicion of possible money laundering or terror financing require businesses to conduct proper due diligence for the clients involved in such transactions.

- Issues with Documentation: If the business suspects that a client has submitted illegitimate identification documents, it may conduct due diligence to ensure the authenticity of the documents submitted, or take legal action against the client who submits false documents.

- General Course of Business: Businesses do not stop conducting due diligence at any point in their operations. Due diligence is an ongoing process to keep the business up to date with the risk profiles of all its clients.

💡 Related Blog: KYC Vs CDD – What is the difference

What are the Different Levels of Due Diligence?

Based on the risk profiles associated with a client, a business may assign one of the following levels of due diligence to them:

Simplified Due Diligence

This level of due diligence is conducted for clients with no risk or negligible risk associated with them. Under Simplified Due Diligence, the business needs to only identify their customer.

While SDD doesn’t require it, prudence suggests that businesses also verify the authenticity of their clients’ identities. The steps involved in the Simplified Due Diligence process are as follows:

- Obtain basic information like the customer’s name, contact information, and the patterns and nature of their transactions.

- Understand the risk associated with the customer and the required level of due diligence.

- Verify the customer’s identity with liveness checks, face match, driving license verification, SSN verification, and more methods.

- Record and report transactions irrespective of whether or not they are suspicious.

- Conduct ongoing monitoring to keep track of the customers’ changing risk profiles and enforce necessary due diligence on them.

Standard Due Diligence

Standard Due Diligence includes going a step further from Simplified Due Diligence and involves mandatory authentication of the client’s identity. Under Standard Due Diligence, businesses need to find the person being represented in case the client is acting on behalf of another entity.

Businesses also need to collect basic information about the client, a copy of their government-issued identification (like driving license, social security card, etc.), and a selfie. These submissions then need to be verified to ensure their legitimacy.

Enhanced Due Diligence

Enhanced Due Diligence is attracted by clients who have the highest likelihood of committing money laundering, terror financing, or other illegal activities. EDD is most commonly applied to individuals with criminal histories, Politically Exposed Persons, companies with operations in high-risk geographies, and more.

EDD includes some additional measures that are taken on top of Standard Due Diligence. These include:

- Collecting additional information about the concerned client.

- Gathering more information about the source and destination of funds.

- Understanding the nature of the relationship between the business and the client in question.

- Investigating the purpose of the transaction being conducted by the client under suspicion.

- Continuing to monitor and record the client’s operations and transactions with the business.

What level of due diligence does your business need?

As we’ve mentioned before, any business that deals with potentially risky customers and is in a line of operations that exposes them to the risk of money laundering, terror financing, or other illegal activities, needs to conduct due diligence.

If you are operating a financial business, due diligence becomes a regulatory requirement under the FinCEN’s AML/CFT laws. The level of due diligence will depend on the risk associated with the customers that you engage with. A Politically Exposed Person (PEP) and people with criminal histories will require stricter due diligence, as the former poses money laundering risk, and the latter could be engaged in illegal activities.

Businesses like casinos and gaming platforms also need to conduct due diligence as these are common methods used to inject illegal money back into the legal financial system.

How Signzy Helps Businesses Conduct Due Diligence

Maintaining proper due diligence standards in a business is an ongoing process and requires attention from the business owners. This process can be streamlined manifold by integrating the processes digitally.

Thankfully, with Signzy, you don’t need to spend too many resources or a lot of time in integrating nifty APIs like KYC Verification, Criminal Screening, PEP Screening, and more. Signzy’s user-friendly platform ensures that you don’t experience any drop-offs while requiring clients to complete their due diligence requirements.

Signzy’s DL Verification API and SSN Verification API also help businesses ensure that they are up to date with the regulatory requirements and maintain compliance an security in their business. All of these APIs bundled together help create a more robust security system that helps businesses remain compliant with the AML and CFT laws.

So book a demo with Signzy and see how you can improve your due diligence processes.

Frequently Asked Questions

What are the different levels of due diligence?

The different levels of due diligence, in the order of stringency, are Simplified, Standard, and Enhanced Due Diligence. The various levels apply to clients with negligible, normal, or high-risk profiles, respectively.

What is due diligence in KYC?

Due diligence is a procedure of identifying, verifying, monitoring, and reporting its clientele by financial institutions. Due diligence is necessary to ensure that any bad actors or possible illegal activities do not pass under the regulatory radar.

What is the EDD process?

EDD, or Enhanced Due Diligence is conducted for customers that are considered high-risk by a financial institution that such client(s) associate with. The EDD procedure involves applying the highest level of monitoring and investigation to a client out of the three levels of due diligence.