- U.S. banks face an estimated two million mule accounts across approximately 657 million bank accounts.

- Money muling can lead to up to 15-30 years of imprisonment depending on the region.

- Over 90% of money mule transactions are directly linked to cybercrime.

Have you seen in every spy movie, there’s a courier who unknowingly carries the goods for the villain – seemingly innocent, entirely unaware, but critical to the entire operation.

Now, imagine that the courier is sitting in your transaction log right now.

Clean. Authorized. Perfect on paper. A model transaction that would pass any audit.

Except it is not.

And just like that, your business becomes the courier. Your accounts become the delivery route. Your transactions become the perfect cover.

This is how “Money Mules” work.

If you think enough, you’ll understand the biggest problem is that they are perfectly ordinary.

How can you spot something that’s not anything different than thousands of your other transactions?

(Well, yes. There. Is. A. Way.)

The patterns are already there. This guide – takes 7 minutes – will show you.

- How to read them

- How to tackle them

- Again, how to tackle them, but with efficiency

And everything in between.

Let’s begin.

What is Money Muling?

Money muling is a deceptively simple yet effective method of money laundering. A money mule moves illegally obtained money between accounts, making it harder to trace the funds back to criminal activities. But what sets it apart is how it blends into legitimate business operations.

Think of it this way: most financial crimes leave obvious signs – unusual transactions, suspicious account activities, or clear regulatory violations. Money mules, however, operate within normal business patterns.

If you think enough, you’ll understand.

- …they don’t trigger alarms.

- …they follow your patterns perfectly

- …they’re counting on your confidence

The transactions look routine. The accounts seem normal. The paperwork appears proper.

And that’s exactly what makes them dangerous – they’re designed to look completely ordinary.

Scale of Mule Accounts

In 2023, financial crime units worldwide identified serious patterns of organized money laundering through mule accounts.

- Money mules constitute up to 0.3% of accounts at U.S. financial institutions, translating to approximately $3 billion in fraudulent transfers.

- Europol’s investigations led to the identification of 10,759 money mules and 474 recruiters, resulting in 1,013 arrests globally.

- In the UK, Cifas reported 37,000 bank accounts showing money mule behavior patterns.

Perhaps more concerning for businesses is that commercial accounts are increasingly becoming targets, showing a 26% rise in exploitation.

The reason is clear: business accounts typically process higher transaction volumes, making illicit fund movements less noticeable among regular operations.

How Does Money Muling Work?

Every business has financial weak points.

Money mule networks study these vulnerabilities, targeting them through sophisticated schemes. Common processes look like:

- Criminals acquire funds through scams, fraud, or cybercrime.

- They identify and target potential mules based on vulnerabilities or needs.

- Criminals recruit mules through fake job offers, romance scams, or investment schemes.

- Mules provide their existing accounts or open new ones under instructions.

- The criminal organization tests the mule with small transactions to build trust.

- Once verified, criminals transfer larger funds to mule accounts (typically around $1,500).

- Mules follow specific instructions about when and how to move the money.

- The funds move through multiple accounts or are converted to different forms.

- Money reaches its final destination through international accounts or complex networks.

- Mules receive their commission, unknowingly completing the money laundering cycle.

Primarily, they operate at three distinct risk levels, each requiring specific attention and mitigation strategies. Here’s how these operations manifest in business settings:

| Risk Level | Description | Key Characteristics |

| High Risk (Professional Mules) | Deliberately created networks targeting business accounts. | Uses AI-generated documentation, creates shell companies, and operates sophisticated transaction networks. |

| Medium Risk (Recruited Participants) | Knowingly involved employees or business associates | Often younger professionals (65% under 30), attracted by commission-based schemes |

| Compliance Risk (Unaware Facilitators) | Legitimate business people unknowingly processing criminal funds | Uses normal business transactions, regular payments, standard transfers |

While professional mules require sophisticated detection systems, protecting against unwitting facilitators often comes down to strong employee education and transaction monitoring.

Signs You Are Dealing With Money Mules

- Funds that come in and go right back out

- Transfers always hitting similar amounts

- Funds originating from high-risk countries

- New accounts immediately processing large volumes

- Provides scripted responses about transactions

- Young or elderly customers handling unusually large sums

- Multiple accounts suddenly connect to each other

- Customers who can’t properly explain their transactions

- Accounts doing things that don’t match their stated purpose

- Users who get defensive when asked basic questions

When you see several of these together, that’s when you need to look closer. One sign alone might mean nothing.

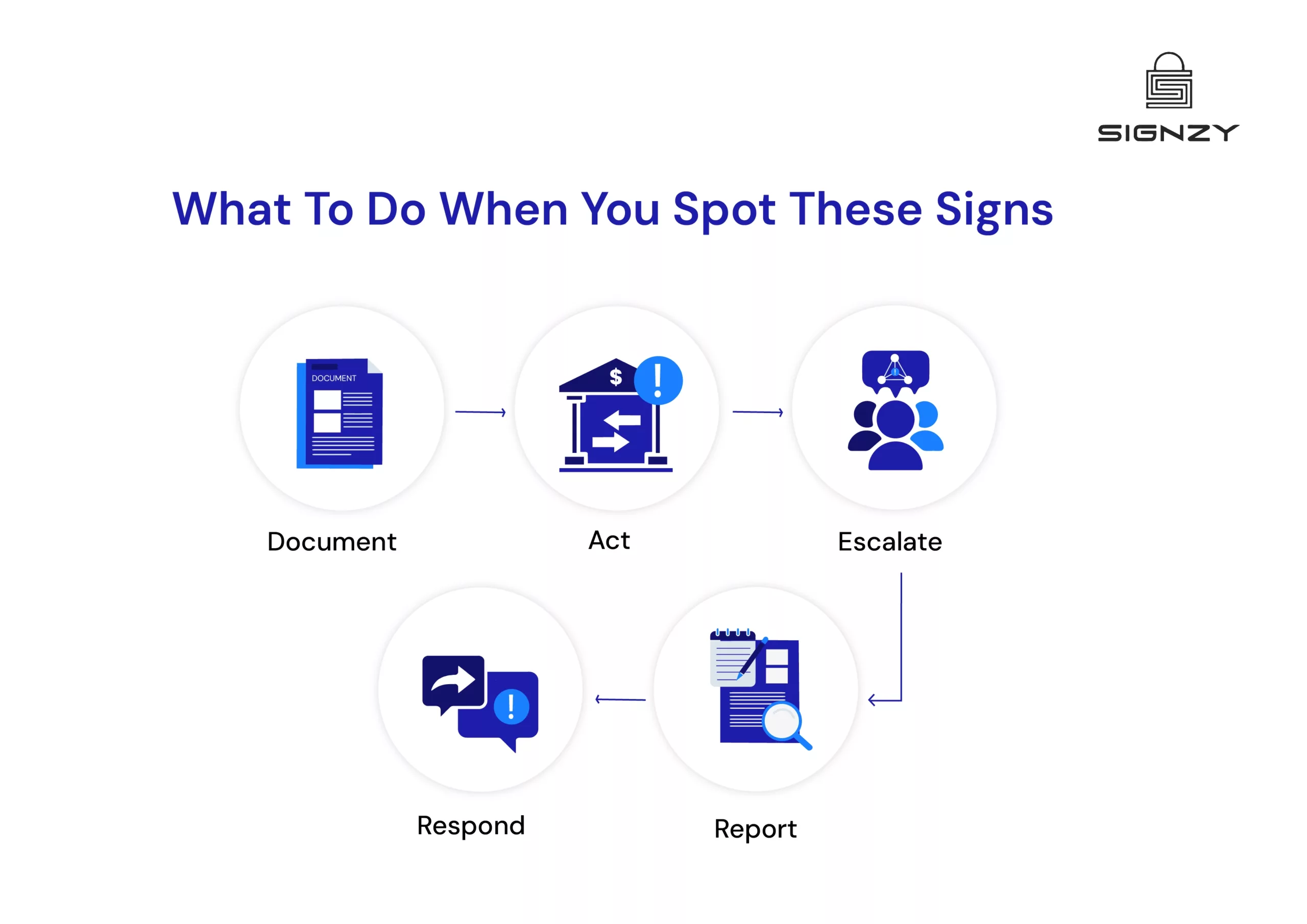

What To Do When You Spot These Signs

If you spot the signs, just follow this 5 step framework.

- Document

- Act

- Escalate

- Respond

- Report

Here’s a detailed explanation of it:

1. Document

Document what you’ve noticed right off the bat.

Write down the specific behaviors and patterns that caught your attention. This helps in two ways – it creates a clear record and helps spot similar patterns later.

Take a closer look at the account history. Often, you’ll find earlier signs that make more sense now. Maybe those small test transactions from last week suddenly look more important.

2. Act

If you spot multiple warning signs, consider these immediate steps:

- Temporarily restrict high-value transfers

- Place holds on suspicious transaction patterns

- Set lower transaction limits on affected accounts

- Flag for enhanced monitoring

But be careful – legitimate customers sometimes do unusual things too.

3. Escalate (Internally)

Share what you’ve found with your compliance team. They might see connections you don’t – perhaps similar patterns in other accounts. Sometimes what looks like one suspicious account is actually part of a larger pattern.

4. Respond

Each situation needs its own approach, but here’s what usually works:

| Level | Signs | Actions |

| Minor Concerns | Single unusual pattern, first-time occurrence, small transaction amounts | Monitor account activity closely, review transaction history, note pattern for future reference |

| Increased Risk | Multiple unusual patterns, sudden behavior changes, inconsistent explanations | Request transaction verification, increase monitoring frequency, document all interactions |

| Serious Risk | Multiple clear red flags, coordinated activity with other accounts, clear deception attempts | Limit high-risk transactions, conduct detailed reviews, prepare for reporting |

Most importantly – stay calm and professional.

Even if you’re sure you’ve spotted a money mule, keep responses measured and documented. Sometimes what looks suspicious has a perfectly good explanation.

5. Report

Report as soon as you have enough evidence to support your suspicion.

Don’t wait to gather every possible detail – suspicious activity reporting is about helping prevent crime, not solving cases. Here’s where you need to report to:

| Region | Authority | When to Report |

| U.S. | FinCEN (SAR filing) | Within 30 days of detecting suspicious activity |

| UK | NCA (SAR filing) | As soon as practicable |

| EU | Local FIU + European FIU | Based on national requirements |

Keep detailed internal records of what you noticed, when you noticed it, and what actions you took. This helps protect your service and shows regulators you’re taking appropriate action.

Catching Mules Efficiently

Finding money mules among thousands of normal transactions can feel like searching for needles in a haystack.

Teams drowning in alerts, hours spent checking documents, and still that nagging worry about missing something important.

To conclude, doing it all manually isn’t working anymore.

But there’s good news: working smarter is possible. Below are some solutions that can help you save the day:

- Document & ID Verification: When money mules use stolen or manipulated identities to open multiple accounts, real-time verification catches them. It matches the ID with the person trying to use it and spots signs of tampering. That person trying to open five accounts with different IDs? They won’t get past the first try.

- Transaction Monitoring: Money mules leave traces – quick deposits followed by instant withdrawals, or multiple accounts suddenly working together. Monitoring catches these behaviors early. When an account that handles small retail payments suddenly moves large sums to multiple new recipients, you’ll know before losses occur.

- KYC Systems: Money mules count on rushed verification to slip through. Digital KYC checks more angles faster – matching names with documents, verifying addresses, and connecting application patterns. When someone tries to open multiple accounts with slightly different details, nothing slips through the cracks.

That’s why at Signzy, we’ve focused on building tools that solve real problems – like our KYC verification and criminal screening checks. Because ultimately, we share the same goal: keeping money mules out while letting legitimate customers do business smoothly.

FAQs

How quickly should we act when we spot potential money mule activity?

Act within 24 hours of spotting suspicious patterns. Document the activity, limit high-risk transactions if needed, and prepare suspicious activity reports as required by your jurisdiction.

Can legitimate businesses accidentally become money mule operations?

Yes. Criminals often target legitimate businesses, especially those with high transaction volumes. Regular monitoring and staff training help spot when normal accounts are being misused.

Are we liable if money mules use our service unknowingly?

Potentially yes. Financial services must show they have reasonable controls and monitoring in place to prevent money mule activity. Documentation of your prevention efforts is crucial.

How do we balance customer experience with money mule prevention?

Focus monitoring on significant pattern changes rather than every unusual transaction. Use technology to verify higher-risk activities while keeping regular transactions smooth.