Whether it is a small or large enterprise, especially in the financial industry, the scanning of watchlists is an essential step. It acts as an essential component of Anti-Money Laundering (AML) compliance programs by assisting in the detection and prevention of issues related to the involvement of high-risk subjects and organizations.

This guide goes into details of how a watchlist screening works. It will explain the mechanisms of watchlist screening, the kinds of watchlists, and the challenges businesses undergo when they are implementing it.

What are Watchlists?

Watchlists are digital databases containing information on individuals and entities associated with a variety of financial crimes, including:

- Money Laundering: Criminals unlawfully conceal the source of their money by transferring it through a maze-like matrix of complex remittances.

- Terrorist Financing: Enablement of terrorist organizations.

- Fraud: Deceptive ploys that are made to defraud people out of their money or property.

- Corruption: Abuse of trusted office for personal aggrandizement.

Some prominent examples of AML watchlists include:

- Office of Foreign Assets Control (OFAC) Sanctions List: The vehicle operated by the US Department of the Treasury informs the people, enterprises, and nations, which are under threat of the economic sanctions.

- Interpol Most Wanted List: Contains individuals wanted for the international docketing.

- Financial Action Task Force (FATF) High-Risk Jurisdictions List: A list of countries with no strong AML features.

- Politically Exposed Persons (PEP) Lists: This category includes people whose job relates to public services and work in the public sector such as employees in the bureaucracy, civil servants, or people with direct links to these elite groups.

The type of watchlist that a business uses will depend on its industry, the geographical area of operation, and the particular risk outline of the business.

How to Check Watchlist Sources?

There are two primary methods for checking watchlists:

- Manual Checks: Actual companies seek government portals as well as public records bases for hits. But this method is slow, tedious, and an error-prone environment, i.e. while dealing with huge data.

- Automated Watchlist Screening Software: Software solutions that automate watchlist blacklist screening can be a reliable tool for organizations.

These tools offer several advantages:

- Efficiency: They can screen massive volumes of information at the speed of light and free up possible mistakes.

- Real-Time Results: They can serve as the first information source of the situation and therefore, businesses fire out instant responses.

- Reduced Errors: The use of automation acts to mitigate the risk of human error present in manual checks.

- Customisation: This flexibility can be tailored to fit the specific blacklists applicable to the overall business activity.

How Does Watchlist Screening Work?

The list screening process requires the comparison of the subject’s identity data with the criminal and terrorist databases. These watchlists are drawn up and kept by agencies within government, international institutions, and law enforcement bodies.

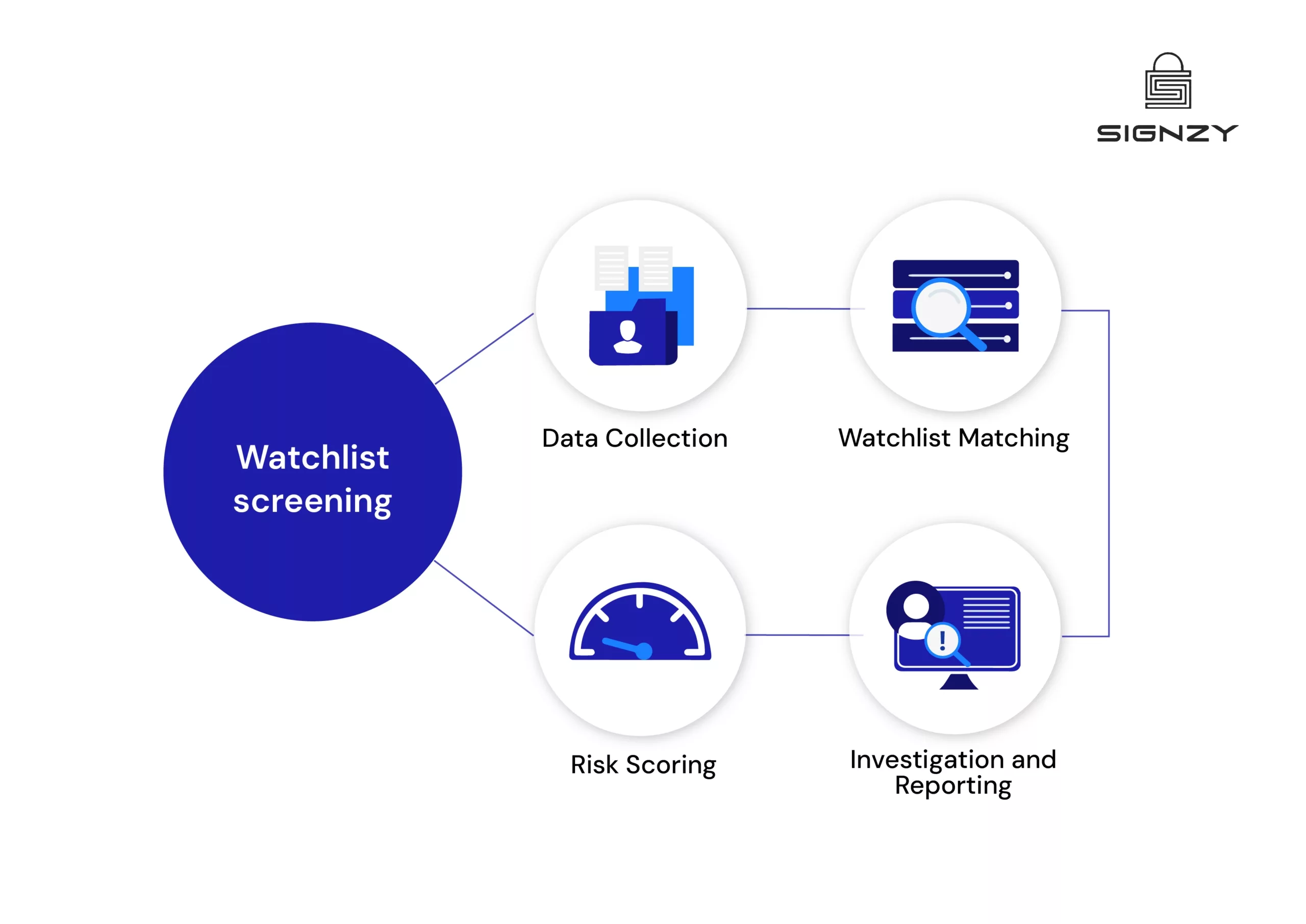

Here’s a breakdown of the watchlist screening process:

- Data Collection: Companies gather customer’s data (mostly name, address and birth date) during signing up.

- Watchlist Matching: This screening process will look for data matching within multiple watchlists to determine if it is a watchlist match.

- Risk Scoring: If a match is then detected, a risk score is generated based on factors such as the level of fraud, the type of business interface, and the overall risk profile of the customer.

- Investigation and Reporting: In case of a high-risk match, additional investigation is needed to ascertain if what is claimed is the sanctioned person or a false positive. Once the suspicious activities are verified, authorities are informed.

What is the Significance of Watchlist Screening?

Watchlist screening plays a crucial role in AML compliance for several reasons:

- Customer Due Diligence (CDD): It provides businesses with a tool that can be used to evaluate the risk that could be created when they engage customers who seem to be involved in crime or are the subject of the sanctions.

- Regulatory Compliance: It helps businesses follow the Anti-money laundering regulations (AML) which are set by national as well as international authorities.

- Non-compliance can trigger fines and other penalties, damage decision makers’ reputations, and even possible instances of criminal prosecution.

- Risk Mitigation: By identifying high-risk individuals, businesses can prevent them from using their services for illicit activities, safeguarding their financial integrity.

Challenges with Liberalisation of Watchlist Screening in SMBs

While watchlist screening offers significant benefits, businesses face several challenges during implementation:

- Complex Entity Matching: Commonly these watchlists have a diversity of names amongst them; it also happens these names may have a different alias or be translated differently depending on language. Elaborated algorithms for identification have to be developed to ensure correct registration of individuals.

- Screening Frequency: Companies should develop a system of checks and tests to determine the periodical intervals to run the screening. Financial institutions (which are considered to have high risks) and lower-risk businesses can provide continuous and periodic scoring.

- Ongoing Monitoring: AML compliance is an enduring process that requires companies to promptly identify and report potential suspicious activities. Watchlists are continuously revised and new entities are added to the high-risk lists on an ongoing basis, thus the monitoring of such underlying changes becomes a significant part of the surveillance.

- Cross-Industry Adoption: Nowadays the field of identifying the persons, entities, and activities exposed to sanctions processes is not restricted only to the financial sector. Businesses from different industries, for example, the healthcare sector have been recognized as key players in the transformation.

Conclusion

In short, watchlist screening acts as a most important measure to build AML compliance programs. Automated watchlist screening may be seen as a way of solving problems that emerge in the landscape of financial crime that changes quickly.

These remedies stand designed to provide greater efficiencies, accuracy, and immediate results, which allow companies to do business effectively and safely with human behavior value in mind.

Nevertheless, the watchlist screening is not ultimately intended to deal with the issue at hand only once time. Businesses will need to take into consideration complex data matching during the screening process procedures, and the continuous monitoring requirements as well as frequency of screenings that depend on potential risks.

AML regulations keep on diverging and evolving, and new threats and challenges arrive in their place. Hence, to stay on top of recently emerging or changing trends, organisations should consider adopting more or less continuous watch list practices.

And we, at Signzy, can help you with AML Watchlist Screening. Visit our website to know more!