- Non-compliance with KYB requirements may lead to significant penalties for businesses or financial institutions, including fines, license revocation, and even criminal prosecution.

- In 2021, financial institutions got hit with $2.7 billion in fines over weak KYB and AML processes.

- One compliance slip-up can cost over $100 million in fines. BitMex serves as good example – they got slammed for lax KYB checks.

How to Handle Failed KYB Verification?

Let’s start with what not to do:

don’t panic, and don’t ignore it.

A failed KYB verification might feel like a massive obstacle in your compliance process, but ignoring it or reacting impulsively only worsens the situation. Instead, knowing the right steps to take can turn a temporary delay into a solvable issue.

Now, here’s what to do:

find out exactly why it failed, fix the issue with your verification process, flag any suspicious activities, and get back on track.

However, it’s not as easy as it sounds. The above steps are an oversimplification of what needs to be done. While it takes slightly more, things are not that complex – you’ll get it in the next sections.

The following sections break down exactly how to handle any business verification failure you might face.

What is KYB Verification Failure?

Just as a doctor carefully screens patients before recommending treatment, Know Your Business (KYB) verification helps financial institutions diagnose potential risks and prescribe appropriate measures.

When KYB checks don’t pass, it’s completely natural for compliance teams to feel concerned.

Yet, a failed verification doesn’t always spell trouble. Take for instance, high-growth companies in international markets – their rapid changes and complex structures naturally trigger verification flags.

What matters is spotting the difference between these natural complexities and genuine warning signals. When a business shows patterns of obscure documentation or resistance to transparency, that’s when you need to lean in closer.

Types of KYB Failures [Problems, Risk Profiles, and Solutions]

| Verification Failure Type | Common Problems | Risk Level | Solutions |

| Document Verification | – Expired registration documents

– Poor quality scans – Missing pages – Documents in foreign language without translation |

🟡 Medium | – Request new, clearly scanned documents

– Use certified translation services – Cross-reference with official registries – Set clear document requirements upfront |

| UBO Identification | – Complex ownership structures

– Shell companies – Incomplete ownership declaration – Unable to verify key stakeholders |

🔴 High | – Request detailed ownership structure diagram

– Conduct enhanced due diligence – Use multiple verification sources – Consider third-party UBO verification services |

| Company Data Mismatch | – Address inconsistencies

– Different company names – Inconsistent registration numbers – Mismatched business activity |

🟡 Medium | – Cross-check against official registries

– Request proof of address – Verify through multiple sources – Document reason for discrepancies |

| Adverse Media Findings | – Negative news

– Legal proceedings – Regulatory violations – Reputation issues |

🔴 High | – Conduct thorough media screening

– Request explanation from company – Document mitigation measures – Consider enhanced monitoring |

| Sanctions Match | – Direct sanctions hit

– Related party on sanctions list – Historical sanctions – Jurisdiction sanctions |

🔴 High | – Immediate escalation to compliance

– Freeze onboarding process – Document all findings – Consider filing SAR if required |

| Business Activity | – High-risk industry

– Unclear business model – Inconsistent revenue sources – Multiple business types |

🟡 Medium | – Request detailed business plan

– Verify revenue sources – Check industry licenses – Consider site visit |

| Financial Documentation | – Incomplete statements

– Inconsistent financials – Missing audit reports – Unusual transactions |

🟢 Low to 🔴 High (depends on context) | – Request additional financial documents

– Verify with accounting standards – Consider independent verification – Document unusual patterns |

Responding To Failed KYB Verifications

When a KYB verification fails, those first moments set the tone for everything that follows.

Start by capturing the complete picture.

Note which specific verification points failed, what documentation was provided, and any unusual patterns. Also take a look at ownership structures and conduct AML screening.

A single missing document might need a simple follow-up, while multiple discrepancies could signal deeper concerns.

Reach out promptly to the business with a professional, balanced message. Explain:

- Which specific checks didn’t pass

- What this means for their application

- Clear next steps they can take

While maintaining open dialogue, protect your institution with appropriate temporary measures:

- Apply necessary account restrictions

- Document your reasoning clearly

- Ensure all relevant teams stay informed

- Monitor for any additional risk signals

Handling High-Risk Scenarios

Not all KYB failures carry equal weight. Some situations demand enhanced due diligence – not to create barriers, but to ensure proper safeguards.

Sanctioned Connections

Adverse Media Findings

Cross-Border Complications

|

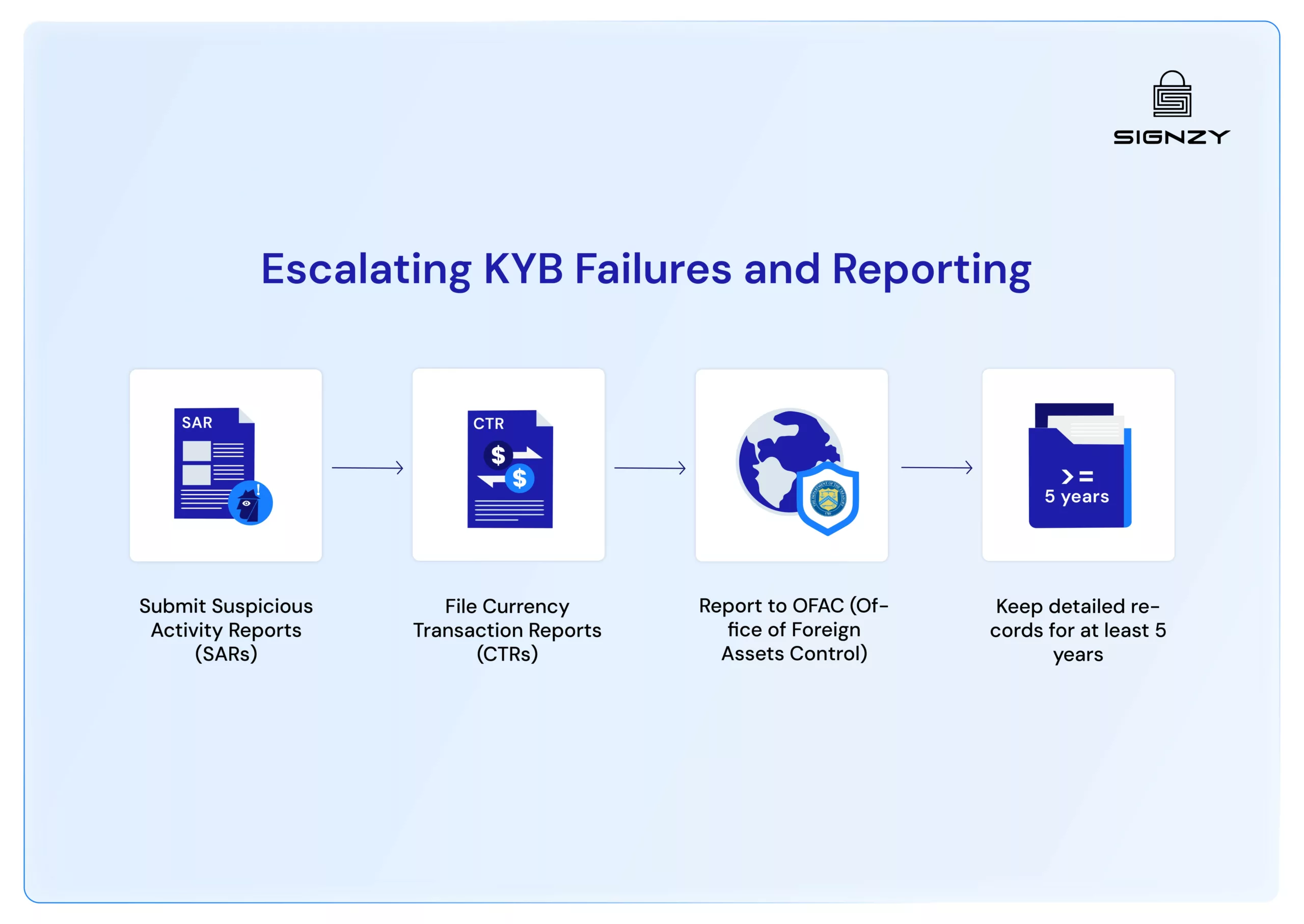

Escalating KYB Failures and Reporting

If your financial institution comes across any KYB verifications that raise significant concerns, you are obliged to maintain clear reporting channels with FinCEN (Financial Crimes Enforcement Network).

- Submit Suspicious Activity Reports (SARs) within 30 days if verification failures suggest potential money laundering or fraud

- File Currency Transaction Reports (CTRs) for relevant cash transaction patterns (If transaction value is >$10k)

- Report potential sanctions violations to OFAC (Office of Foreign Assets Control)

- Keep detailed records of all reports filed for at least 5 years

If you report verification failure after 30 days, you would need a strong reason for doing so.

Whenever you report, make sure you provide comprehensive details about verification failures, document your reasoning clearly, and maintain strict confidentiality about SAR filings.

Strengthening Your KYB Verification Framework

While handling verification failures effectively is crucial, prevention remains the best strategy.

When KYB verifications fail, every business faces a choice: treat each case as an isolated incident, or use these experiences to build stronger systems. Adapting the latter path can help you build verification systems that prevent issues right at the door.

Now, to top it all, institutions can adapt verification APIs which can help you access everything from one place: business verification, ownership checks, and political exposure screening – all working smoothly together.

For organizations looking to take their KYB verification systems a notch higher, Signzy offers,

- Business Verification API – for comprehensive company authentication

- UBO Check API – for clear ownership verification

- PEP Screening API – for thorough political exposure checks

FAQs

How long should a KYB verification typically take?

Standard KYB verifications usually take 2-3 business days. However, complex cases involving international businesses or intricate ownership structures might require 5-7 days for thorough verification.

What's the first thing to do when a KYB verification fails?

Document the specific reason for failure and communicate clearly with the business about what’s missing or incorrect. Quick, professional communication helps maintain good relationships while resolving issues.

Can a business continue operations during a failed verification?

This depends on your risk policy and the nature of the failure. Minor documentation issues might allow limited operations, while serious concerns typically require pausing business activities until resolution.

If a verification fails due to technical issues, how should we handle it differently?

Technical failures should be resolved quickly through your IT team or verification service provider. Always communicate the technical nature of the issue to the business to maintain transparency and trust.