- As revealed in the Stolen Asset Recovery Initiative, anonymous companies were involved in hiding the proceeds of corruption in 85% of grand corruption cases reviewed.

- The leaked Panama Papers revealed that over 214,000 offshore companies were used to conceal UBOs.

- KYB checks that fail to identify UBOs make it harder for financial institutions to properly assess business risk, increasing exposure to fraud.

Unless a company appears in Fortune 500 headlines, finding its true owner (not always the one who claims to be) is rarely straightforward.

However, it’s still possible. You just need to understand exactly where to look, what to verify, and most importantly – what might be missing.

And 8 minutes is all you need.

The following guide details all steps and information you need to find a company.

Clock starts now.

💡 Related Blog: How to verify businesses?

Who is the Ultimate Beneficial Owner Exactly?

Here’s a quick definition: an Ultimate Beneficial Owner (UBO) is the natural person who ultimately owns or controls a company.

But here’s where it gets interesting – the definition varies by region.

However, across all major markets including the United States, European Union, Canda, and UAE, UBO is anyone who has 25% or more ownership and control rights.

It’s worth noting that pure ownership percentage is not the complete story.

Control comes in three distinct forms:

- Direct Ownership: The straightforward scenario where an individual holds shares or voting rights directly in the company. Think of a startup founder who owns 60% of their company’s shares.

- Indirect Control: This involves control through intermediary entities. Imagine a chain of companies where each owns the next, with a single individual controlling the first company in the chain.

- Economic Benefit Rights: Sometimes, control isn’t about voting rights at all. It’s about who receives the profits, dividends, or other financial benefits. A trust beneficiary might have no formal ownership but could be the UBO if they’re the primary beneficiary of the company’s success.

Why Is It Important to Identify Ultimate Beneficial Owners?

Companies omitting UBO verification are subscribing to a world of risks which can result in unwanted consequences – legal penalties, imprisonment, and even total business halt.

Some common risks of not verifying UBOs are

- Money Laundering Schemes: Companies with unclear ownership structures can become conduits for cleaning illicit funds. A complex web of corporate entities, especially across multiple jurisdictions, can make tracking the true source of funds nearly impossible without proper UBO verification.

- Terrorist Financing: When beneficial ownership remains opaque, legitimate businesses might unknowingly become channels for funding terrorist activities.

- Tax Evasion: UBOs might use sophisticated offshore structures to conceal their wealth and evade tax obligations. This isn’t just about lost government revenue – it’s about maintaining fair business practices and preventing market distortion.

- Sanctions Evasion: Perhaps the most immediate risk is sanctions evasion. Sanctioned individuals often use nominee directors or complex ownership structures to continue business operations despite international restrictions.

The Pandora Papers investigation revealed more than 810,000 shell companies, revealing how UBOs can conceal their identities to evade taxes, dodge sanctions, or worse.

These shell companies held at least 8% of global wealth – over $11.3 trillion in funds potentially tied to illicit activities.

You can be part of this picture unknowingly if you don’t know how to properly identify UBOs…and face legal consequences.

This brings us to the main section.

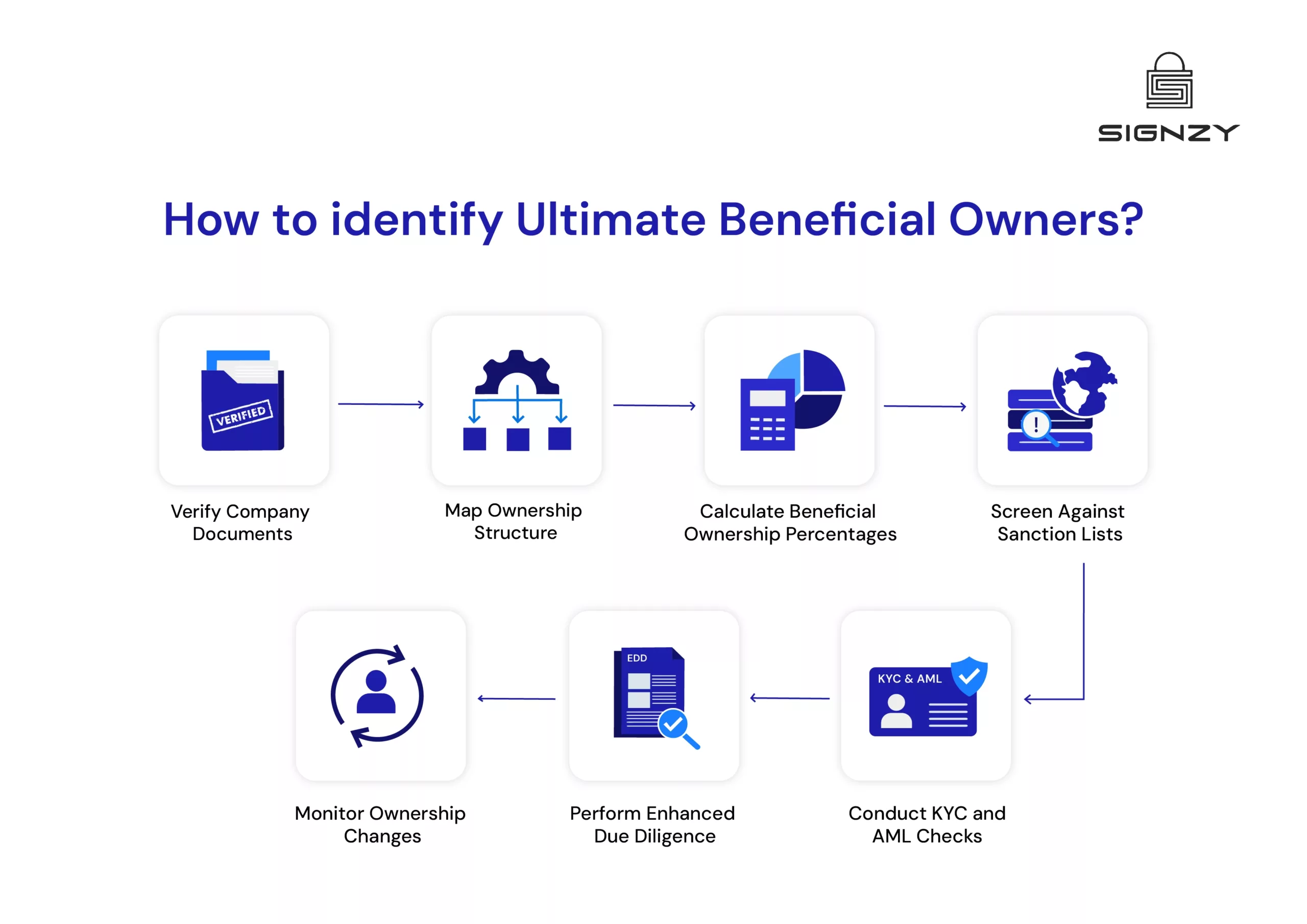

How to identify Ultimate Beneficial Owners (UBOs)?

Here’s a step-by-step answer of how to identify UBOs of any company:

- Verify Company Documents: Request and authenticate basic company documents to establish legal existence and reported ownership structure.

- Map Ownership Structure: Draw clear connections between shareholders, related entities, and control relationships to reveal the complete ownership picture.

- Calculate Beneficial Ownership Percentages: Determine both direct and indirect ownership shares to identify individuals meeting UBO thresholds.

- Screen Against Sanction Lists: Check potential UBOs against global watchlists to identify any regulatory red flags or restrictions.

- Conduct KYC and AML Checks: Verify the identity and background of identified UBOs through standard KYC and AML procedures.

- Perform Enhanced Due Diligence: Apply additional scrutiny for complex structures, high-risk jurisdictions, or concerning findings.

- Monitor Ownership Changes: Establish processes to track and verify any changes in beneficial ownership over time.

This systematic approach helps ensure compliance while protecting against financial crime risks.

UBO Verification Documents Requirements

While requirements vary across regions and entity types, certain basics remain constant. Every UBO verification needs:

- Current government ID (like Emirates ID in UAE, Green card in U.S)

- Proof of address (like utility bills and driver license)

- Tax registration details

Ownership Analysis

Understanding ownership means following the money and control.

Simple ownership is straightforward – but business structures rarely are. Here’s what it looks like in practice:

- Direct UBO Example

- Company X owns 80% of Company Y.

- Entity A controls 50% of Company X.

The math will be: Entity A’s real ownership in Company Y = 80% × 50% = 40%

But what happens with multiple ownership paths? Let’s break it down:

- Complex UBO Example

Entity B controls:

- 60% of Company P

- 40% of Company Q

Both P and Q own 30% each of Company R.

The math becomes: (60% × 30%) + (40% × 30%) = 30% total control.

Unlike direct UBO structure, this structure raises concerns.

Entity B has split its ownership across two companies to own the same target (Company R).

While the math shows 30% total control, this split structure could be designed to appear below regulatory thresholds at each individual company level, potentially avoiding scrutiny.

When ownership is fragmented this way without clear operational necessity, it often indicates an attempt to obscure the total control.

Red Flag Checklist

Every business relationship carries risk. But certain patterns have historically been associated with attempts to hide true ownership or facilitate financial crime.

Here’s a red flag checklist you keep with you:

| 🚩 Multiple holding companies without clear business purpose

🚩 Ownership percentages consistently at 24.9% (just below common reporting thresholds) 🚩 Circular ownership patterns (Company A → B → C → A) 🚩 Nominee shareholders or directors with no apparent business involvement 🚩 Ownership traced to recognized tax havens 🚩 Sudden ownership changes without business justification 🚩 Reluctance in ownership information disclosure 🚩 Document inconsistencies 🚩 Unnecessarily complex offshore structures 🚩 Sanctioned entities appearing in ownership chain |

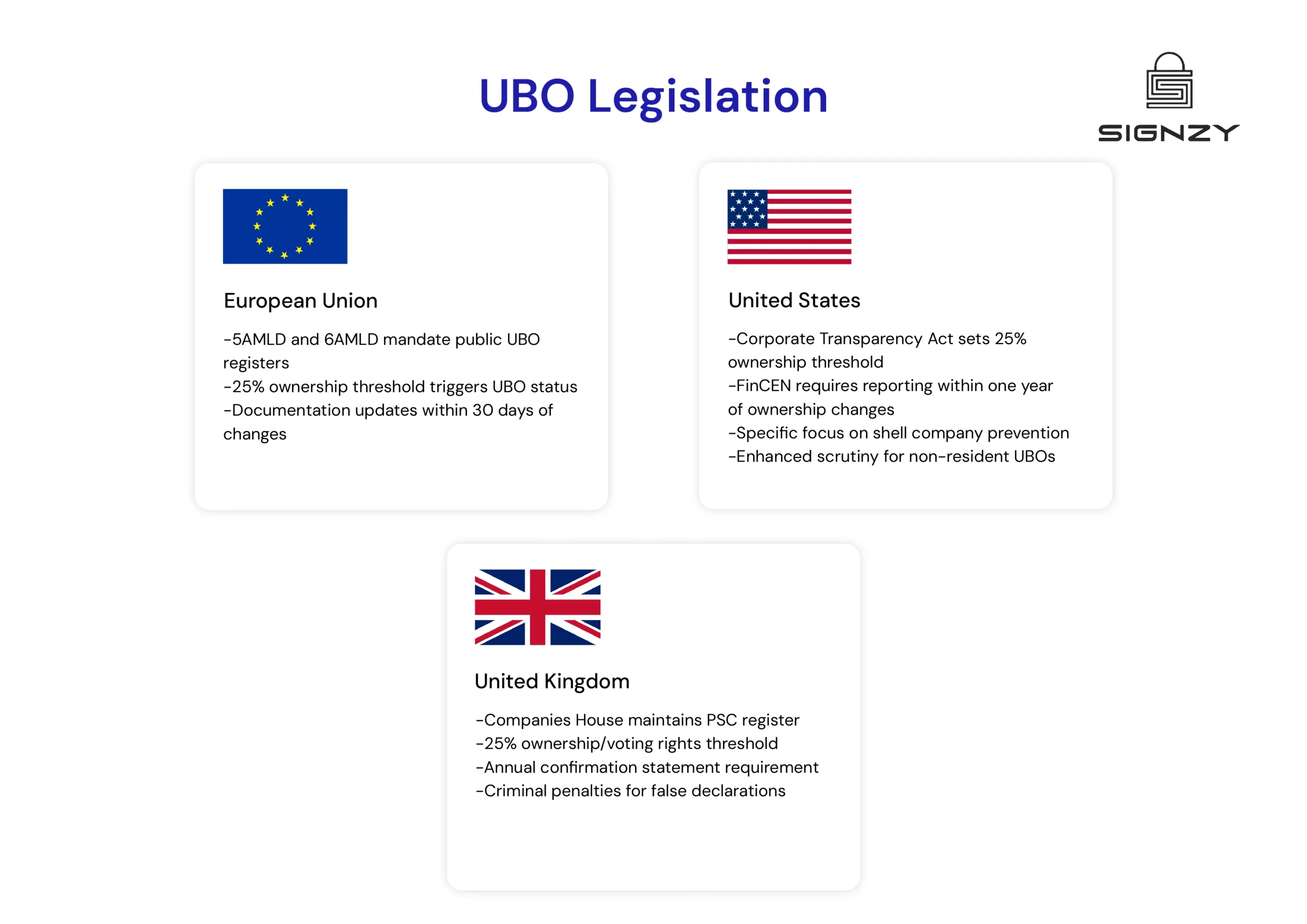

UBO Legislation: Regulatory Requirements of UBO Verification

The regulatory landscape for UBO verification varies significantly across regions, with each jurisdiction setting its own standards. However, recent years have seen a global shift toward stricter transparency requirements.

Financial Action Task Force (FATF) provides the international framework, but implementation differs:

Recent enforcement actions show regulators actively pursuing violations.

For example, in 2024, DBS Bank Limited in Singapore faced a $1.93 million fine for inadequate anti-money laundering checks. The bank failed to properly identify and verify ultimate beneficial owners in their transactions between 2014 to 2020.

The Solution

Now that you have made it so far, let’s be honest – UBO verification is complex.

Even with all documentation in place, manual verification poses significant challenges.

Think about it: multiple company registries, cross-border ownerships, continuous monitoring requirements, and the constant risk of missing crucial ownership changes.

A single verification can take weeks, and still might miss critical connections.

This is exactly where modern technology makes a difference. API solutions transform this complex process into something manageable and reliable. These APIs work by:

- Connecting with global company registries in real-time

- Cross-referencing ownership data automatically

- Screening against international sanctions lists

- Monitoring ownership changes as they happen

- Creating clear audit trails for compliance

What once took weeks now takes minutes. More importantly, the accuracy improves significantly.

For organizations looking to modernize their UBO verification process, Signzy offers comprehensive UBO verification APIs alongside KYB and KYC solutions. Our platform connects with global databases to streamline the entire verification process while maintaining compliance standards.

FAQs

What if a company does not have an UBO?

Every company has at least one UBO. If no individual meets the ownership threshold, senior managing officials are considered UBOs under regulatory requirements.

Is UBO verification mandatory?

Yes, for regulated entities like financial institutions, real estate companies, and professional services firms. Non-compliance can result in significant penalties.

How does UBO verification fit into KYB process?

UBO verification is a crucial component of Know Your Business (KYB). While KYB verifies the business entity, UBO verification identifies the natural persons who ultimately own or control it.

What happens if UBO information cannot be verified?

Businesses must either obtain additional documentation, conduct enhanced due diligence, or consider terminating the business relationship if UBO cannot be conclusively verified.